Some of 2020’s highest-returning funds were hit with losses on last week’s news that Democrat candidate Joe Biden had won the US presidential election and the unveiling of a better-than-expected coronavirus vaccine, Trustnet research shows.

At the same time, many of the strategies that have sat at the very bottom of their sector during the ongoing coronavirus pandemic and the recent election in the US rocketed to the top last week.

Although current US president Donald Trump has yet to concede the election, Biden has secured his place in the White House, promising to launch a more effective response to the pandemic and unveil further stimulus to support the economy. In addition, it is almost certain that he will have a less volatile leadership style than Trump.

Added to this was the announcement from US pharmaceutical giant Pfizer and German biotechnology company BioNTech SE that their BNT162b2 vaccine candidate was found to be more than 90 per cent effective in preventing coronavirus infections. This created hope that the vaccine could start to be deployed in the months ahead.

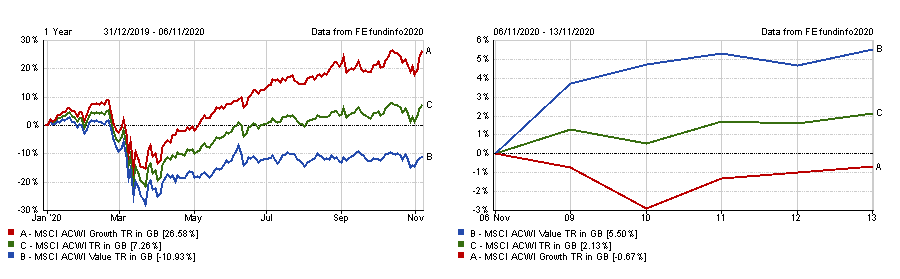

This combination of good news led to a market rally last week, with the MSCI AC World index rising by 2.13 per cent over the span of five days. Over the whole of 2020 to the end of the week before, it had made 7.26 per cent.

In this article, Trustnet has looked to see how the best and worst-performing funds in the Investment Association universe fared over the course of last week, given the potential magnitude of the changes it witnessed. However, it needs to be kept in past performance is no guide to future returns and one week is a very short period to examine.

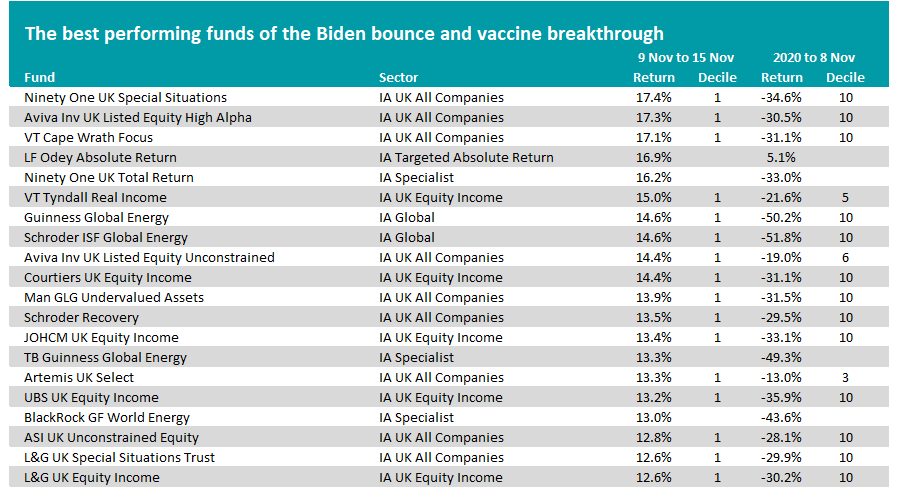

The fund that made the highest total return last week is Steve Woolley and Alessandro Dicorrado's Ninety One UK Special Situations fund, which was up 17.4 per cent.

Source: FE Analytics

The table above shows the 20 funds that made the highest total returns last week (spanning 9 November to 15 November), along with the returns for 2020 up to 8 November and their decile rankings where appropriate.

As can be seen, Ninety One UK Special Situations – which uses the out-of-favour value investing style – was in the IA UK All Companies sector’s bottom decile for 2020 before the Biden bounce and vaccine announcement.

The fund’s biggest sector weighting is to industrials, while its largest overweights are to support services, travel & leisure, aerospace & defence, automobiles & parts and banks. These areas suffered over the coronavirus pandemic but are poised to rally should a vaccine be successfully rolled out.

However, the table makes clear that this isn’t the only fund to move from its sector’s bottom decile to the top decile in last week’s performance rankings.

Well-known funds such as LF Odey Absolute Return, Man GLG Undervalued Assets and Schroder Recovery also did the same, as did Schroder ISF Global Energy – which had made the biggest losses over the rest of 2020.

In all, 57.1 per cent of funds that were in the bottom decile of their peer group for 2020 jumped into the first decile for their returns over the past week, with another 16.5 per cent going into the second decile.

Conversely, 52.5 per cent of first-decile funds turned in 10th decile returns last week, while another 16.3 per cent fell in the ninth decile.

