The first six months of the year will likely be remembered as one of the most unprecedented periods in financial market history. This was not a typical downturn, and no one could have foreseen the scale of its impact in early January.

The outbreak of the Covid-19 coronavirus in Wuhan, China soon became a global pandemic and the ensuing lockdowns brought businesses to a standstill.

A broad-based market sell-off in March was one of the worst since the global financial crisis of 2008, and investors flocked to the relative safe havens of government bonds and gold.

Governments and central banks quickly embarked on fiscal and monetary policies to ease the shock to the economy and the decisive action allowed the market to rebound during April.

Since the sell-off, debate has centred around what shape the recovery might take, having been led by technology stocks as lockdown conditions have increased demand for services catering to those working from home and those who have been furloughed.

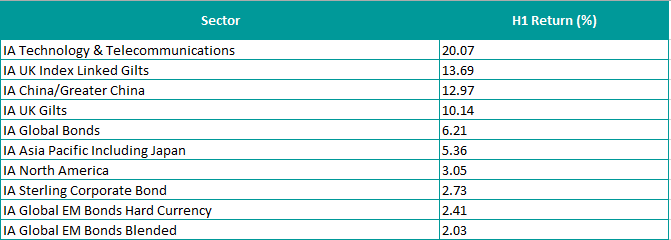

Top-10 best-performing IA sectors

Source: FE Analytics

As such, it is no surprise that the top-performing sector was IA Technology & Telecommunications.

Not only has technology allowed businesses and families to communicate effectively during lockdowns, they have seen profits surge.

Many of the funds in the sector have exposure to the technology giants in the US equity market, such as Microsoft, Apple and Amazon.

In second place was the IA UK Index Linked Gilts sector, where strategies invest at least 95 per cent of their assets in sterling-denominated AAA-rated, UK government backed index-linked securities.

Performance has been bolstered by two interest rate cuts and substantial quantitative easing programmes, increasing expectations of inflation.

In third was the IA China/ Greater China sector returning 12.97 per cent year-to-date. Despite being the epicentre of the virus, the lockdown and subsequent recovery was swift in comparison to the rest of the world. This allowed Chinese businesses to get back on their feet and encouraged consumers to start spending.

The latest growth predictions from the International Monetary Fund’s World Economic Outlook revealed the China would be the only major economy to grow in 2020, albeit by just 1 per cent. Meanwhile the outlook for the UK was more negative with the economy expected to shrink by 10.2 per cent.

Indeed, the three worst-performing sectors were focused on the UK: IA UK Equity Income (down 20.19 per cent), IA UK All Companies (-17.69 per cent),and IA UK Smaller Companies (-16.59 per cent).

The UK has been one of the hardest-hit nations in Europe, having delayed lockdown, while its traditional role in portfolios as a dividend stronghold for investors has been damaged following high-profile dividend suspensions.

Despite being at bottom for performance during the first half, the three UK sectors have performed well since the market bottom on 23 March.

IA UK Smaller Companies funds have performed particularly strongly, with the sector up by 32.8 per cent. While the lower-end of the market cap scale includes many domestically-focused cyclical industries – such as industrials, financials and consumer goods – there are also growth companies in sectors such as telecommunications and technology.

