While the opening three months of 2020 saw stock markets plunge and investors scramble for safe havens, the most recent quarter witnessed a strong revival in risk appetite.

Although the coronavirus pandemic continues to spread, investors welcomed massive amounts of fiscal and monetary stimulus designed to shore up the global economy. Sentiment was further bolstered when some countries passed their first peak and started to ease their lockdowns.

Below, Trustnet reviews the performance of markets during 2020’s second quarter, looking at returns by asset class, geography, investment style and a range of other viewpoints.

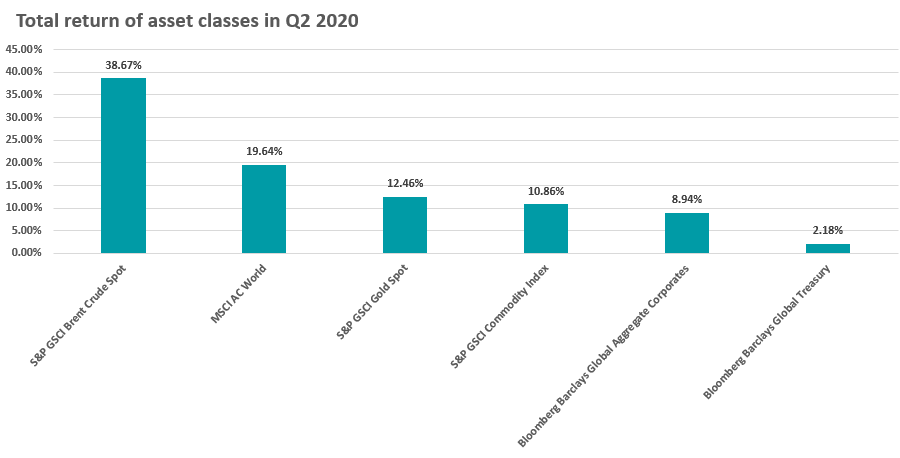

Asset classes

In the first quarter of the year, the coronavirus crisis sparked a heavy sell-off in risk assets with the MSCI AC World index dropping 16 per cent and the commodities index plunging almost 40 per cent.

The most recent quarter, however, witnessed a strong snapback as stimulus measures were unveiled, coronavirus infection rates started to slow in some parts of the word and countries emerged from their lockdowns.

As a result, the MSCI AC World rose 19.64 per cent in the three-month period while commodities were up 10 per cent; government bonds made lower returns as risk appetite returned, but gold continued to attract money.

Source: FinXL

Neil Wilson, chief market analyst at Markets.com, said: “Stocks rallied so sharply in Q2 for a number of reasons – chiefly stimulus, both fiscal and monetary, as well as the reopening of economies and better virus rates in most countries, though this trend has somewhat come undone in the US in the last couple of weeks.

“The aggressive pullback in February and March also left stocks rather oversold on a short-term basis, when considering the stimulus and relative yields to government bonds. Meanwhile hopes of a vaccine are central if we are to see 2021 look more like 2019 than this year.

“For gains to be sustained in Q3 stocks require the continued support of stimulus, which remains on tap, as well as a better outlook on the virus spread and for the hard economic data to show a strong bounce from Q2, both of which could be more tricky.”

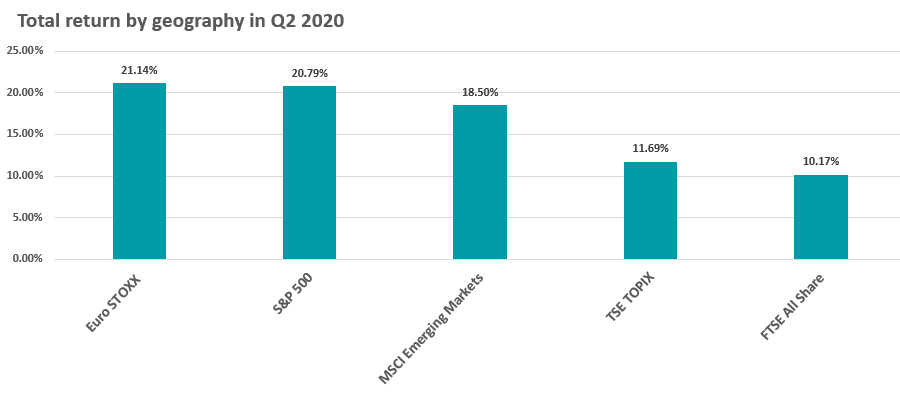

Geographies

With risk assets rising strongly over the quarter, it shouldn’t be too much of a surprise to see that equities in all the major geographic regions were in positive territory at the end of 2020’s second quarter.

