The impact of Covid-19 and resulting nationwide lockdowns have encouraged investors to re-examine their portfolios and turn to the expertise of financial advisers.

In the first of a series on the FE Adviser Fund Index (AFI) benchmarks – which help the investment community to compare performance – Trustnet looks at the funds that advisers are recommending for more risk-averse investors.

The FE AFI benchmarks are made up of 10 weighted fund picks chosen by a panel of leading UK financial advisers.

This article will look at the AFI Cautious index – where panellists are asked to select funds suitable for an investor in their late 50s – asking two long-serving panellists for their perspective on its objectives and the funds within it that they like.

Trustnet also spoke to a member of FE Investments to understand how his team use the index to substantiate their own research and analysis.

Chris Wise, Whinchat Financial Planning – “Understanding different risk budgets is key”

Whinchat Financial Planning managing director Chris Wise has been an AFI panellist for 15 years and sees great benefit in a portfolio made up of funds from large asset managers to boutiques.

In his capacity as a chartered financial planner, understanding an investors risk profile is key and supersedes age bracket assumptions.

“Some may have a slightly different risk budget than they would have done previously,” he said. “But some may not.”

This he said, reiterates the importance of clear dialogue in understanding a client’s investment strategy, especially as the Covid-19 pandemic has diminished traditional income streams.

“Considering the level of dividend cuts, looking at strategies that generate incremental growth, so as to take a combination of income and capital as a total return,” said Wise.

Given the level of volatility in markets over the last nine months, it would be natural for investors to try and taper their level of risk to avoid future shocks. However, as the financial planner explained, the opposite happened as memories of the global financial crisis inspired individuals to take advantage of a ‘clear’ investment opportunity.

As such, many of his clients either kept their risk profile or added to it, taking advantage of the fall in financial markets, using cash to increase their exposure.

BlackRock UK

Although the UK has struggled with investor outflows, the adviser believes the five FE fundinfo Crown-rated BlackRock UK fund is a good way to get exposure to UK equities that will eventually begin to recover.

Managed by Nick Little since 2011, some 70 per cent of the £516.3m fund is invested in larger-cap names including Experian, AstraZeneca and Reckitt Benckiser.

“With these companies it's about time scale,” he said. “It hinges on tailwinds like the development of a vaccine and reverting back to normal economic conditions, then those companies will begin to recover.”

He said while it is impossible to tell when that recovery will be, having the other 30 per cent invested elsewhere can take advantage of any strong recovery within the UK small-cap sector, which has tended to outperform larger peers over longer periods.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, BlackRock UK has made a total return of 14.11 per cent, compared with a loss of 9.4 per cent for the IA UK All Companies sector and a loss of 11.21 per cent for the FTSE All Share. It has an ongoing charges figure (OCF) of 0.92 per cent.

Andy Parsons, The Share Centre – “People are looking to de-risk and reduce equity exposure”

A panellist for eight years, Andy Parsons, head of investments and product proposition at The Share Centre, said the AFI portfolios put a retail investor of any age in a great starting position.

Parsons said that for the older investor, the AFI Cautious index seeks to find the optimum blend of asset classes, in order to provide a level of sustainable growth with a level of income too.

This has become increasingly difficult as the traditional “safe havens” of income investing have declined in value.

“What we’ve seen with negative yield on bonds and the destruction of dividend income, investors may have to sell some of their capital to meet income needs,” said Parsons. “That is completely nullifying the traditional view on using capital for income, but it’s the predicament some people are finding themselves in.

“People are now looking to de-risk their portfolio and reduce that that equity exposure.”

First Sentier Global Listed Infrastructure

With that in mind, Parsons opted for the £1.7bn First Sentier Global Listed Infrastructure fund, managed by Peter Meany and Andrew Greenup. Meany established the fund in 2007 and invests in infrastructure projects around the world, including utilities, highways, railways and airports.

“Infrastructure is a really good store in a portfolio, these are government-backed initiatives with price inflation built-in,” he said. “They are how governments worldwide get economies going.

“Infrastructure is a much more of a defensive style play. The assets tend to have built-in price escalators which benefit from inflation further down the line.

The fund could also benefit from the increase in government fiscal spending on green infrastructure, planned in the UK, US and EU.

“For me to have equity exposure, the fund offers a form of equity exposure with a degree of less risk because of the type of companies its involved in.”

