The global, North American and European equity sectors seem to be punching above their weight when it comes to housing the most top-rated funds following the latest FE fundinfo Crown rebalance.

The FE fundinfo Crown Ratings are a quantitative rating based on a funds’ historical performance relative to an appropriate benchmark and are designed to highlight funds that have superior performance in terms of stock picking, consistency and risk control.

They are based on performance over the previous three years and hone in on three key metrics: alpha, volatility and consistent performance. The top 10 per cent of funds receive an FE fundinfo Crown Rating of five and the next 15 per cent are awarded four crowns; the remaining quartiles are ranked one to three.

Following the July rebalance of the ratings – they are rebalanced in January and July – Trustnet has reviewed the Investment Association universe at a sector level to find out where the most five-crown funds can now be found.

On an absolute basis, the IA Unclassified sector has the most five-crown funds with 53 of its members being awarded this rating in the rebalance. This shouldn’t be too surprising as the peer group is the largest in the Investment Association universe, with 516 of its members eligible for a crown rating.

It’s followed by IA Global as 49 of its 279 eligible members hold an FE fundinfo Crown Rating of five, while IA Specialist is in third with 26 five-crown members (out of 216 eligible).

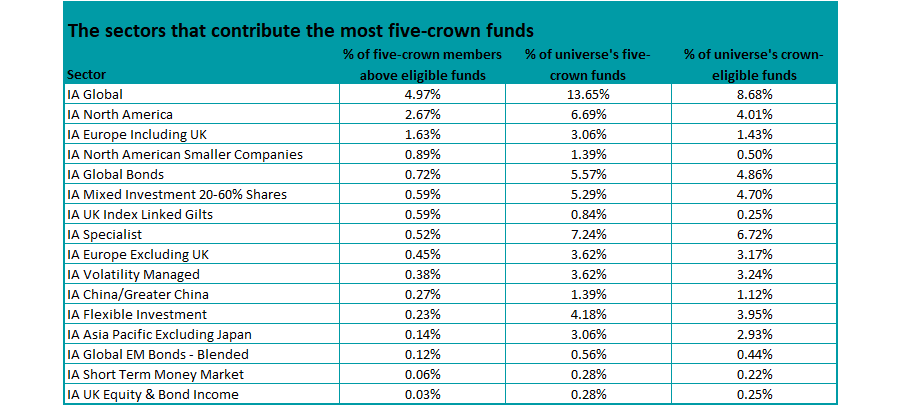

However, Trustnet dug a little deeper to find out which sectors have a disproportionate number of their members holding the top rating. One way we did this was comparing their share of the Investment Association universe’s five-crown funds with their overall share of rated funds.

Source: FE fundinfo

As the table shows, the IA Global sector is home to 8.68 per cent of the funds that were eligible for an FE fundinfo Crown Rating in the July rebalance but contributed 13.65 per cent of all the five-crown rated funds – resulting in a contribution that is 4.97 percentage points higher than it should be.

Among the IA Global funds that hold the top rating are well-known offerings such as Fundsmith Equity, Baillie Gifford Global Discovery, Lindsell Train Global Equity, Liontrust Global Smaller Companies, Morgan Stanley Global Brands, Seilern World Growth and Trojan Global Equity. All of these funds were rated at five crowns ahead of the rebalance.

The IA North America also has a disproportionate share of top-rated funds, with the likes of Ninety One American Franchise, Seilern America and T. Rowe Price US Blue Chip Equity holding this status.

IA Europe Including UK is another sector outperforming for its share of five-crown funds.

When we reversed this to look for the sectors that have a disproportionate number of bottom-rated funds, IA Sterling Strategic Bond came off worse. It is home to 6.46 per cent of the Investment Association universe’s one-crown funds, but holds just 2.58 per cent of eligible funds.

Oliver Clarke-Williams, portfolio manager at FE Investments, said: “It was slightly disappointing to see the sector that topped the rankings six months ago, the IA Sterling Strategic Bond sector, drop to the bottom of the list. With the high amount of freedom managers have within this sector there was an opportunity to produce high levels of outperformance, ultimately though only a few were able to.”

IA Mixed Investment 40-85% Shares, IA UK Equity Income, IA Flexible Investment and IA Global Equity Income also have more one-crown members than their size would suggest.

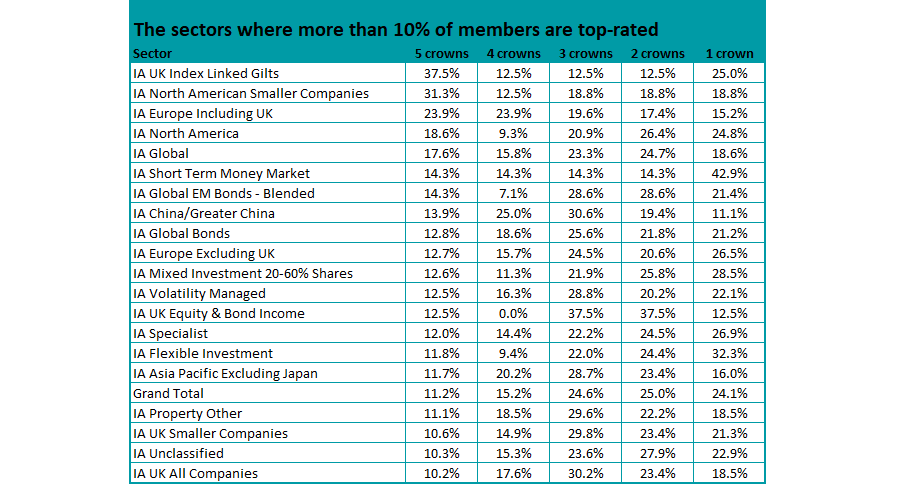

Trustnet also looked for sectors with a disproportionate number of their members holding five crowns. Given that only the top 10 per cent of funds are awarded a top rating, you’d expect this to be roughly reflected within individual peer groups.

However, the table below shows this isn’t the case.

Source: FE fundinfo

At the top is the IA UK Index Linked Gilts, as 37.5 per cent of its members that are eligible for a rating have been awarded five crowns. They include BNY Mellon Index Linked Gilt, Insight UK Index Linked Bond and Royal London Index Linked.

IA North American Smaller Companies also did well, thanks to members such as New Capital US Small Cap Growth, JPM US Small Cap Growth and T. Rowe Price US Smaller Companies Equity, as did IA Europe Including UK because of the likes of Comgest Growth Europe, Fidelity European Dynamic Growth and Threadneedle Pan European Focus.

Clarke-Williams added: “The recent performance of some sectors is perhaps counterintuitive to what we might expect given the difficult markets.

“Index-linked gilts, which have the highest percentage of five-crown rated funds, are traditionally seen as a very difficult asset class for managers to differentiate themselves in and provide outperformance as their investment universe is so small. Gilts did very well during the Covid-19 sell-off and the ratings suggest that some managers had the foresight to see what was coming and reposition the duration positions of their funds to benefit accordingly.

“Similarly, seeing the two North American sectors sitting second and fourth on the list will be a surprise to many given the assumption that you cannot outperform the US market. The US markets with its high exposure to the technology sector has allowed some managers who anticipated how people’s lives would change under lockdown to produce way above market returns.”

In all, 20 sectors have more than 10 per cent of their members holding an FE fundinfo Crown Rating of five after the July rebalance.

However, there are also six peer groups that do not have a single top-rated fund: IA Technology & Telecommunications, IA Japanese Smaller Companies, IA European Smaller Companies, IA Asia Pacific Including Japan, IA Global EM Bonds - Local Currency and IA Standard Money Market.