Investors should be looking for flexible strategies headed up by experienced managers if the recovery from the coronavirus crisis does not take the hoped-for ‘V’ shape, according to several discretionary fund managers (DFMs).

Recent figures showed the UK economy grew by just 1.8 per cent in May, which was below expectations and led experts to argue that a V-shaped recovery is now looking increasingly unlikely.

Many now think the recovery will be W-shaped – which is often known as a double-dip and involves a series of improvements and relapses before a proper recovery takes hold.

With this in mind, Trustnet asked five DFMs which funds they think long-term investors could consider if we are heading into a W-shaped recovery.

BlackRock Emerging Markets

Emerging markets arguably responded to the coronavirus pandemic better than the developed world, owing to past experiences like SARS and higher adherence to public health measures. Meanwhile, the International Monetary Fund expects the economic hit of the pandemic will be lower in emerging markets.

But given that a W-shaped recession could lead to another bout of volatility, FE Investments senior fund analyst Tanvi Kandlur highlighted Gordon Fraser’s £427m BlackRock Emerging Markets fund as an attractive option.

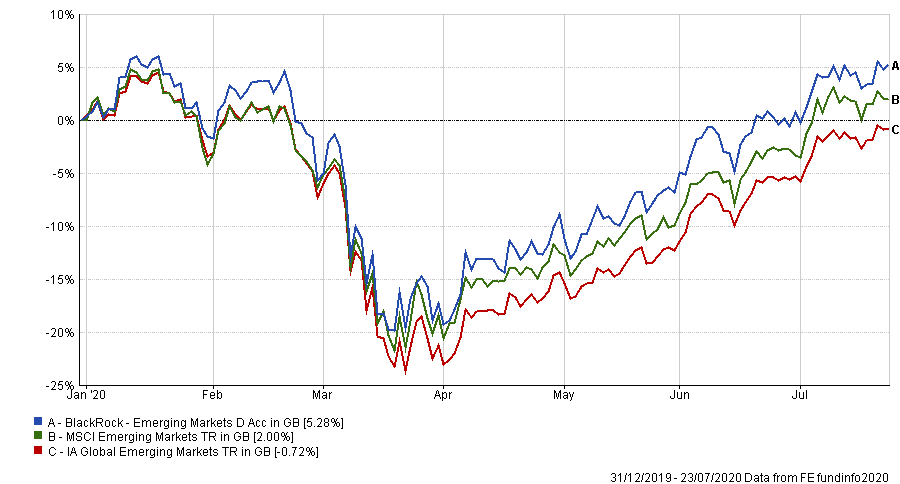

Performance of fund vs sector and index over 2020

Source: FE Analytics

FE fundinfo Alpha Manager Fraser has run emerging market equities for over a decade and most of this experience was in absolute return and hedge fund strategies. When he took over the fund in March 2017, the manager brought in a flexible investment strategy that adapts to different market conditions by tilting the portfolio between styles and currencies as well through making country and sector calls.

Kandlur said: “This is a high conviction fund that adapts positioning as opportunities present itself and draws on the work of a 40-strong team of research analysts to take advantage of inefficiencies in emerging markets.

“The fund adopted this flexible approach with the appointment of Fraser in 2017 and since then it has consistently outperformed its benchmark and sector in both rising and falling markets. The fund’s volatility can be higher than its benchmark and sector, but recent drawdowns have been less severe.”

BlackRock Emerging Markets has an ongoing charges figure (OCF) of 0.97 per cent and yields 1.31 per cent. It has an FE fundinfo Crown Rating of five.

PIMCO Dynamic Multi-Asset

With diversification being seen as one of the best ways of protecting a portfolio against the unexpected, Quilter Cheviot head of investment fund research Nick Wood went for the €2.2bn PIMCO Dynamic Multi-Asset fund.

“This is a very diversified fund run by an experienced and well-resourced team. Within the absolute return space, the fund has delivered well on its objectives,” he added.