European equities were the place to be for sterling investors as the continent continued to open its economy after seeing a peak in new coronavirus cases, closely followed by the US despite its rising infection rates. The UK market, however, rose just half as much as these two.

Source: FinXL

Ben Yearsley, director at Fairview Investing, said: “It’s difficult to know whether to be optimistic or pessimistic about markets, however despite some new lockdowns and partial closures of UK, Germany and the US, developed world markets seem to have moved out of the coronavirus funk recording some of the best quarterly returns on record.

“In some parts of the developing world it is a different story unfortunately with Brazil still in the eye of the storm. Have markets got ahead of themselves? Maybe, but the worst of this phase of the coronavirus pandemic appears to have passed.”

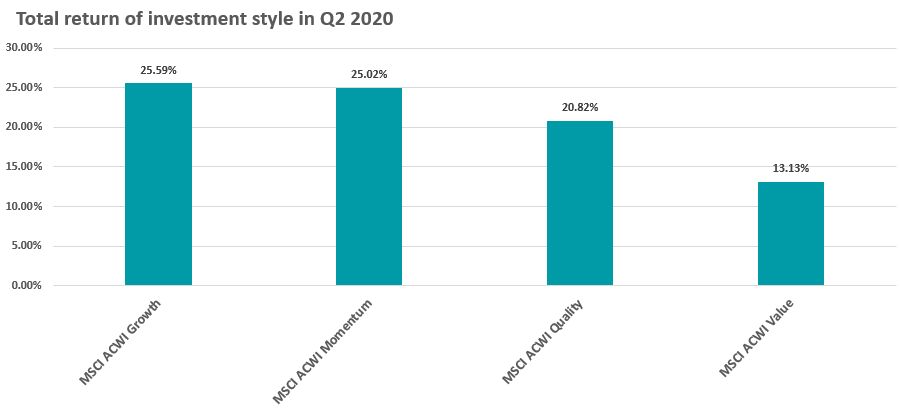

Investment style

Turning to investment style and it was yet another quarter when growth and quality stocks outperformed the value style by a significant margin. The underperformance of value has carried on for so long that some are questioning whether the style can ever return to outperformance.

Fiona Frick, chief executive at Unigestion, said: “Value style has experienced an extraordinary period of underperformance relative to growth investing, spanning more than 13 years. Value has become so cheap versus growth that its current valuation is in the 97th percentile of its historical distribution. A number of narratives have been offered to explain why the value factor’s poor relative performance may be the ‘new normal’. One such theory is that the value definition has become obsolete.

Source: FinXL

“It is true that value can no longer be defined solely as book value, as proposed by the Fama-French model, but for every definition of value we examine in measuring relative cheapness – price-to-book, price-to-earnings, price-to-sales and price-to-dividends – it has underperformed growth since 2008. Furthermore, the definition of ‘cheap’ is no longer limited to industrial companies, cyclical stocks or financials.

“We believe that there is no reason why the value premium should have disappeared. Such a lost decade is not unprecedented in history and variations are still well within the range that may be expected statistically. Indeed, value performance in the 2010s was remarkably similar to the 1990s, which is perhaps unsurprising since both these decades also saw double-digit excess returns for the equity market. Factor premia, including value, still exist and should deliver long-term performance. However, their performance in the short term can be quite cyclical and extreme.”

