The European market, particularly the small-cap space, is starting to “reinvent itself”, according to FE fundinfo Alpha Manager Stephen Paice, who has been investing his £2.5bn Baillie Gifford European fund in emerging opportunities.

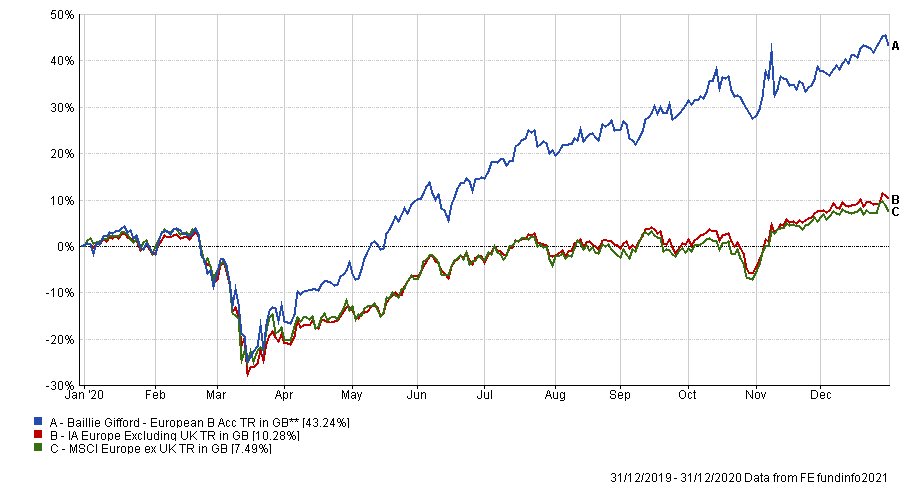

In 2020, the Baillie Gifford European fund was the second best performer across the three IA European equity sectors in 2020. During that time, it made 43.24 per cent, beating the IA Europe Excluding UK sector (10.28 per cent) and the MSCI Europe ex UK benchmark (7.49 per cent).

Performance of fund vs sector & benchmark in 2020

Source: FE Analytics

Paice said that over the past few years there have been a couple of changes made as to the types of companies the fund invests in which led to it outperforming during a crisis year for markets.

One of the changes was that Baillie Gifford had started to identify an “asymmetry in the market”, whereby just a small number of companies make up the majority of returns.

Identifying and investing in these companies became a core part of the investment process, along with the long-term time horizons, he said.

Referring to them as “outliers”, Paice said: “I think that was a big change over the last five or 10 years [was] working harder to find to find these outliers to produce these phenomenal returns.”

The second part relates to the change going on within the European market itself, and that the ‘outlier’ companies Paice is looking for are no long coming from the traditional winning sectors in Europe.

Instead he thinks that the composition of what the big winners in Europe will look like for the next 10 years is shifting into tech.

He said: “We believe that Europe has started to reinvent itself through smaller companies to begin with, whether that's [on] the private side, or in the public markets.

“When we kind of look back at the composition of big winners in Europe over the last 10 or 20 years, you will see lots of industrials, lots of brands, luxury goods companies, there are very few banks, very few utility companies.”

Nevertheless, Paice (pictured) said the ‘clusters of excellence’ in Europe – such as world-leading industrial companies or consumer franchises – are likely to make way for more technology companies.

However, technology is not a sector Europe is especially well-known for at the moment, something which Paice himself acknowledges.

“Technology is something which Europe hasn’t done well. I think if we look at the European market, probably close to 10 per cent would be tech,” he said.

But what’s changing now are more entrepreneurs coming through with “disruptor companies”, mainly in digital platforms, Paice said.

“One of the things that has held European companies back – and certainly technology companies in Europe – has been the lack of funding,” he said. “But [there is] also a lack of ambition and understanding that the behaviour and some of the massive success stories in China [means] you need to kind of forget that short-term profitability because you need to focus on growth and building out the biggest user base you can possible manage. And then the value and the profits will grow beyond that.

“Now I don't think that that understanding or the ambition to grow massive technology platform has an existed up until now in Europe.”

Paice said five years ago the Baillie Gifford European fund had zero exposure to digital platforms. But as that opportunity set has changed he has invested more of the fund into that area of the market. Today it makes up one-third of the portfolio.

These include companies such as Zalando, a German e-commerce site which launched in 2014 and is now one of the biggest fashion market places. Or Adyen, a Dutch digital payments processing company. There are also delivery companies, such as Delivery Hero or Just Eat Takeaway.

A lot of these companies are supported by strong structural growth trends, according to Paice, alongside being on the ‘right side’ of consumer changes as people move more to online shopping than they have done in the past.

While a lot of the pandemic elements favoured these online companies in 2020, Paice said they also have the ability to maintain that performance in the longer term, including over the five-to-10 year period that Baillie Gifford favours.

He added: “I think, you're going to see the fruits of that innovation, changing levels of ambition coming through into public markets as well over the next five or 10 years.

“So, Europe has been a bit of a laggard. I think it was one of those regions which people just don’t really like investing in because they look at it from a top-down view and just see the kind of large, boring companies which don’t really grow so much.

“But when you look down the market cap and when you look at the private side some of the innovation areas we’ve talked about, you can build up a very good case that this is Europe’s time to shine [over the] next five or 10 years.”

Paice manages the Baillie Gifford European fund along with Moritz Sitte, Chris Davies and Josie Bentley.

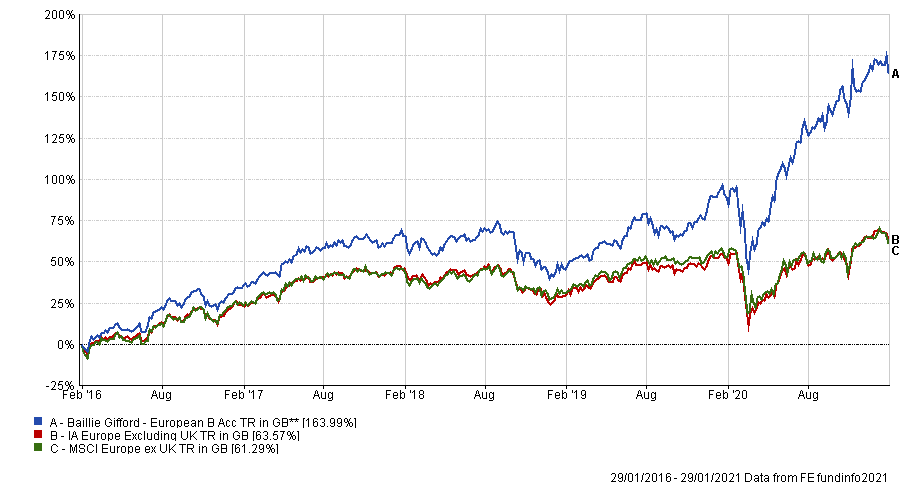

Over the past five years, the fund has made a total return of 163.99 per cent, outperforming the sector (63.57 per cent) and benchmark (61.29 per cent), shown in the chart below.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

With an FE fundinfo Crown Rating of five the fund has an ongoing charges figure (OCF) of 0.58 per cent.