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

First Sentier Global Listed Infrastructure has made a total return of 9.14 per cent over three years, compared with 23.89 per cent for the IA Global sector, and 14.15 for the FTSE Global Core Infrastructure index. It has an OCF of 0.79 per cent.

Charles Younes, FE Investments – “The AFI is the qualitative approach alongside our quantitative approach”

Charles Younes, research manager within FE Investments believes that the AFI index is complementary to the metrics used in its investment process.

“It’s a forward-looking assessment of funds,” he said. “Instead of relying on historic performance, you rely on the survey of panellists and their recommendations. We use four metrics in our quantitative process and the AFI is one of them.”

The FE fundinfo Crown and FE fundinfo Alpha Manager ratings and a fund group score provide independent quantitative analysis based on historic performance, but the AFI offers a qualitative approach.

“It brings something very different to the other metrics and it can be very complementary,” said Younes.

Janus Henderson Strategic Bond

Younes highlighted the £3.2bn Janus Henderson Strategic Bond fund – overseen by John Pattullo and Jenna Barnard – as one of two funds in the AFI Cautious index, that he likes.

“This is a genuinely ‘strategic’ bond fund in that it is flexible and can use derivatives extensively,” he said. “The managers are very skilled in employing this freedom, although it does result in a fund that is a little more volatile than many bond funds.

“However, the managers have a counteracting bias to defensive sectors that should be more stable over the course of the economic cycle.”

He added: “It’s a good option for those who want a total return approach – and not only income – from their bond allocation.”

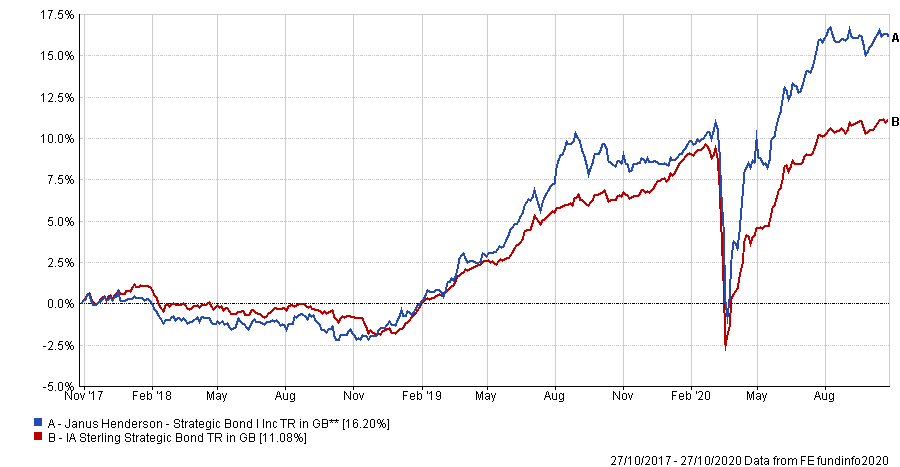

Performance of fund vs sector over 3yrs

Source: FE Analytics

The Janus Henderson Strategic Bond fund has returned 16.20 per cent over three years, compared with an 11.08 per cent gain for the IA Sterling Strategic bond sector. It has a yield of 3.40 per cent and an OCF of 0.68 per cent.

Royal London Sustainable Leaders Trust

Younes’ second choice was the £2.2bn Royal London Sustainable Leaders Trust run by FE fundinfo Alpha Manger Mike Fox.

“The manager’s investment style brings something different to UK equity funds as he combines the principles of socially responsible investing (SRI) with in-depth company financial analysis,” he said. “Furthermore, the fund is distinguishable from its ethical peers, who focus predominantly on negative screening whilst Fox and his team go a step further and screen all ‘ethical’ companies.”

This, he explained, helped identify companies that are actively engaging in sustainable areas as well as those which operate in socially neutral areas, such as alcohol production, but which utilise responsible methods of production.

He finished: “It’s a very good candidate for investors who specifically want exposure to companies that are making a positive impact for society or operating in a sustainable manner.”

Performance of fund vs sector over 3yrs

Source: FE Analytics

Since October 2015, the Royal London Sustainable Leaders Trust has returned 25.83 per cent, compared to a loss of 9.40 per cent from the average IA UK All Companies sector peer. It has an OCF of 0.76 per cent.