Experience of past crises and volatility in Japan can help fund managers navigate the challenges thrown up by the Covid-19 pandemic, according to Comgest’s Richard Kaye.

The £3.7bn Comgest Growth Japan fund was the second best-performing fund from both IA Japan and IA Japanese Smaller Companies sectors in 2020, narrowly losing out to top performer Nomura Japan High Conviction.

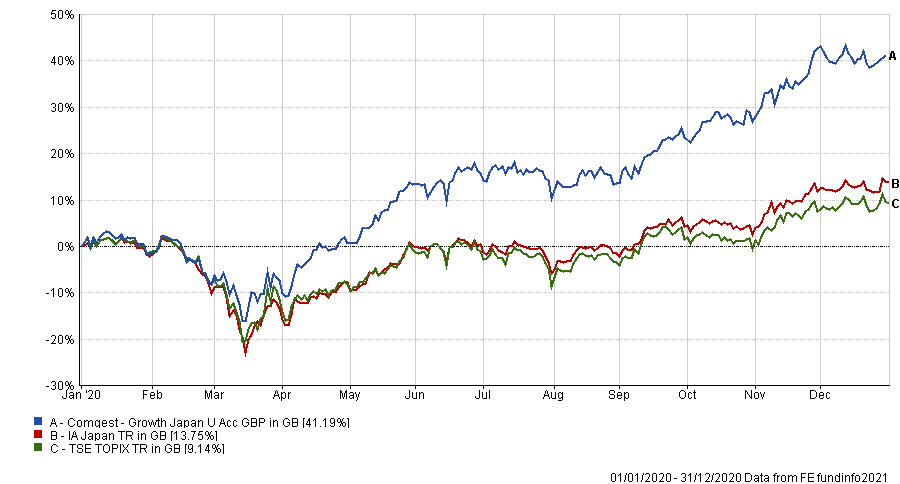

It made a total return of 41.19 per cent, outperforming the IA Japan sector (13.75 per cent) and the TSE TOPIX index (9.14 per cent).

Performance of fund vs sector & benchmark during 2020

Source: FE Analytics

Kaye said part of his fund’s ability to outperform during what was a challenging year for markets globally was having had experience managing money in the Japanese markets through several crises and years of high volatility.

This experience helped them add companies to the portfolio that can withstand intense periods in markets, “survivors”, as he called them.

He said: “Japan’s market has had equally volatile years in the past 20 years we have been investing in the country.

“For example, 2013 when the reforming Shinzo Abe government came in, 2011 after the tsunami, 2009 [after the global financial crisis] and 2001 [after the dotcom bubble] like other markets, and several years in the 1990s as the ‘Bubble Market’ unwound.

“Each bout of market volatility heightened investors’ focus on survivors, which can grow despite all the negatives and these survivors are where we look to invest for the long term.”

Japan’s market and economy has recovered better than others from the impacts of Covid-19, although it’s struggle with exports is impinging the recovery, Kaye said.

Indeed, Japan took a different approach to handling the Covid-19 outbreak.

Unlike other countries it avoided a full-scale lockdown, which allowed it to “[keep] the basic functions of its economy open despite the pandemic,” Kaye said, as businesses such as shops, restaurants and bars could continue trading, albeit at a reduced rate.

“The recovery has therefore been easier, but Japan still needs to export so has been hostage to some extent to the lockdowns in the rest of the world,” he added.

