While the ‘giant’ funds of the investment world garner a lot more of the attention than the smaller ones, it doesn’t mean necessarily mean smaller funds aren’t worthy, or that smaller size equals worse returns.

This was shown by the £169.9m L&G European Trust, which was the best performing European equity fund under £300m across the three IA European equity sectors in 2020.

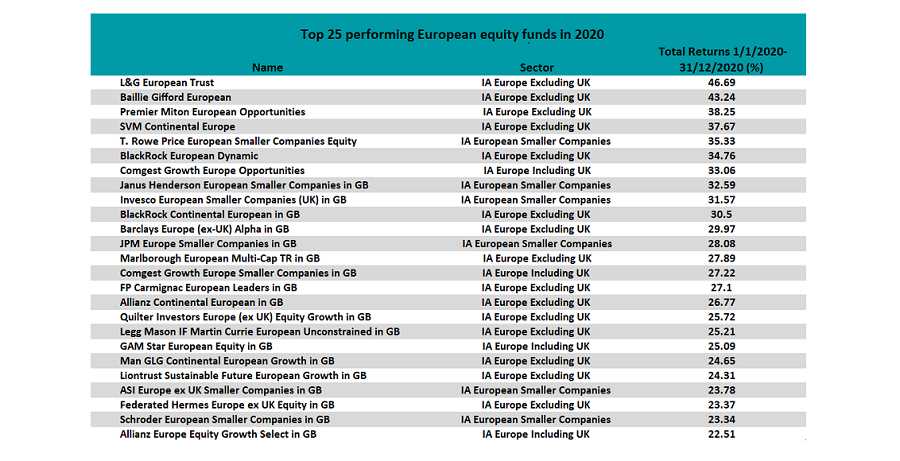

The L&G European Trust was the best performer from across the IA European Excluding UK, IA European Including UK and IA European Smaller Companies sectors making a 46.69 per cent total return, outperforming some of the Beating significantly larger strategies in the process.

Source: FE Analytics

Fund manager Gavin Launder, who has run L&G European Trust for almost a decade, said its growth-focused approach and ‘multi-theme’ investing are what helped it outperform in 2020.

One of the major themes for the fund in 2020 was tech, also a significant sector for global markets last year as well.

Launder said: “Europe is often accused of not having growth companies and that you have to look at the US [for them]. That is sort of true in that we don’t have a Facebook or much of anything like an Amazon, although Zolando and ASOS are trying.

“But we do have a lot of very strong tech companies that are sort of behind the scenes type things like ASMl Holding, SAP, Infineon and so on.”

Launder (pictured) added that while tech had been a big focus for the fund it had also invested in strong “non-tech growth stories”. One of which was ESG (environmental, social and governance), or what Launder called “the green theme”.

ESG has been a major investment theme across the investment space in 2020, as the pandemic highlighted the need and opportunity to invest in climate and social solutions.

Europe has appeared ahead of other markets when it comes to the number of ESG or sustainable companies on offer and government policies supporting sustainability. This has been seen with the EU’s Covid Recovery Fund which works directly with its Green Deal and includes explicit financial support for climate change solutions.

Launder said that “ESG has been increasingly integrated into the whole process over the last few years”, noting that part of this integration involved splitting it into three sections.

One, is the ESG ‘sinners’ such as oil, gas or tobacco companies, which Launder said, “they’re never going to get in there [the fund]”. The second section is ESG ‘winners’: companies which are fully immersed in ESG and sustainability, providing active solutions. Stocks falling into the middle make up the third category where Launder said the bulk of the portfolio is invested and where the L&G apply more of their engagement focus, encouraging companies to become more environmentally or socially friendly.

“[There] you’ve got everyone else and varying degrees of ESG sinning or winning and we’re very happy to engage with companies,” he said.

“And what we’re trying to establish is what their path is to improvement and whether it’s possible or feasible. And so that would be the bulk of the portfolio in a way, because there are only so many high ESG ratings you have.

“And it’s not like the market has missed them at the moment,” he said.

Some of the fund’s ESG names were the strongest performers last year, according to Launder. Such as Dutch company Alfen which manufactures and connects renewable energy to power grids.

“They’ll do battery storage for big events,” said Launder. “So back in the day a rock concert would have a big 20-foot container behind the stage with a diesel generator.

“Nowadays, it would be that 20-foot container with a big electric battery in it that they would have charged and delivered. And then they [also] do charging ports [for vehicles].

“So [they’re] throughout Europe, including in the UK. And that I think was our best performer last year, so it was a very strong name.”

Looking ahead to 2021, Matthew Courtnell, equities product specialist on the fund, said that the ‘green theme’ as an investment opportunity in Europe cannot be understated.

He said: “I really think on the outlook I do not think you can underestimate the impact of sustainability as a tailwind to Europe in particular.

“You’ve got a lot of markets with rich industrial heritage which are effectively shifting quite rapidly with the emergence and growing focus on companies with sustainable solutions or solution enablement, [which] is only going to get more significant in Europe [compared] to other markets in the world.”

He added that t government policy to support decarbonisation is going to benefit secular growth trends – and the fund – in the long-term.

“But now I think just emphasising that stainability angle, and that transition across Europe is really going to benefit the fund and how it’s positioned,” he said.

Discussing the market’s recovery from the Covid-19 coronavirus, Launder agreed that the delay in getting a unified vaccine programme rolled out across Europe would impact the market’s recover.

Europe is currently behind the UK in terms of vaccine rollout, but it’s expected that by the summer the people most vulnerable to coronavirus will have received their vaccine, Launder said.

But during that recovery Launder said that the market might rotate into more value areas as things like travel and airlines start to pick up.

However, this won’t change what he is doing in the fund.

“I think we’re going to see some rotation into those sorts of names at some point,” the L&G European Trust manager said. “But principally we wouldn’t be changing much.

“What we’re investing in we hope and believe our multi-year trends, the lower carbon economy, the circular economy, technology-driven disruption. These are things that are here to stay for quite some time.”

While some of these themes “may have gotten a bit expensive in the last year”, according to Launder he still thinks that investors will ultimately come back to quality stocks.

“You get these periods of rotation,” he explained. “Every year in the last five years there’s been a period stretching from two weeks to two or three months where you’ve had that rotation.

“But typically the world has focused back on quality again because, I believe firmly, that’s what equity investors want, as a core their long-term holdings.”

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Over the past five years the L&G European Trust has made a total return of 111.37 per cent, outperforming the FTSE World Europe ex UK index (83.72 per cent) and the IA Europe Excluding UK sector (71.71 per cent). It has an ongoing charges figure (OCF) of 0.81 per cent.