FE fundinfo Alpha Managers such as Nick Train, Douglas Brodie and Keith Ashworth-Lord have delivered some of the highest returns of their peers over the difficult conditions of 2020, Trustnet research shows.

Reviewed every year, the FE fundinfo Alpha Manager Ratings assess the performance of fund managers over their careers including all the funds they have managed and the places they’ve worked. The rating is designed to identify fund managers who have consistently performed well over the longer term and is awarded to the top 10 per cent of the industry.

Within this group of high performers, Trustnet has reviewed the performance of their funds over 2020 so far, to see how many are sitting within the top quartile of their Investment Association sectors.

However, in this difficult market period, some of those managers preside over funds that are in the fourth quartile over the last six months.

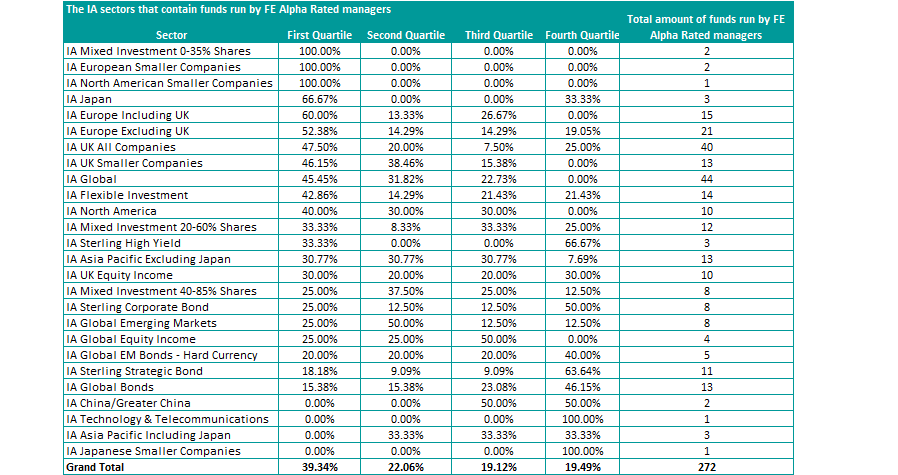

As the table below shows, there are 272 that have an FE fundinfo Alpha Manager working on them and 107 of these – or 39 per cent – have made top-quartile total returns over the opening half of the year. Another 60 (or 22 per cent) are in the second quartile and just 53 – or 19 per cent – are at the bottom of their peer group.

The IA sectors that contain funds run by FE Alpha Rated managers

Source: FE Analytics

The IA Global Sector contains the greatest number of funds with an Alpha Manager working on them and 20 of these – or 45.5 per cent – are in the peer group’s first quartile over 2020 to date (as 7 July).

James Thomson’s Rathbone Global Opportunities fund and David J. Eiswert’s T. Rowe Price Global Focused Growth Equity funds are among those in the top quartile.

Thomson, who was named sole manager of the Rathbone Global Opportunities fund in 2005, has maintained consistently high returns over that period, with a proven track record in bull and bear markets. The fund’s largest geographical allocation is to the US and its top-10 holdings include payment technology platforms such as Paypal, Visa and Mastercard.

Funds such as Douglas Brodie’s Baillie Gifford Global Discovery and Stephen Yiu’s LF Blue Whale Growth funds are other well-known global equity strategies that are in the sector’s top quartile in 2020.

While the IA Mixed Investment 0-35% Shares and IA European Smaller Companies sectors have 100 per cent of their Alpha Manager-headed funds in the first quartile, this is because they have only relatively few funds which disproportionately alter the scores.

The IA UK All Companies sector has a large percentage of Alpha Managers outperforming their peers, with 47.50 per cent in the top quartile and 20 per cent in the second quartile.

