After seven months at Trustnet, I recently wrote about the lessons I’ve learnt which have inspired the investment decisions for my own portfolio. With both the core and satellite options chosen and invested, I wanted to share the methodology behind my choices with the Trustnet readers.

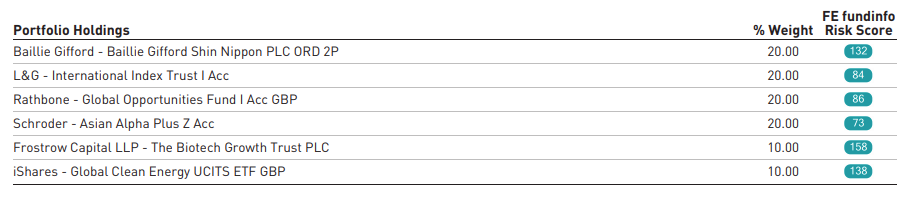

My portfolio is entirely made up of equities, through six funds, four core holdings – representing 20 per cent each – and two satellite funds – each representing 10 per cent of my portfolio.

I have been somewhat liberal with the definition of core and satellite funds, with my core holdings including some highly concentrated choices. But such is my confidence in these funds, I plan on holding them for the long term.

Indeed, the power of compounding returns drives my investment thesis and for that reason I’m not looking to interrupt its growth.

Monthly top-ups and annual rates of growth combined with compounding can yield great results over a 30-to-40 year time horizon that I plan to invest over.

Research has shown that, over the long term, asset allocation determines the greatest part of a portfolio’s investment outcome.

For this reason, I have invested in broad geographies and themes which I wholly believe in and have avoided picking individual assets or areas I don’t understand.

With bond yields at current levels, the areas for diversification away from equities were limited to property, cash or gold.

I don’t quite understand the appeal of gold, but I can be objective enough to see its value as a diversifier. Considering too, the uncertainty in coming years – with growing sovereign debt levels, the implications of a no-deal Brexit and a weaker dollar – gold might do well.

However, at this stage of my investment journey, it’s not something I will be investing in just yet.

And it was with a heavy heart that I decided not to invest in the UK either.

While there is a considerable amount of value across the market cap spectrum, the uncertainty from the Brexit fallout is hard to fathom and unfortunately – like betting on your own football team – I couldn’t separate impartiality from my own sentimentality.

Using data and tools from FE Analytics, I was able to backtrack the performance of my portfolio over five years, as well as understanding its risk score and weighed risk score of the holdings.

The data assesses the diversification benefit of my portfolio to be “medium” and with a risk score of 88, this is in line with what I expected considering its concentration in equities.

Portfolio holdings and weightings

Source: FE Analytics

For the first two global core holdings, I wanted one active and one passive strategy. It was a difficult decision, but I chose Rathbone Global Opportunities and L&G International Index Trust.

I wanted a strong passive fund at the spine of my portfolio and the L&G International Index Trust fits all the criteria.

By tracking the FTSE World ex UK index, it gives exposure to all of the big names which have enjoyed great success not only this year but in the previous decade.

For my global active strategy choice, it was largely based on FE fundinfo Alpha Manager James Thomson.

I believe in the investment style and his defensive, resilient approach is exactly what I’m looking for over the long term. Combined with strong outperformance over the years, it was one of the easier decisions I made.

I have no issue holding two strategies from the broad Asia region within my core holdings.

According to consultancy McKinsey, Asia is on track to top 50 per cent of global GDP by 2040 and drive 40 per cent of the world’s consumption. Considering that my time horizon stretches far beyond 20 years from now, my portfolio is primed to take advantage of this global change.

In an article in September I mentioned that I’m bullish on the investment opportunity in Japan and that hasn’t changed.

However, this was a tricky one as I wanted an investment trust as opposed to an open-ended vehicle and as such opted for the Baillie Gifford Shin Nippon Trust over its open-ended sister fund, Baillie Gifford Japanese Smaller Companies.

For something that I’m comfortable holding for the foreseeable future, I wanted a structure that could make good use of gearing to boost returns.

The 10.1 per cent premium was slightly higher than I would have liked, but I’m ready to accept any short-term losses in net asset value because of the investment time frame.

While both strategies invest in Japanese small caps, the trust invests in businesses that are considered to have above-average prospects for growth and therefore boasts an impressive number of innovative businesses among its top holdings.

The other strategy I chose was Schroder Asian Alpha, selected to give me exposure to non-Japanese companies.

While Chinese companies understandably make up the largest proportion of the fund, there are also a number of top Korean, Taiwanese and Indian companies in the portfolio primed to enjoy considerable growth over the next decade.

Performance of portfolio since 2015

Source: FE Analytics

Had I invested while I was still at university, my portfolio would have returned 143.65 per cent and – while past performance is no indicator of future growth – I expect the areas that I’ve invested in to benefit from the current environment more so now than if I had invested in 2015.

My satellite picks are more thematic in nature and are therefore personal calls on areas that I believe will benefit in the years ahead: iShares Global Clean Energy Index fund and Biotech Growth Trust.

I have previously said that I would invest in biotechnology for many reasons, but its defensive qualities and long-term growth prospects driven by innovation and demand make it an important addition to my portfolio in the Biotech Growth Trust.

While it has made the news in the search for a vaccine, demand is not limited to healthcare and covers crop production, agriculture, industrials, biofuels and biodegradable plastics.

Finally, I think environmental, social & governance (ESG) investing is at an interesting crossroads. I would agree with Mike Fox, of the Royal London Sustainable World Trust, that the sector needs a period of consolidation lest its true definition gets lost among the number of funds jumping on the bandwagon.

That being said, it’s clear that over the next decade clean energy will become ever more important, as the drive towards net-zero carbon emissions herds consumers towards renewable sources like hydropower, solar and wind.

As such, the iShares Global Clean Energy Index exchange-traded fund tracks the performance of the S&P Global Clean Energy index, made up of 30 of the largest companies from around the world involved in clean energy-related businesses.

When I started saving early last year, I would have never imagined that 20 per cent would be in biotechnology and green energy: they both seemed like concepts for the future and I wasn’t prepared to invest just yet.

However, this year has had a funny way of accelerating these trends, and while the world is nowhere near ready to abandon fossil fuels, we have, in my opinion, passed the point of no return.

Thank you reader for your supportive comments and suggestions, I look forward to hearing your thoughts.