Bond managers must be even more disciplined when it comes to assessing fundamentals as vast sums of central bank liquidity keep more challenged businesses alive for longer, according to Lloyd Harris, head of fixed income at Premier Miton Investors.

The onset of the Covid-19 pandemic saw central banks around the world take action to help support economies and new rounds of quantitative easing have been funnelled towards corporate bond markets, particularly by the Federal Reserve.

But that could cause issues for corporate bond investors, according to Harris (pictured), manager of several fixed income strategies at Premier Miton Investors.

He explained: “There’s been quite a lot of liquidity directly or indirectly from central banks in the corporate bond market. In some ways you expect that to float all boats, and in many cases it has.

“This means as a corporate bond manager you’ve got to be ever more fundamentally disciplined because you can have companies there that are just not pricing right, because of the liquidity.

“Liquidity will not stop companies going bust, it may help, but it does not ultimately stop a company consistently making losses.”

He added: “It’s easy to think that the central bank is helping out the entire credit market. It’s not. Companies can still go bust, and companies will still get downgraded.”

Indeed, the fund manager highlighted the impact of the pandemic on the economy and the operating environment for businesses.

But there hasn’t been a full-scale crisis in the corporate bond space, as yet.

He said: “We will see delinquencies and we will see defaults, but the banking sector is well placed to weather those.

“We’ve also seen government step up, as well, and fill the void, and that’s likely to be the case in the rest of the world where countries need it.”

The fund manager added: “The important thing for governments is that the central banks have got their back.”

Harris said the fundamental malaise in the corporate bond market, particularly from a banking system perspective, has probably been over-exaggerated.

“A lot the market has been very worried about the fundamental backdrop, but the fact that you've got governments willing to step in and effectively pay mortgages, keep businesses going, has massively just flattened the credit curve,” he explained.

And because the US elections didn’t see a ‘blue wave’, Harris believe that the Federal Reserve may need to step up and do more to support markets.

“We won’t get as much fiscal [support] as a ‘blue wave’ would have in place,” he said. “However, we do see Joe Biden as much more likely to be able to do deals and get a fairly decent fiscal response through.

“So, we see the Fed stepping up and we also see fiscal, but not the $3.2trn that would have been on the table earlier, we’re probably talking something like $2trn.”

Given the incredibly supportive central banks around the world, Harris said there is a positive backdrop for bond markets. And he also believes the European Central Bank has laid the groundwork to potentially expand its purchase programme in December, which could possibly mean purchasing so-called ‘fallen angels’ – an investment-grade bond that has fallen to junk status – in the same way as the Fed has.

Harris joined Premier Miton Investors as head of fixed income in August this year from Merian Global Investors, taking over the £115m Premier Corporate Bond Monthly Income fund as the asset manager launched two similar strategies to his Merian mandates – Premier Miton Strategic Monthly Income Bond and Premier Miton Financials Capital Securities.

The manager said he and co-manager Simon Prior have taken a similar approach on the £115.7m Premier Corporate Bond Monthly Income fund as they did with the Merian Monthly Income Bond fund, which he previously managed between 2015 and 2020.

Performance of fund vs sector & benchmark during tenure

Source: FE Analytics

During his tenure on the fund, it made a total return of 25.81 per cent compared with a gain of 20.51 per cent for the average IA Sterling Strategic Bond sector peer.

Harris said part of his previous success has been down to the team’s unique approach to credit markets.

“We don’t take big strategic positions, we don’t run lots of credit risk, and we look for lots of mean reversion on the curve and that manifests itself in actually in taking lots of small incremental profits,” he explained. “If you’ve got bonds that trade wide of the curve – 20 or 30 basis points wide of the curve – then ultimately it's cheap to the curve, something’s got to give.

“Either the curve’s got to move to the bond or [the] bond has got to move to the curve. Ultimately, it’s a value type of strategy within credit, but it’s in high-quality credit.”

He said this is a very low-risk way of consistently keeping the profitability of a portfolio “ticking over”.

Nevertheless, there have been parts of the corporate bond markets that he has avoided as they were challenged heading into the pandemic and remain challenged, with Harris holding no exposure to retail debt or retail real estate debt before the crisis – in his Merian strategies – and none since at Premier Miton.

“You’ve probably heard it one million and one times before that the trends that were going on before Covid have just been accelerated, like the move to online shopping, etc. But I don’t know if everyone was positioned in that way,” he said. “That it is actually the way we were positioned earlier in the year and we don’t have any desire to change that.”

Currently, he prefers financials – both insurance and banks – as well as telecoms.

He said: “We think Verizon, in particular, is going to get upgraded, and it’s actually a very positive backdrop for telecoms at this very point in time.”

Harris also likes big tech companies, adding: “They are just very boring. If you have a company that is sat on hundreds of billions of cash, you’re actually getting your money back as a bondholder.”

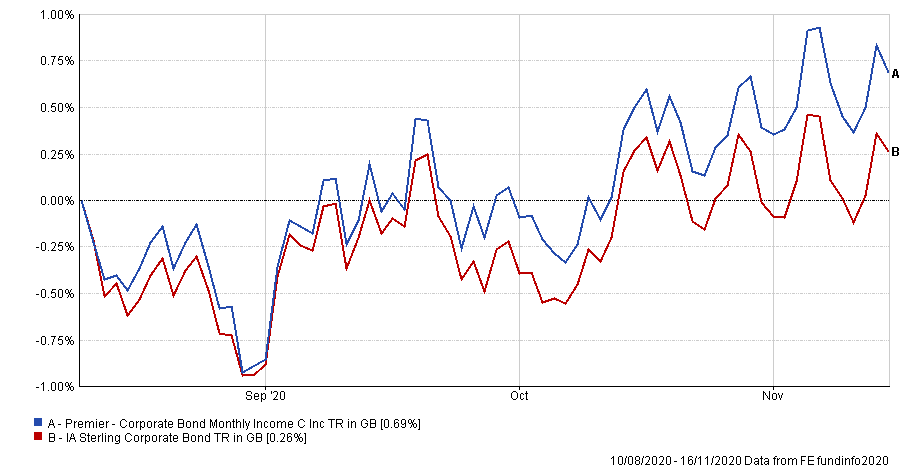

Performance of fund vs sector under Harris

Source: FE Analytics

Since Lloyd Harris took over the Premier Corporate Bond Monthly Income fund in August, it has delivered a total return of 0.69 per cent compared with a 0.26 per cent loss from the average peer in the IA Sterling Corporate Bond sector. The fund is currently yielding 1.96 per cent and has an ongoing charges figure (OCF) of 0.35 per cent.