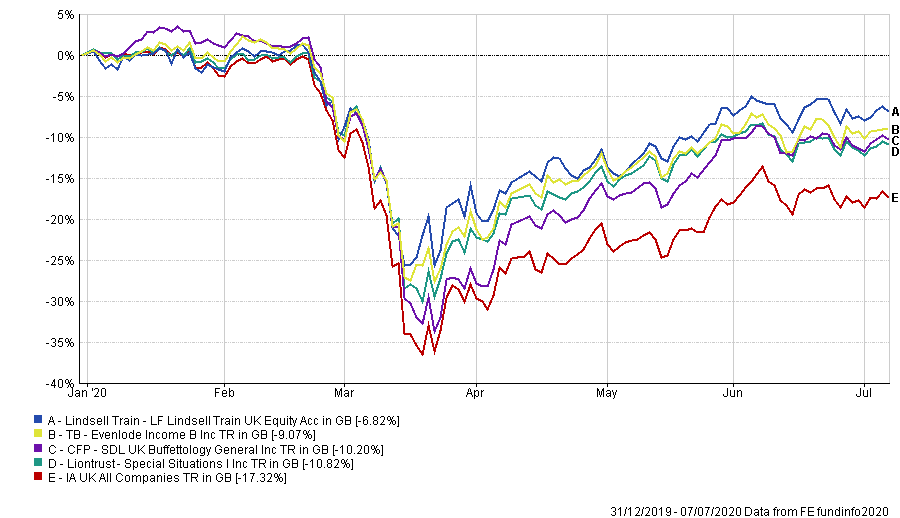

Within the 250 funds within this sector, there were 41 that fit the criteria, this included some familiar names with Nick Train’s LF Lindsell Train UK Equity, Anthony Cross and Julian Fosh’s Liontrust Special Situations, Hugh Yarrow’s TB Evenlode Income and the CFP SDL UK Buffettology funds all making the list.

The Buffettology fund, managed by Keith Ashworth-Lord, has a bottom-up stock picking approach and builds a concentrated portfolio of up to 50 companies, which he believes have strong operating franchises, high returns on equity and a strong free cash flow.

Performance of funds vs sector YTD

Source: FE Analytics

The IA UK Smaller Companies sector, while only containing 13 funds with FE fundinfo Alpha Managers in charge, had 46.15 per cent of those in the top quartile (including Marlborough Special Situations and Liontrust UK Micro Cap) and 38.46 per cent in the second quartile. Like IA Global, none of the funds were in the bottom quartile.

The IA North America sector, which has returned 32.89 per cent since the March sell-off, had 40 per cent of Alpha Manager-run funds within the top quartile and 30 per cent in the second quartile.

Within this sector, Kenneth M Stuzin’s Brown Advisory US Equity Growth fund and Robbie McNab’s Legg Mason IF Martin Currie US Unconstrained fund were in the top quartile.

T. Rowe Price US Blue Chip Equity, managed by Larry J Puglia, has some of the highest returns in its sector.

Puglia, who has managed the fund since 2003, has made returns of 167.1 per cent over the last five years. The fund is heavily weighted toward US technology giants such as Amazon, Microsoft and Alphabet, all of which have enjoyed very lucrative lockdown periods.

Out of the 15 Alpha Manager-headed funds in the IA Europe Including UK sector, 60 per cent are in the top quartile.

Carmignac Portfolio Grande Europe, managed by Mark Denham, and Allianz Europe Equity Growth Select, managed by Thorsten Winkelmann and Robert Hofmann, were among those in the top quartile of funds.

Considering the IA Global Bonds sector contains 13 funds that are run by Alpha Managers, it has a relatively high proportion in the fourth quartile at 46.15 per cent.

However, 15.38 per cent of the funds were in the top quartile. This included MFS Meridian Global Opportunistic Bond and M&G Global Macro Bond.

The IA Sterling Strategic Bond sector also contained a high proportion in the fourth quartile, at 63.64 per cent.

Craig Veysey’s Man GLG Strategic Bond fund has endured a difficult 2020 period, making a loss of 6.2 per cent over the last six months. However, it is worth noting that this is relative to returns of 26.2 per cent over five years, which put it in the top quartile.