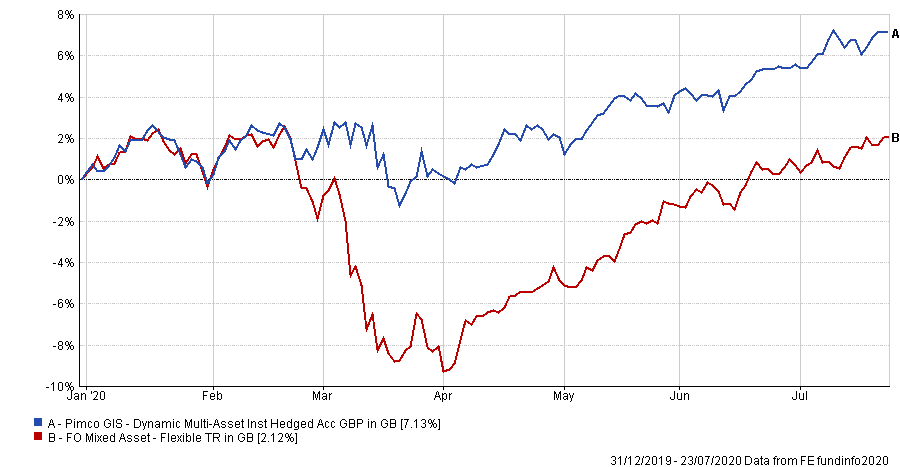

Performance of fund vs sector over 2020

Source: FE Analytics

Headed up by Geraldine Sundstrom with Emmanuel Sharef and Erin Browne as deputy managers, the Dublin-domiciled fund has the objective of maximising total return, in a way “consistent with preservation of capital and prudent investment management”.

“This year was the real test and in March the fund held up well, producing a slight positive return for Q1, whilst benefitting from the market recovery in Q2, leaving it up 6 per cent for the first six months,” Wood said.

“We have seen the team act very nimbly, especially around the initial phase of the pandemic, the key to it holding up well. The fund targets a relatively higher risk and return profile, as well as the preservation of capital. The fund is expected to have equity beta between 0.3 to 0.5.”

PIMCO Dynamic Multi-Asset has a 0.85 per cent OCF and holds an FE fundinfo Crown Rating of four.

BlackRock Global Unconstrained Equity

Luke Hyde-Smith, head of fund selection at Waverton Investment Management, chose BlackRock Global Unconstrained Equity as his fund for a W-shaped recovery.

This is a new fund, having only launched in January this year, but is managed by the BlackRock strategic equity team led by the experienced Alister Hibbert. It is built around a concentrated portfolio of global equities, which the team said have proven track records of generating high returns on capital, the ability to able to re-invest cash flows back into their business and compounding growth over time.

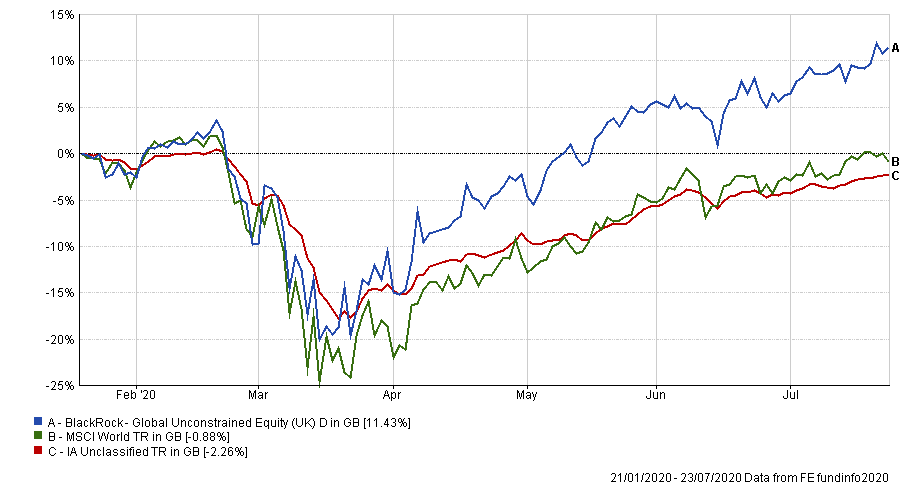

Performance of fund vs sector and index since launch

Source: FE Analytics

The fund has got off to a strong start despite the market turmoil thrown up by the coronavirus crisis. As the chart above shows, BlackRock Global Unconstrained Equity’s 11.43 per cent total return since launch in January is far higher than that made by its MSCI World benchmark.

Hyde-Smith said: “Not a defensive portfolio heavily invested in staples, the portfolio has a significant quality-growth bias and large weight to technology.

“The managers seek to own true global leading businesses over the long term. In the managers’ view, those businesses which can sustain exceptional returns with longevity, provide a compelling opportunity through their ability to harness the long-term power of compounding earnings.”

BlackRock Global Unconstrained Equity has a 0.97 per cent total return.

Royal London UK Equity Income

Peter Brunt, head of manager research at Schroders Personal Wealth, opted for the £1.9bn Royal London UK Equity Income fund as one that could be a good long-term option, even if it is more volatile in the short term.