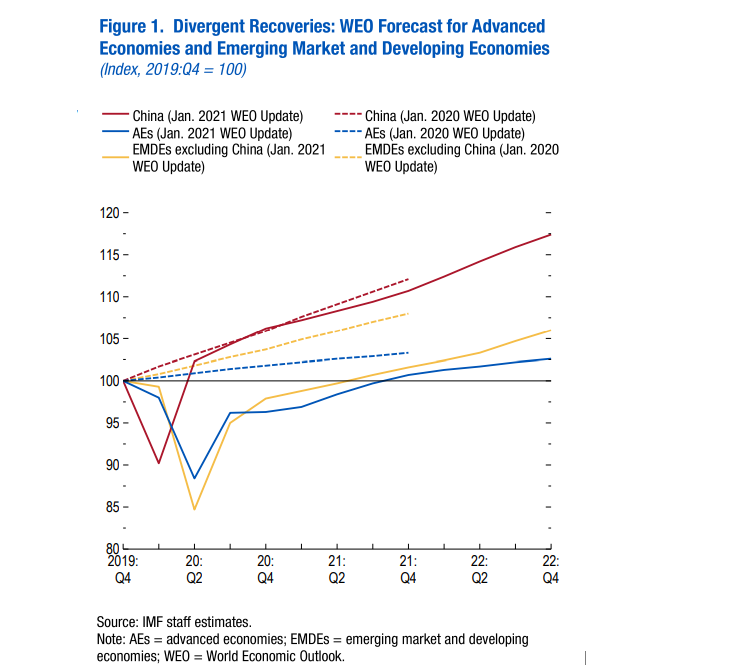

Japan’s recovery has been helped by China’s early rebound last spring, Kaye said.

Japan’s recovery has been supported by accommodative fiscal policy as new prime minister Yoshihide Suga announced an economic package worth $700bn at the end of last year. The stimulus looks to support corporate cash flow and promote new green and digital technology.

As its name suggests, the Comgest Growth Japan fund follows the growth style and aims to invest in high-quality companies long-term.

Applying that process during the pandemic, Kaye said the fund had invested in the various social changes which had already been occurring in Japan and were accelerated by the pandemic.

He said: “Japan is catching up to the rest of the developed world when it comes to online medical services, cashless payments and other kinds of e-commerce.

“In 2020 many of these changes proceeded at ‘warp-speed’, partly because of the pandemic.”

Some of the companies playing this theme were medical portal M3, cashless processor GMO Payment and Daifuku an e-commerce infrastructure provider.

These were all “major contributors”, to the fund’s performance last year, according to Kaye.

Looking ahead, the manager said these accelerated changes would continue playing out in the long term.

“Like with fashion after Japan modernised in the 19th century, sport after the war [when Japanese adopted baseball], or the switch to online shopping after the 2011 earthquake, so with Covid-19 Japan ditched ages-old practices in an instant and replaced them with remote working and shopping, new ways of signing documents digitally, and even online religious ceremonies,” Kaye said.

“These changes will stick beyond the pandemic, and the companies providing them will grow.”

Underlying all of this will be the growth across Asian markets, which Kaye thinks is going to be a significant theme for the next decade, filtering back into the Japanese companies “who supply aspirational brands to Asia’s growing consumer base and unique technology to its industries”.

But one of the most important changes to come out of the pandemic for Japan is that domestic investors have started to buy and focus on its own companies more.

“Domestic investors rediscovered their own market during Covid-19,” Kaye said, which has significantly driven up the index’s performance compared to other equity markets.

Kaye runs the Comgest Growth Japan along with Chantana Ward and Makoto Egami.

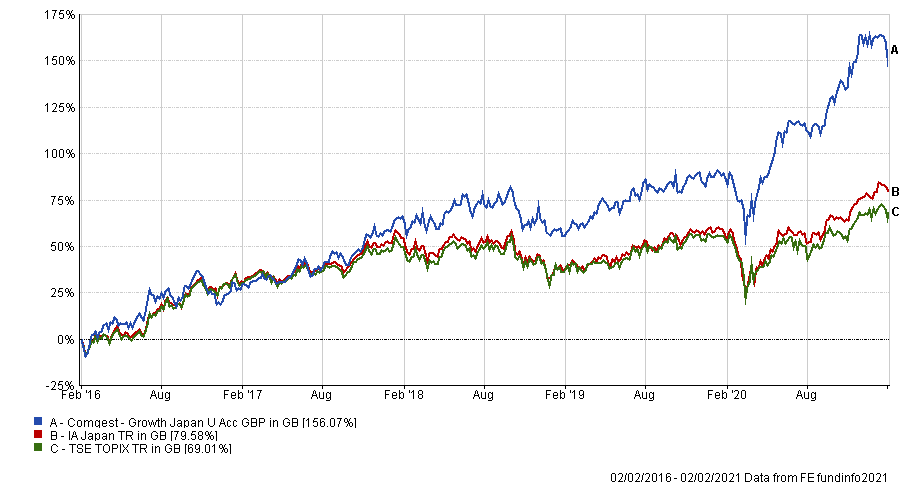

Performance of fund vs sector & benchmark over 5yrs

Source: FE fundinfo

Over the past five years, the fund has made a total return of 156.07 per cent, outperforming both its sector and index. The five FE fundinfo Crown-rated fund has an ongoing charges figure (OCF) of 0.92 per cent.