Close to 70 funds that had been among the strongest of their peers over the past decade have fallen towards the bottom of their sectors in the turbulent conditions of 2020, Trustnet research shows.

The coronavirus pandemic and the resulting economic uncertainty has thrown up many challenges for fund managers to navigate, with markets endured heavy falls in March before staging something of a comeback over April and May. However, many are predicting further volatility in the months ahead.

In this research, Trustnet has examined the performance of funds that made top-quartile returns over the decade to the end of 2019 to see where they ranked in the opening five months of 2020.

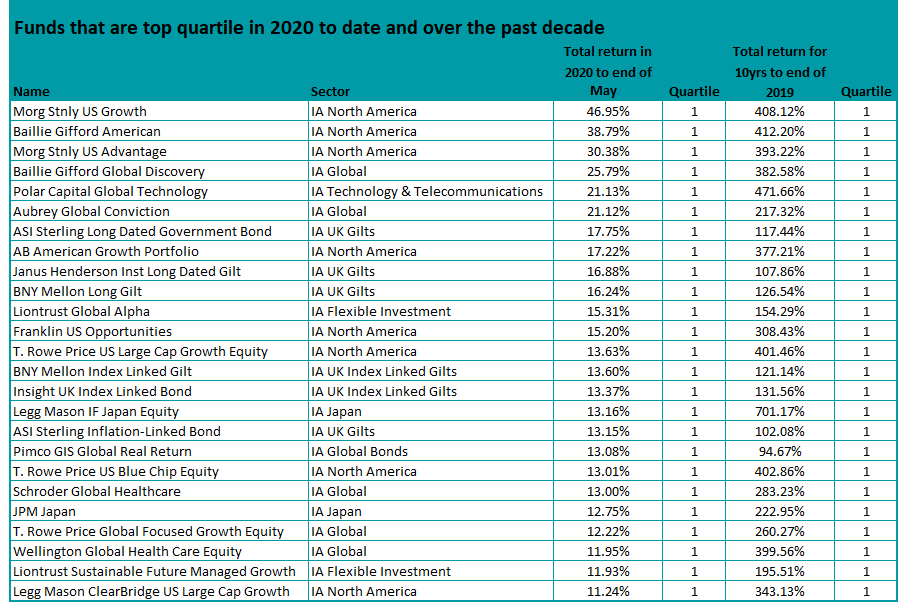

Of the 373 Investment Association funds with first-quartile total returns over the 10 years under consideration, 150 have remained in the top quartile over 2020 so far. The 25 funds with the highest returns this year can be seen in the below table.

Source: FE Analytics

In the wider list of 150 long-term outperformers maintaining a top-quartile position in 2020 can be found popular offerings such as LF Lindsell Train UK Equity, Liontrust Special Situations, Jupiter Strategic Bond, Baillie Gifford American and Trojan Income.

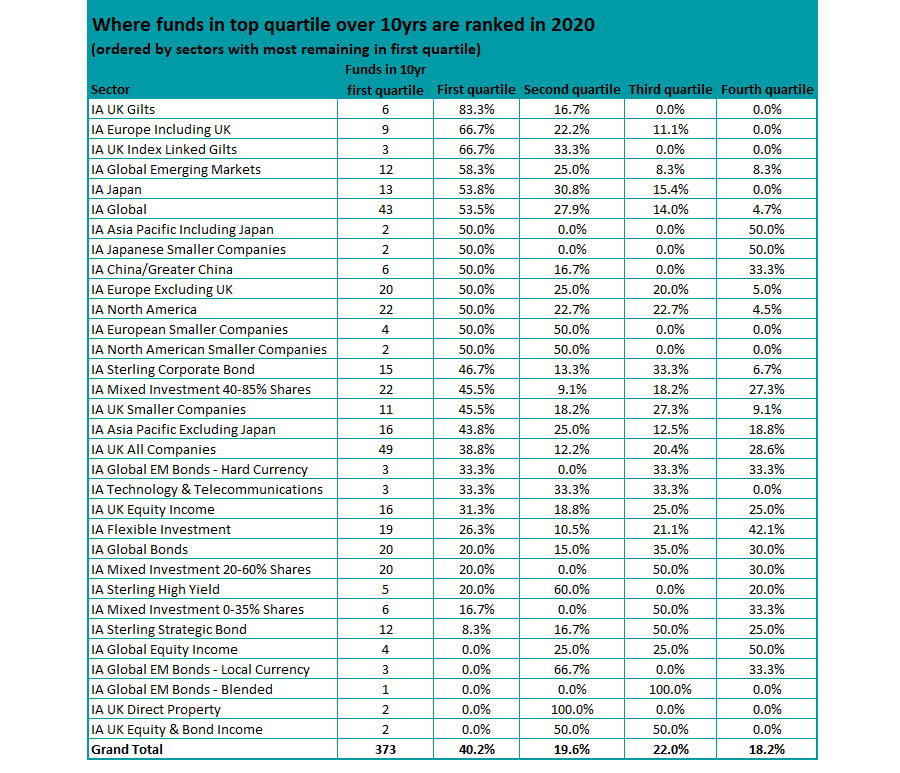

The sector where the biggest proportion of funds are in the top quartile over both 10 years and 2020 is IA UK Gilts. Some 83.3 per cent of its members have done this.

It has six funds that were top-quartile over the past decade and five of them held their place at the top of the sector this year, including the £3.6bn Vanguard UK Government Bond Index tracker. Insight UK Government All Maturity Bond has slipped into the second quartile in 2020.