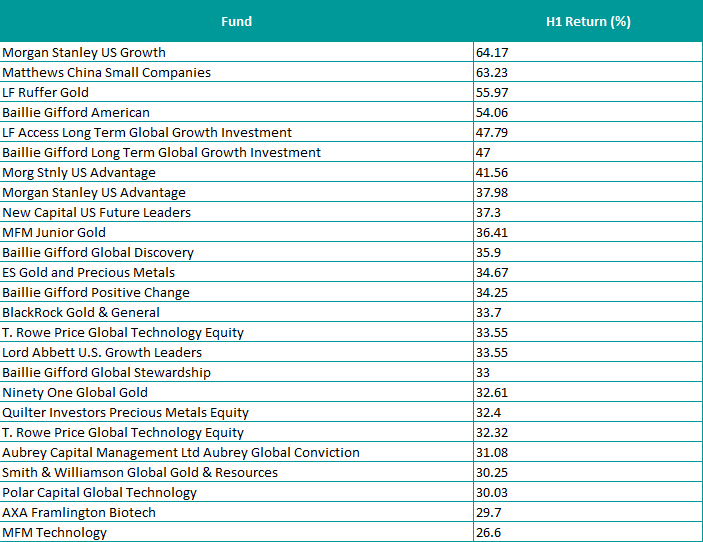

Top 25 best-performing funds

Source: FE Analytics

On an individual fund basis, Morgan Stanley US Growth had the highest return at 64.17 per cent, one of many US equity strategies among the top performers, including Baillie Gifford American, Morgan Stanley US Advantage and New Capital US Future Leaders.

Despite the US struggling to control virus cases and ongoing political and social divisions, it remains a well-loved region for investors and the Federal Reserve has injected huge sums into the system in an effort to stabilise the economy.

The $4bn, five FE fundinfo Crown-rated Morgan Stanley fund has also benefited from the strong performance of technology and media platforms and includes online retailer Amazon, music streaming service Spotify and e-commerce platform Shopify among its top holdings.

The technology boom has in part been responsible for this rise in US stocks, but how quickly the market rebounded after the sell-off was key.

Considering the strong performance of the IA China/ Greater China sector, it is unsurprising to see Matthews China Small Companies within the top three performing funds of H1.

Managed by Tiffany Hsiao and Lydia So, the $218.4m fund has returned 63.23 per cent in the first half of the year.

Chinese president Xi Jingping prioritised labour output, which allowed several smaller companies focused on software, automation and AI to resume production.

“Small businesses make up the bulk of companies of China’s private sector today,” said Hsiao. “Yet only about 2 per cent of the MSCI China index consists of small businesses. Chinese small companies remain an untapped universe that can offer genuine diversification benefits.”

Gold historically does well in a crisis, with fears of recession and inflation leading investors to turn to the yellow metal.

Inflation was what policymakers had hoped to avoid in the early days of stimulus, however in recent weeks disinflation and deflation has also emerged as a realistic possibility, weakening confidence in traditional currencies.

Amidst this backdrop and with fears of a second wave or prolonged continuation of the first wave, the price of gold rose to $1,800 per ounce, its highest level since 2011.

As such, the LF Ruffer Gold fund seems to have benefited from more bullish sentiment toward gold that has continued during the recovery returning 53.52 per cent.

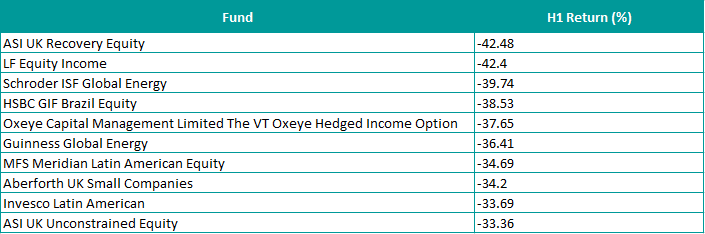

Top 10 worst-performing funds

Source: FE Analytics

The theme among the worst performing funds is the presence of energy funds and those from Latin America, and more specifically Brazil, the largest market in the region.

Brazil has suffered the worst outbreak behind the US and faced similar criticism of its leadership to contain the virus and reveal testing data.

As such countries with large overweights to Brazil such as Invesco Latin American, MFS Meridian Latin America and Brazilian equity strategy HSBC Brazil Equity were among the first half’s worst performers.

However, the worst performing fund of the first half was the ASI UK Unconstrained Equity fund, the £275.2m fund overseen by Wesley McCoy, which made a loss of 33.36 per cent.

As mentioned, energy firms have also experienced a difficult period as first US-Iran relations worsened and an oil price war between Russia and Saudi Arabia made markets more volatile and saw oil prices crash as the Covid-19 pandemic took hold.

As such, Schroder ISF Global Energy and Guinness Global Energy are among some of the worst performers, making losses of 39.74 per cent and 36.41 per cent respectively.

In addition, the energy sector is also undergoing somewhat of a structural change as investors’ ESG (environmental, social & governance) concerns take centre stage and companies usher in a new era of renewable energy that threatens the oil & gas industry.