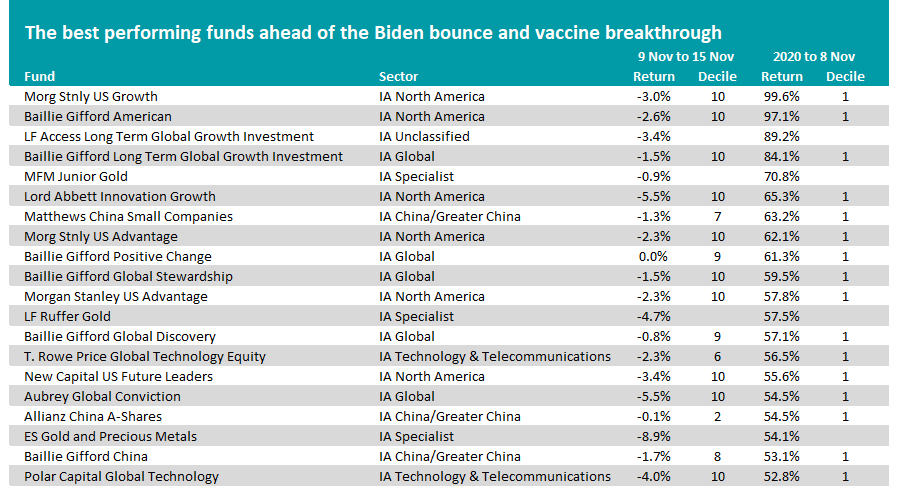

Source: FE Analytics

The above table shows the best performers of 2020 to 8 November and how they did last week. Please note that this is ranked by 2020’s returns, not last week’s – so this is not a table of last week’s worst performers.

Many of the names on the table are quality-growth funds with heavy exposure to so-called coronavirus winners, especially those in the tech space. Strategies run by Baillie Gifford and Morgan Stanley had been enjoying an extremely strong 2020 but were among the worst of their peer groups on the back of last week’s news.

The heaviest losses last week came from gold funds – which had been rising thanks to demand for safe havens. Funds like Ninety One Global Gold, Quilter Investors Precious Metals Equity, ES Gold and Precious Metals and BlackRock Gold & General lost almost 10 per cent last week.

The worst result, however, was from FP Argonaut Absolute Return, which was down 11.89 per cent. Its total return of 31.19 per cent for 2020 up to 8 November was the highest from the IA Targeted Absolute Return sector.

As the chart below makes clear how last week flipped the dynamic between value investing – which has struggled for more than a decade – and the growth style – which only got stronger in 2020’s pandemic.

Performance of growth vs value in 2020

Source: FE Analytics

But before investors rotate wholesale into value, FundCalibre managing director Darius McDermott said: “The million-dollar question now is whether this value rally will continue or if it will be short-lived. If the vaccine news flow remains positive, which I think it will, value could do well now until the end of the year.”

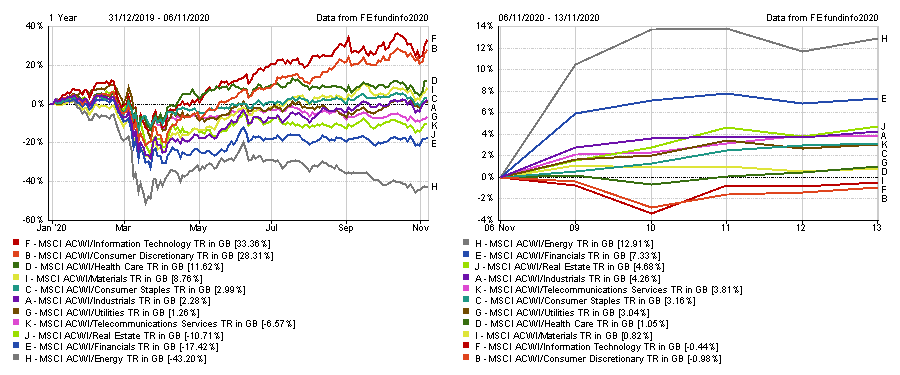

In a similar vein, there was a dramatic shift in the sectors leading the market after last week’s news opened up the potential for a stronger economic recovery under a Biden administration and with a coronavirus vaccine.

Tech and consumer discretionary stocks were shunned by investors amid last week’s positive news, while cyclical area like energy and banks rocketed.

Performance of MSCI industries in 2020

Source: FE Analytics

David Jane, multi-asset manager at Premier Miton Investors, said: “We have been saying for some time that an economic reacceleration is ultimately inevitable. The deeper the economic decline, the greater the ultimate recovery.

“The question has always been when that would take place and when it would feed through into stock prices. We have felt that the initial moves would be seen in the bond market, specifically US 10-year yields. These have recently been rising, obviously not hugely but still noticeable, suggesting greater confidence in medium-term growth.

“More recently, this has begun to feed through into those sectors most sensitive to the economy, notably banks, resources and materials. Even the oil sector has been showing some signs of life. These trends have certainly become stronger over recent days, post the vaccine optimism.”