The IA Global Emerging Markets sector has seen seven of its 12 long-term outperformers remain in the top quartile over the first five months of 2020.

These include GS Emerging Markets Equity Portfolio, GS Emerging Markets CORE Equity Portfolio, JPM Emerging Markets and Baillie Gifford Emerging Markets Growth, all of which are more than £1bn in size.

Three have fallen into the second quartile, two have moved in the third and one – Templeton Emerging Markets Smaller Companies – has dropped into the bottom quartile after losing 15.24 per cent this year.

As the table below shows, the IA Global sector – which is among the biggest in the Investment Association universe and one where a lot of money has flowed in recent years – has a decent number of funds that have held onto a top ranking.

Source: FE Analytics

Of the peer group’s 43 members that were in its top quartile for the decade to the end of 2019, 23 – or 53.5 per cent – have stuck there over the coronavirus crisis.

Morgan Stanley Global Brands is the largest on the list, with assets under management of £13bn. It looks for high-quality companies that have competitive advantages such as dominant market positions, hard-to-replicate intangible assets, high returns on operating capital, strong free cash flows, recurring revenue streams, pricing power and low capital intensity.

The quality-growth approach was highly successful in the 10-year bull market that followed the financial crisis and has held up over the coronavirus pandemic as investors favoured companies that are considered to be ‘safer’ than their more cyclical peers.

Other IA Global funds that follow a similar approach and are in the top quartile over both 10 years and the year to date include Rathbone Global Opportunities, T. Rowe Price Global Focused Growth Equity, JOHCM Global Select, Seilern World Growth and Trojan Global Equity.

Fundsmith Equity, of course, is one of the best-known members of the sector to use a quality-growth approach; it is in the top quartile this year but does not yet have a 10-year track record.

The largest sector in the Investment Association universe is IA UK All Companies and funds here have been less successful in holding onto a top-quartile ranking, however. Of the peer group’s 49 members that were top-quartile over the 10 years to the end of 2019, only 38.8 per cent – or 19 funds – remain there during 2020 so far.

LF Lindsell Train UK Equity and Liontrust Special Situations have already been mentioned, but other popular members of the sector achieving this include TB Evenlode Income, Ninety One UK Alpha, Royal London Sustainable Leaders Trust and Slater Growth.

However, of those 49 funds that are top-quartile over the long term, 14 have dropped into the bottom quartile this year. JOHCM UK Dynamic, Franklin UK Mid Cap, Schroder UK Mid 250 and ASI UK Unconstrained Equity are some of the names among them.

Source: FE Analytics

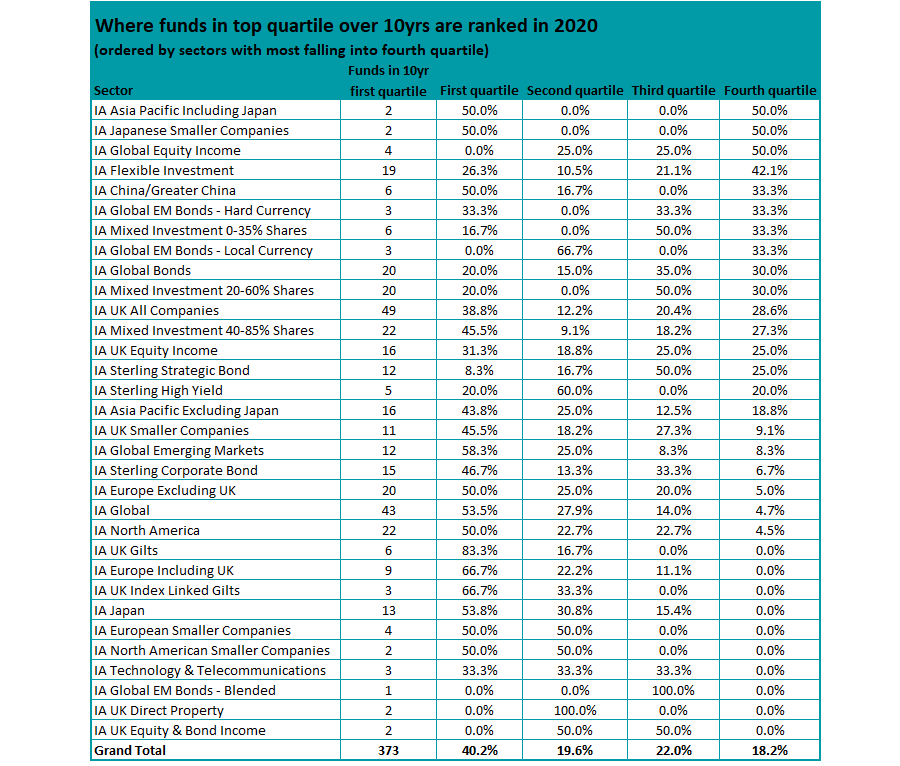

When it comes to the sectors with the biggest share of members moving from the top quartile over 10 years to the bottom quartile in 2020, IA Asia Pacific Including Japan, IA Japanese Smaller Companies and IA Global Equity Income have all seen half hit by this fall – although they are relatively small peer groups.

IA Flexible Investment is much bigger than these four, however, and 42.1 per of its top-quartile funds – or eight of them – have dropped into the bottom quartile. Among these are the Quilter Investors Cirilium Dynamic Portfolio, Invesco Managed Growth (UK) and RBS Managed Equity Growth funds.

In total, 68 funds went from being in the top quartile of their peer group for the 10 years to 2019’s end to the fourth quartile this year. Another 73 went into the second quartile and 82 moved into the third.