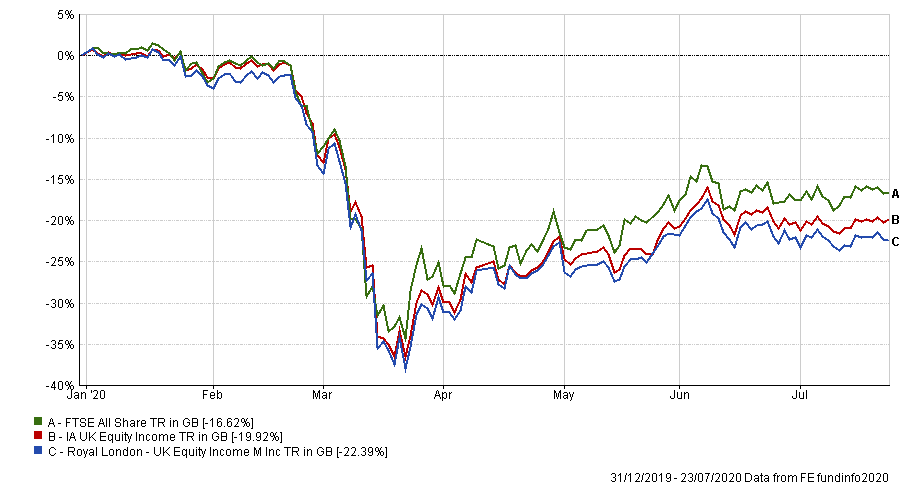

Performance of fund vs sector and index over 2020

Source: FE Analytics

The chart above shows that Royal London UK Equity Income has underperformed both its average peer and FTSE All Share benchmark over 2020 so far, but the fund does have a very strong long-term track record. Over 10 years, it has made a 128.86 per cent total return, ranking it fifth out of 64 funds in the IA UK Equity Income sector.

Brunt said: “Manager Martin Cholwill’s preference for mid-cap names and valuation discipline saw the portfolio face headwinds in the first half of 2020, as a number of retail and consumer-related names struggled in light of Covid and growth continued to outperform.

“Looking forward, while the portfolio may experience raised volatility in a W-shaped recovery, the clear focus on strong business models, sound finances and sustainable dividends should stand it in good stead to perform well over the long term. Underpinning our conviction here is Cholwill’s long experience and effective implementation of his robust approach over multiple market cycles.”

Royal London UK Equity Income has a 0.72 per cent OCF and is yielding 4.74 per cent. It has an FE fundinfo Crown Rating of two.

BlackRock European Dynamic

Daniel Pereira, investment research analyst at Square Mile Investment Consulting and Research, went for the £4.7bn BlackRock European Dynamic fund – which like BlackRock Global Unconstrained Equity is managed by Alister Hibbert.

Europe is one of the favourite regions of BlackRock as an investment house at the moment. In a recent update, the firm said it is overweight European stocks because of the strong monetary and fiscal support unveiled to tackle the coronavirus crisis as well as its robust public health systems, which will help to supress further outbreaks of the virus.

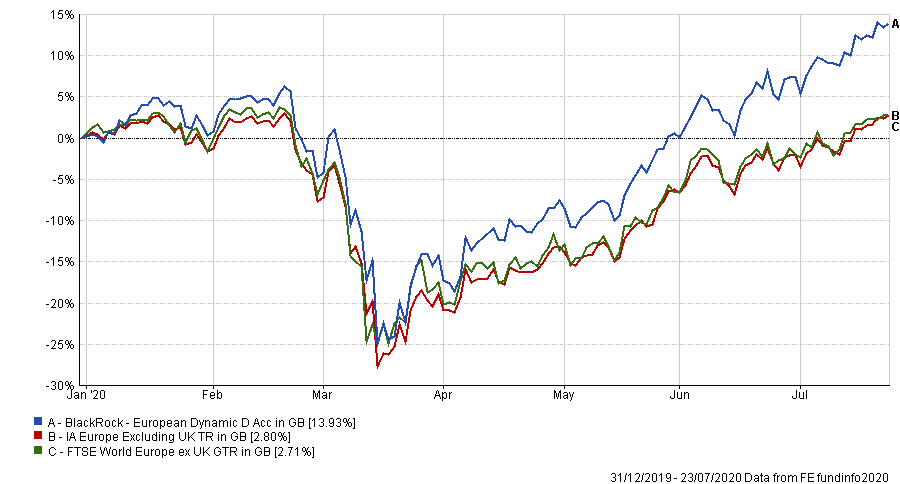

Performance of fund vs sector and index over 2020

Source: FE Analytics

“One of the key attractions of this fund is that it is not constrained to a particular style of investing, with the fund's managers having demonstrated their abilities over time by suitably shifting the portfolio to take advantage of the opportunities that the market presents,” Pereira said.

“We think highly of the lead manager, Alister Hibbert, who we believe to be a skilled investor. His temperament is suited to the demands of this mandate and his lengthy experience gives him the edge one needs to run this type of strategy. Ably supported by co-manager, Giles Rothbarth, both managers make good use of the resources available to them, namely, BlackRock's highly regarded European equity team, and more recently, the use of newer data tools at the firm.

“We would note that although the fund uses its flexible approach to outperform in an array of market conditions, there will inevitably be times that it will fall short of these, so it is better suited to investors with a long-term investment horizon.”

BlackRock European Dynamic has an OCF of 0.92 per cent holds a four FE fundinfo Crown Rating.