Over one-third of the funds that best protected their investors during 2008’s global financial crisis continued to shield them in 2020’s coronavirus crash, research by Trustnet shows.

The early part of 2020 saw stocks plunge into bear market territory as the coronavirus pandemic brought the economy to a halt, causing widespread losses among investment funds.

While markets have been rallying for the past couple of months, Trustnet reviewed the maximum drawdowns of funds to see how many have been among the most defensive of their peer group in both the 2008 global financial crisis and the 2020 sell-off.

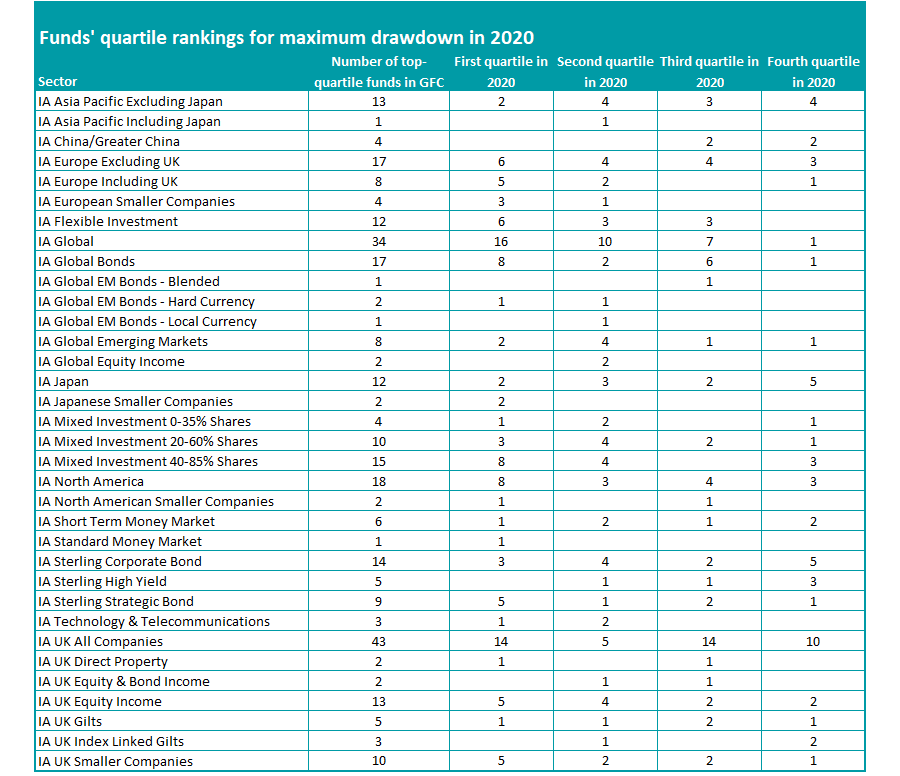

Across the Investment Association universe, there are 303 funds were in the top quartile of their sector for maximum drawdown during the financial crisis and 111 of these achieved the same ranking in the volatile opening five months of 2020.

Source: FE Analytics

The table above shows this broken down by Investment Association sector (and, of course, it only includes the sectors were quartile rankings are deemed appropriate). It’s ranked alphabetically.

The second column shows the number of funds that were in the first quartile for maximum drawdown in the 2008 crash – so those that lost the least amount of money – and the remaining four columns reveal how many of these funds sit in each maximum drawdown quartile over 2020 so far.

As can be seen, there’s some difference in the results of the sectors. In some of the smaller peer groups – like IA China/Greater China, IA Asia Pacific Including Japan, IA Global Equity Income and IA Sterling High Yield – none of the funds with the lowest maximum drawdowns in 2008 ranked as well this year.

In two decent-sized sectors, less than 20 per cent of the funds are on top for maximum drawdowns over the two periods in question.

In IA Asia Pacific Excluding Japan the funds that were top-quartile over both periods are Comgest Growth Asia Pac Ex Japan and Fidelity Institutional South East Asia; in IA Japan, they were Lindsell Train Japanese Equity and Fidelity Japan Smaller Companies.

However, things are much better in other sectors. IA Japanese Smaller Companies has two funds in the top quartile for the financial crisis’ drawdowns and both were best at protecting investors this year: Aberdeen Standard SICAV I Japanese Smaller Companies and Janus Henderson Horizon Japanese Smaller Companies.

In all, 11 of the 34 Investment Association sectors we looked at in this research have seen half of their members that were top-quartile for drawdowns in the financial crisis also achieve this ranking in the opening five months of 2020.

