While the majority of fixed income strategies have floundered in the opening months of 2021, one fund has managed to stay head and shoulders above its peers.

The £102.2m Man GLG High Yield Opportunities fund has shown itself to be one of the strongest funds in the IA Sterling High Yield sector since its launch in 2019.

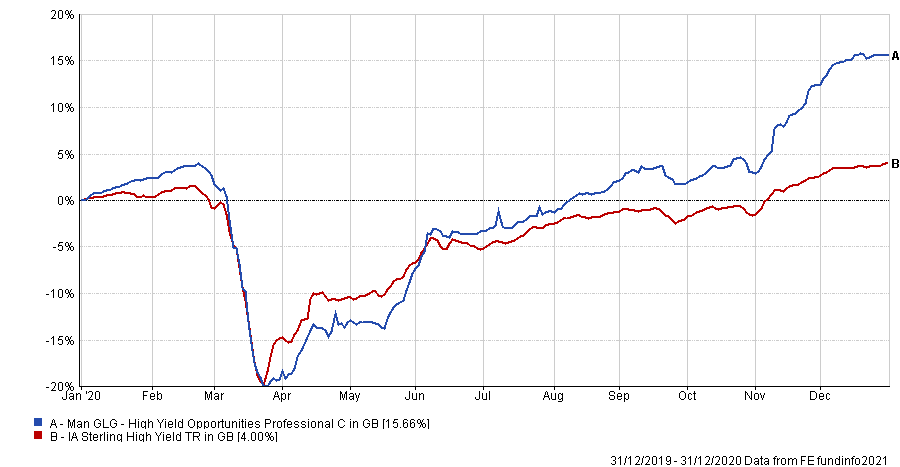

Its total return of 15.66 per cent in 2020 was over three times the average total return of its peers and the best result of the sector.

Performance of fund versus sector over 2020

Source: FE Analytics

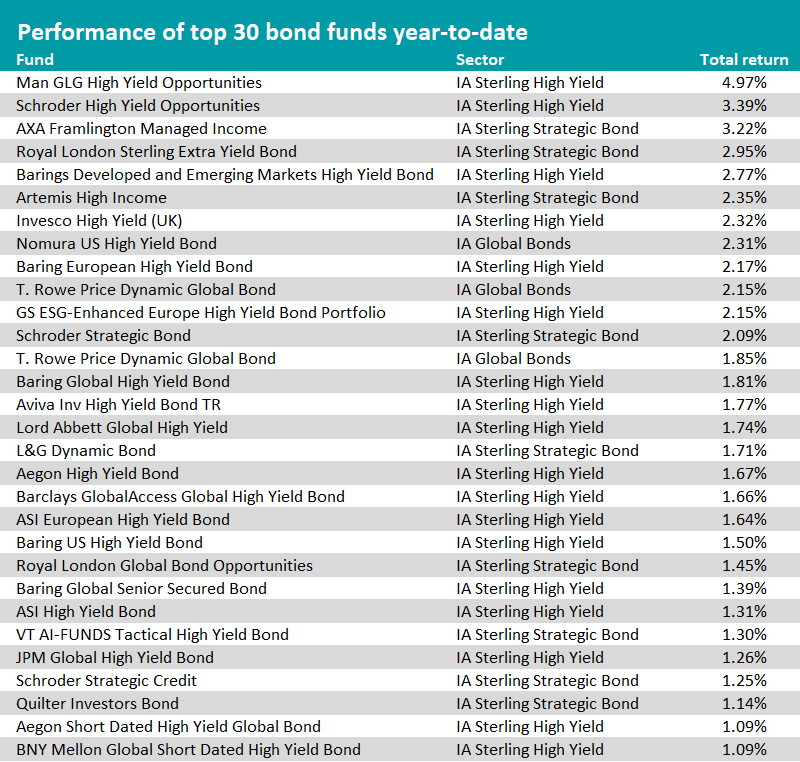

Year-to-date, it has maintained this outperformance amid the bond market sell-off during the first months of the year, returning 4.97 per cent. Again, it is the IA Sterling High Yield sector’s highest returner over this period.

Source: FE Analytics

Man GLG High Yield Opportunities is managed by Michael Scott, who previously ran a similar strategy at Schroders.

Discussing what drove the fund’s performance last year and allowed it to hold up well during the sell-off, Scott said that there were three “critical” elements to the process.

The first is the bottom-up process used to assess the strength of companies.

According to Scott, investing in high yield bonds lends itself to a bottom-up process for delivering the best risk adjusted returns.

Scott explained that because the companies issuing debt here are smaller they can be “significantly impacted by prevailing conditions”, such as less pricing power and more variable cash slows.

“That's just the nature of the asset class,” Scott said.

“And that's why it's absolutely critical to be able to analyse these cash flows and credit strength, and really [to] have seen a number of cycles to understand how cash flows and credit quality changes through the cycle.”