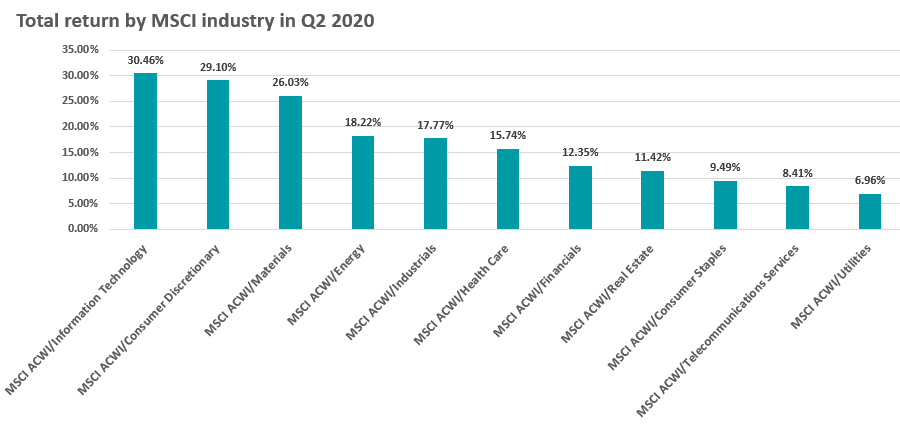

MSCI industries

On a sector level, tech stocks continued their strong run over 2020’s second quarter. This sector led the decade-long bull market that followed the financial crisis and has built on these gains during the coronavirus pandemic as greater working from home and social distanced led to more reliance on products such as video conferencing, media streaming and online gaming.

Adrian Lowcock, head of personal investing at Willis Owen said: “The demand for technology stocks has rocketed this year as investors see them as winners of the chaos caused by Covid-19, with wider social and business trends being accelerated.”

Source: FinXL

The above table also highlights something of a turnaround for more cyclical sectors over the past three months, as investor sentiment towards the health of the global economy started to improve as lockdowns were eased and some data points came back better than expected.

The MSCI ACWI/Energy index, for example, dropped more than 40 per cent in 2020’s opening quarter as the price of oil sank and demand plummeted. But it rose 18.22 per cent last quarter on the back of improving demand and rising prices.

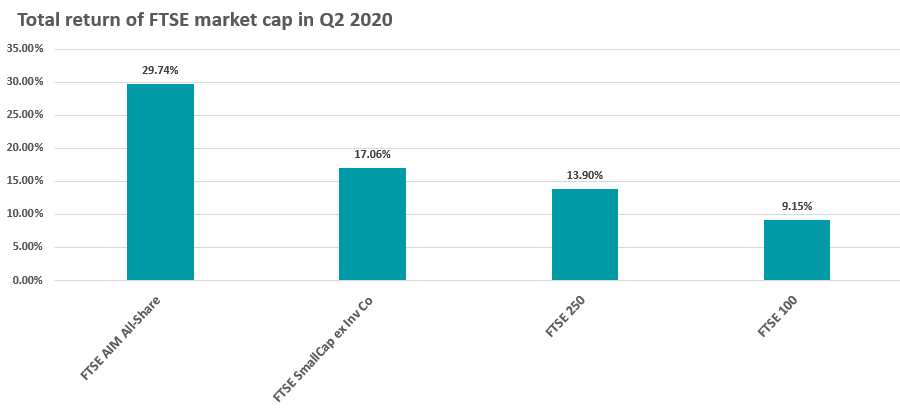

FTSE market caps

In keeping with growing risk appetites, there was also a reversal in the market cap of companies that led last quarter’s gains.

In the UK, smaller companies had a strong quarter with the FTSE SmallCap ex ITs index gaining 17.06 per cent. This was the worst performing part of the market in Q1 with a fall of 32.43 per cent.

Source: FinXL

Large-caps lagged behind in the second quarter, however, with the FTSE 100 posting a total return of just 9.15 per cent.

While all UK stocks have had the headwind of the country being among the worst affected by the coronavirus pandemic, the FTSE 100 has been hit especially hard by widespread dividend cuts. As of the end of June, 48 members of the index had cut, deferred or cancelled their dividend.