This includes relatively popular peer groups such as IA Sterling Strategic Bond, IA Mixed Investment 40-85% Shares, IA Flexible Investment and IA UK Smaller Companies, which are home to well-known funds like Trojan, ASI UK Smaller Companies, Jupiter Merlin Balanced Portfolio and Marlborough Special Situations.

Defensive funds in the IA Global sector haven’t done too bad with 16 of the 34 in the financial crisis’ top quartile for maximum drawdown – or 47.1 per cent – returning there this year. Among these are Morgan Stanley Global Brands, Wellington Global Health Care Equity and Threadneedle Global Select.

The IA UK Equity Income sector has performed a little worse with just 38.5 per cent of its members repeating a top-quartile performance, including Threadneedle UK Equity Income, Trojan Income, Threadneedle UK Monthly Income and BlackRock UK Income.

IA UK All Companies trails with 32.6 per cent of its best funds for maximum drawdown in 2008 also beating their peers in 2020. Lindsell Train UK Equity, Liontrust Special Situations and BNY Mellon UK Equity are some of the funds doing this.

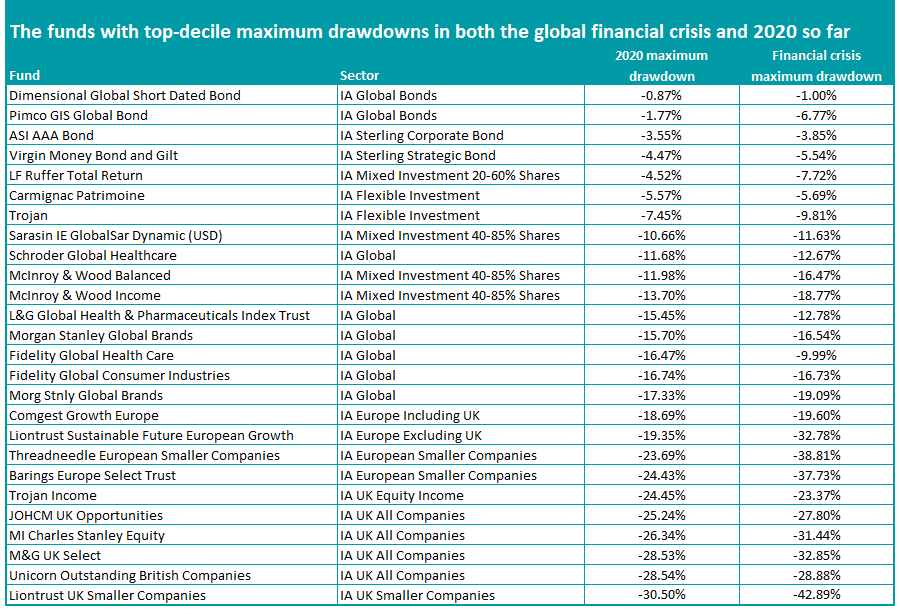

If we tighten the criteria to only look at funds that were first decile for maximum drawdown in both the global financial crisis and the coronavirus pandemic, then we are left with just 26 names (after excluding money market funds). They can be seen in the following table, with their drawdowns for both periods.

Source: FE Analytics

There are several funds on that list which have a strong reputation for preserving capital, with LF Ruffer Total Return being one of them. Its maximum drawdown for 2020 so far stands at just 4.52 per cent.

The £3.3bn fund resides in the IA Flexible Investment sector but is run with an absolute return focus. Managers Steve Russell, Alexander Chartres and Matt Smith are unconstrained in what kind of assets they will hold but the over-riding factor is the aim not to lose clients’ money.

Ruffer’s Bertie Dannatt recently told Trustnet how the fund was able to avoid the worst of March’s coronavirus crash thanks to its cautious positioning.

“It is the overarching context that financial markets have been manipulated by central bank policies for the last decade, which has had the distorting effect of pushing all conventional asset prices up to near-record highs almost wherever you look, in bonds, equities – even in fine wine – while concurrently moving volatility down to record lows,” he said.

“What we’ve observed is there’s nowhere left to hide, because all traditional asset classes have been caught up in this distortion. Given that context, I think what you’re now starting to see is signs of the market internalising exogenous shocks into an endogenous event and how this instability stemming from central bank policies has created the potential for this market to be avalanche prone.”

The £4.8bn Trojan fund, which is headed up by Troy Asset Management’s Sebastian Lyon, is another multi-asset fund that has a name for capital preservation, as does its stablemate Trojan Income.

Other funds that are larger than £1bn and were in the top decile for maximum drawdown over both periods include Morgan Stanley Global Brands, Pimco GIS Global Bond, Comgest Growth Europe, Barings Europe Select Trust and Liontrust UK Smaller Companies.