Scott added that the process doesn’t completely ignore the top-down scenarios. Rather it has a focus on bottom-up fundamentals, which are used to access and anticipate trends, counterbalancing them with secular top-down thematic analysis.

The second element is “getting the fundamental calls right. It’s absolutely critical to being successful in this asset class”, Scott said.

“There may be dislocations, technical dislocations at certain points of the cycle, but ultimately it’s really fundamentals which will win out and I would say that remains our prime focus here at Man GLG.”

The final critical element is remaining nimble as this allows the fund to adapt to changing opportunity set in the asset class throughout the cycle.

“I'd say that that slightly differs to more kind of benchmark orientated approaches, where typically they're more macroeconomic-driven, top-down driven. They say ‘I want to be overweight this sector or this currency block or this rating bucket’,” he said.

“We all know that the world isn't necessarily designed in that way, it’s much more complicated. So we try to assess this complexity and we think that that is the key to driving long-term sustainable, high risk adjusted returns.”

Applying this process during the Covid-19 market crisis last year, Scott said that during the initial outbreak in January he focused on making Man GLG High Yield Opportunities more defensive, focusing on areas of the market which he thought would be more significantly impacted by the pandemic.

This included Asian-based or consumer-facing businesses in travel, leisure, or transport.

“And that stage was back in January, not that we were fully expecting it [Covid-19] to morph into the size of the problem that it did,” Scott said.

As the full impact and implications of Covid-19 snowballed into the March sell-off, Scott had anticipated a short but deep recession thanks to the vast amounts of monetary and fiscal support being issued.

“That obviously has big implications for your default rate cycle. At that stage the expectations were for very high annualised default rates, which we thought were completely miss founded, based on fundamentals,” he said.

According to Scott a significant amount of value had opened up and he took the opportunity to build substantial positions in some of the more Covid-affected sectors. “There, we felt we were looking for the best houses in bad neighbourhoods,” he said.

Looking ahead and one thing which Scott pointed out was that default rates, despite a year of crisis for many companies, are actually declining.

He explained that with economies expected to reopen it will be easier for companies to generate cash flow, meaning they’ll be more likely to keep up with payments.

Scott said: “As economies reopen, we're expecting to see actually quite a substantial shift from good spending back to services and leisure. And that I would say that's particularly where default rate pressure is most acute.

“Our view is actually that for a number of these businesses where, certainly if lockdowns continue, have a rather difficult outlook, but that's certainly not our base case or our central case for 2021.

“When it comes to defaults, ultimately default is driven by non-payment, and that’s either the non-payment of a coupon or a non-payment of a bond maturity. Coupons become easier to pay if your cashflows are growing. So that's why the returns of the space are very much driven by the business cycle as opposed to the interest rate cycle.”

While there has been widespread recovery across markets, Scott still thinks that selection and performance of individual bonds will have a big impact this year.

“As we look through this year, we do think that spreads and asset prices have recovered across all majority and many risk asset classes. But it doesn't really tell you the full or close to full story of where the value is,” he finished.

“And this goes back to my point, that while we think in aggregate asset prices have come a long way since the lows of last year, there is still a significant idiosyncratic opportunity from stocking picking this year.”

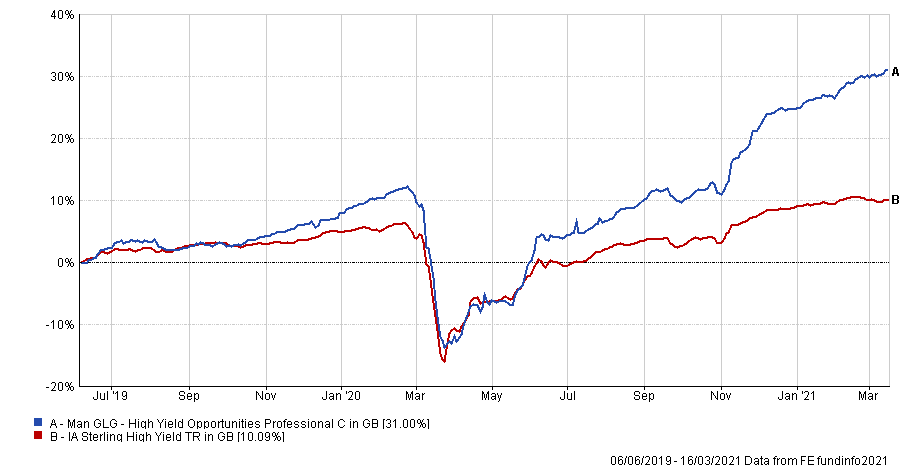

Performance of fund vs sector since launch

Source: FE Analytics

The Man GLG High Yield Opportunities fund has an ongoing charges figure (OCF) of 0.75 per cent and is yielding 6.84 per cent.