Investors who have taken exposure to areas such as global equities, tech stocks and Japan through investment trusts have tended to outperform those who used open-ended funds, research by Trustnet suggests.

However, this hasn’t been the case in every area and the same research shows that the average investor in US equities, global emerging markets and flexible investment strategies would have been better off in open-ended funds.

There are some important differences between open-ended funds and investment trusts. Open-ended funds are arguably the simpler option and can be easier to buy, while trusts can be bought at a discount to net asset value, can use gearing and allow managers to run portfolios without worrying about inflows.

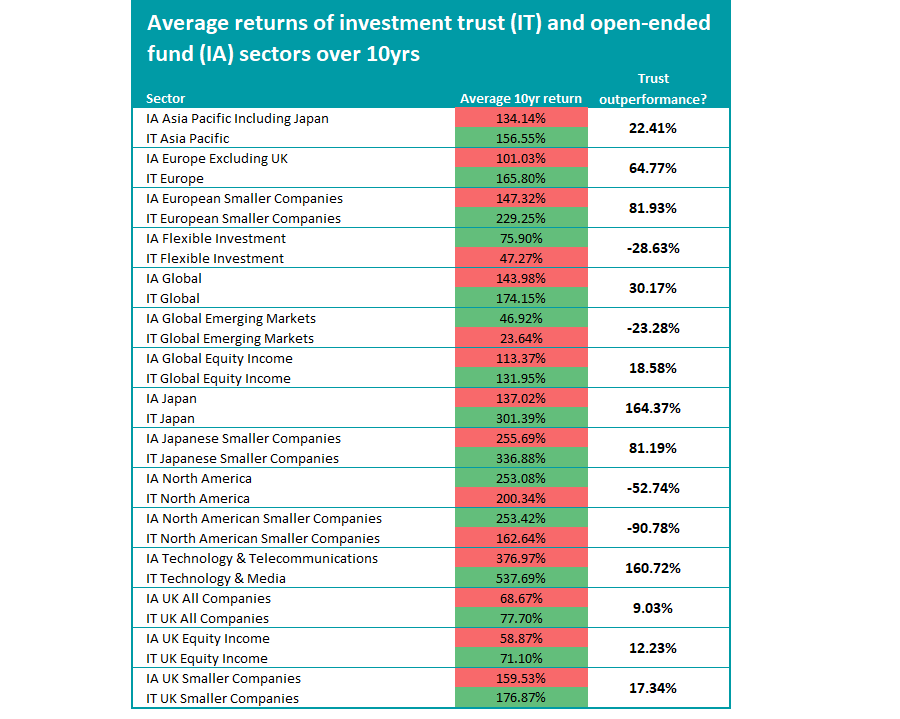

Here, we have reviewed the 10-year returns of the average trust in 15 Association of Investment Companies sectors alongside their counterparts in the Investment Association universe to see in which areas which structure has pulled ahead of the other.

Performance of average Japan trust vs average Japan fund over 10yrs

Source: FE Analytics. Data as at 27 Oct 2020

The difference in returns has been most stark in Japanese equities – in favour of investment trusts. The average member of the IT Japan sector is up 301.39 per cent over the past decade, compared with 136.99 per cent from the average IA Japan fund – a difference of 164.37 percentage points.

There are four trusts in the IT Japan sector and the best 10-year return has come from Baillie Gifford Japan Trust, which has made 486.74 per cent. The £862.5m trust is managed by Matthew Brett with Praveen Kumar as deputy, although much of the 10-year track record was built under former manager Sarah Whitley. The trust focuses on quality-growth companies, with a bias towards small- and mid-caps.

The lowest returning member of the IT Japan peer group is still outperforming the average open-ended fund with its 154.70 per cent return.

However, not every Japan trust has outpaced every open-ended Japan fund. Indeed, the best performing member of the IA Japan sector has beaten every investment trust.

Legg Mason IF Japan Equity has made 975.79 per cent over the past decade, albeit with very high volatility, making it the highest returning fund in the entire Investment Association universe.

Managed by Hideo Shiozumi since its launch in 1996, the £1.3bn fund is built around smaller companies that offer exposure to the ‘new Japanese consumer’, rather than focusing on ‘old Japan’ through large-caps and manufacturing names as many Japan funds do.