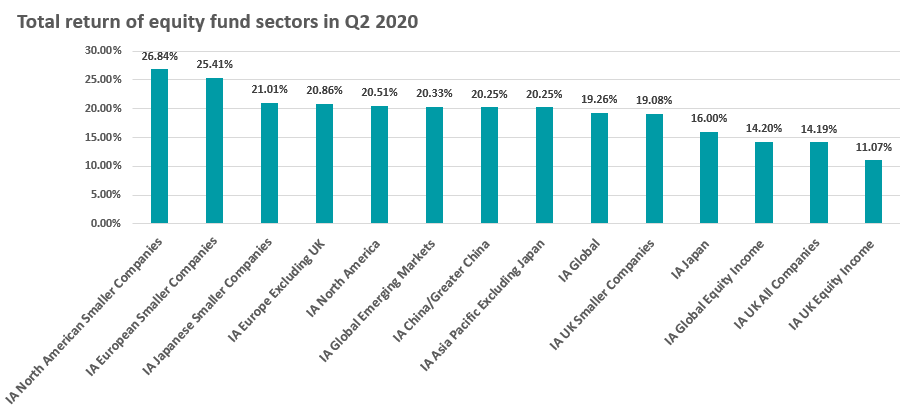

Fund sector performance

A look at the performance of equity funds highlights many of the themes discussed above.

The smaller companies sectors performed the strongest in the second quarter, with IA North American Smaller Companies, IA European Smaller Companies and IA Japanese Smaller Companies all seeing their average member return more than 20 per cent.

Source: FinXL

And it was the UK bringing up the rear, with IA UK Equity Income sitting at the bottom thanks to those dividend cuts.

Willis Owen’s Lowcock said: “The rate of dividend cuts in the UK is unprecedented. Many dividend paying companies have lagged in the rally as they sat in areas of the markets not set to benefit from any short-term changes in people’s behaviour - such as energy, financials and insurance. Whilst we expect more to come, the worst is probably over, as British companies acted fast to cut dividends.”

In the bond sectors, IA Global EM Bonds Hard Currency led with an average return of 14.41 per cent and the other two emerging market debt sectors were close behind.

Sonja Laud, chief investment officer at Legal and General Investment Management, said: “There is also a significantly higher yield available from hard-currency emerging-market debt at the moment, with that part of the universe paying around 6.5 per cent compared with less than 5 per cent for local-currency bonds.”

Source: FinXL

The worst performing bond sector was IA UK Gilts, reflecting the fall in demand for safe havens as investors embraced risk over the quarter.

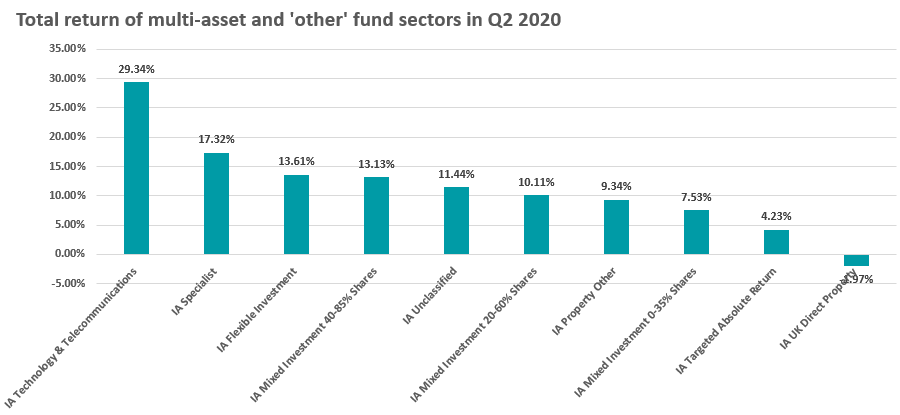

A look at the multi-asset and more specialist sectors has IA Technology & Telecommunications at the top by a clear margin.

IA Specialist is in second place, with gold funds leading the way. Although the demand for safe havens eased, gold continued to perform strongly with MFM Junior Gold rising 94.34 per cent last quarter, followed by LF Ruffer Gold (64.48 per cent) and ES Gold and Precious Metals (61.50 per cent).

Source: FinXL

IA UK Direct Property was the worst performing sector over the quarter. Several of its members are suspended because of outflows and liquidity concerns.

IA Targeted Absolute Return funds also had a lacklustre quarter on average, although there was a big variance in returns from its members. LF Odey Absolute Return, for example, was up 21.30 per cent over the three-month period while BlackRock Emerging Markets Absolute Alpha was down 7.29 per cent.