But this is the only IA Japan member to beat Baillie Gifford Japan Trust over the past decade. Only 14 of the IA Japan sector’s 52 funds have been able to outpace the lowest 10-year return of the investment trust sector.

Source: FE Analytics. Data as at 27 Oct 2020

The above table shows the 15 sector pairings we looked at in this research, along with the level of out- or underperformance of the average investment trust.

In all, the average investment trust has outperformed its open-ended rival in 11 of the 15 investment areas examined, over 10 years. But this slips to trust outperforming in nine of the areas over five years, while over three years they outperform in just six of them.

As can be seen, the outperformance of the average tech trust over 10 years isn’t too far behind that seen among Japan trusts.

The best performing member of the IT Technology & Media over the past 10 years has been Walter Price’s £1.1bn Allianz Technology Trust, which is up 772.31 per cent. This compares with the 574.84 per cent made by Ben Rogoff and Nick Evans’ Polar Capital Global Technology fund, which is topping the open-ended peer group.

European equities, European smaller companies and Japanese smaller companies are other areas where trusts have powered ahead of funds.

Global equity strategies, meanwhile, are one of the most popular investment areas at the moment and another where the average trust has outperformed, this time by around 30 percentage points over 10 years.

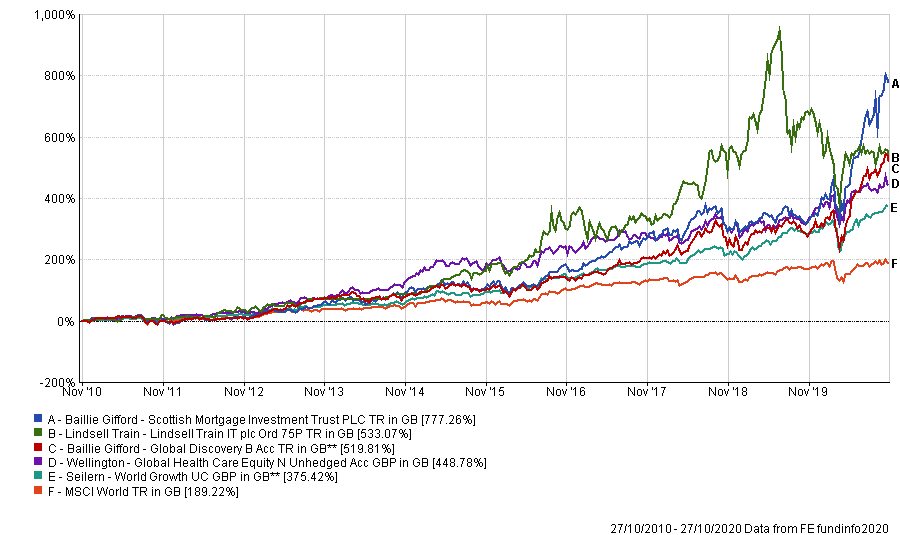

Baillie Gifford’s Scottish Mortgage, which is the largest trust in the business, leads the pack with a 777.26 per cent total return.

Managers James Anderson and Tom Slater look for companies with the potential for exceptional long-term returns then invest in them at an early stage. This often leads them to the tech space and the trust is known for investing in unquoted companies.

The best performing member of the open-ended IA Global sector over the same period has been Douglas Brodie’s £1.6bn Baillie Gifford Global Discovery fund, which is up 519.81 per cent. The fund applies Baillie Gifford’s well-established growth-orientated investment process to global smaller companies.

Performance of top global trusts and funds over 10yrs

Source: FE Analytics. Data as at 27 Oct 2020

Of the 199 strategies in the global fund and trust sectors, 54 have made more than 200 per cent over the last 10 years, including Lindsell Train IT (533.07 per cent), Wellington Global Health Care Equity (450.55 per cent), Seilern World Growth (375.42 per cent) and Guinness Global Innovators (350.56 per cent).

Investment trusts haven’t outperformed in every part of the market, however, with the US appearing to be a particularly challenging area.

The US is a difficult enough market for active managers, given its highly efficient nature and depth of analyst coverage. But the average North American smaller companies trust has underperformed its open-ended peer by 90 percentage points over the past decade.

The average IT North America trust, meanwhile, is 52.74 percentage points behind the average fund in the IA North America sector.