Funds managed by Baillie Gifford benefited from a significant increase in attention from investors over 2020’s third quarter on the back of very strong performance amid the coronavirus crisis, Trustnet figures suggest.

The third quarter saw risk assets gradually rise, but at a much lower pace than the stimulus-fuelled rally that dominated the second quarter. Over the three-month period, the MSCI AC World index posted a 3.35 per cent total return (in sterling), on the back of strong returns from the US and emerging markets.

But which funds were investors researching the most during the quarter? If we look at all the fund factsheet views from Trustnet readers over the quarter, the most popular sector was IA Global, followed by IA UK All Companies and IA Mixed Investment 40-85% Shares.

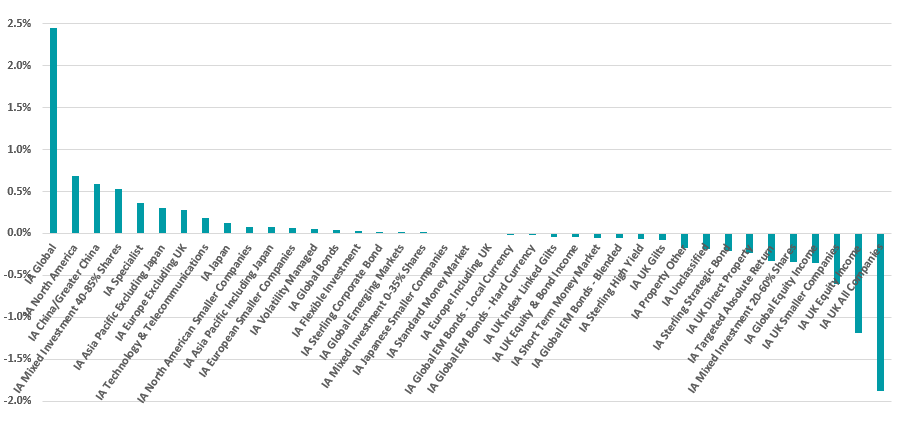

However, by comparing how each sector’s share of pageviews increased or decreased between 2020’s third quarter and the previous 12 months, we can see how investors’ research interests have changed.

Source: Trustnet

Funds in the IA Global sector have witnessed the largest uptick in research on Trustnet. They were already the most popular funds over the previous 12 months, accounting for 14.1 per cent of Investment Association factsheet views, but this climbed to 16.6 per cent in the third quarter of 2020.

Interest in IA North America and IA China/Greater China funds also increased, reflecting the strong performance of these areas over the coronavirus crisis.

However, as has been the case for a number of years now, research continued to drop in the UK equity peer groups. The IA UK All Companies sector was hit by the biggest fall in its Trustnet research share, followed by IA UK Equity Income and IA UK Smaller Companies.

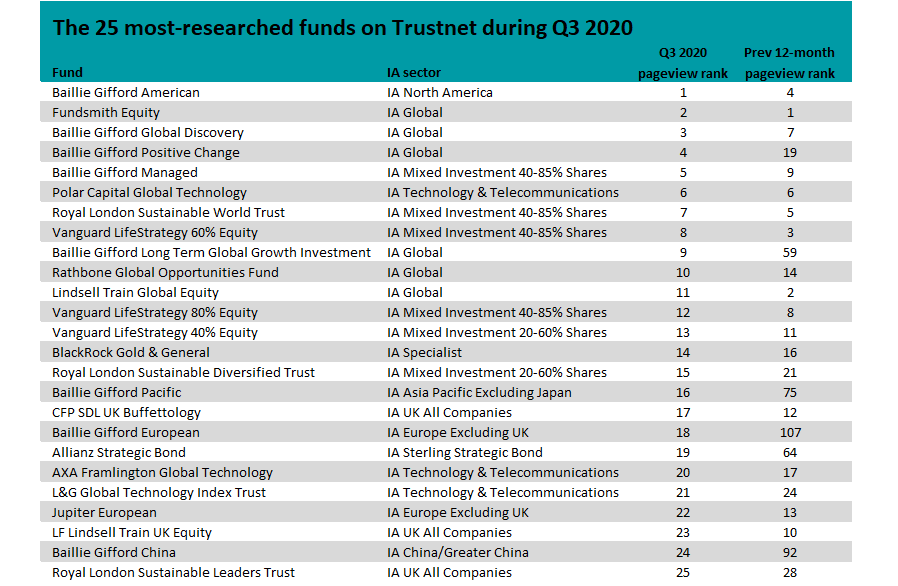

When it comes to individual funds, Baillie Gifford American was the most-viewed factsheet over the third quarter.

This fund has had a strong run in 2020 and is one of the year’s best performers in the Investment Association universe. Recent research by Trustnet found that it was the fund which has beaten its benchmark (the S&P 500) by the widest margin over the year so far.

Tom Slater and his team run a concentrated portfolio of between 30 and 50 stocks, with top holdings including the likes of Tesla, Amazon and Zoom Video Communications – all of which have performed strongly over 2020’s pandemic.

Source: Trustnet

As the table above shows, Baillie Gifford American had been the fourth most-popular fund over the previous 12-month period. In jumping into the top spot, it has pushed Fundsmith Equity – the largest member of the IA Global sector – into second place.

Another six funds run by Baillie Gifford are among the 25 most-researched funds, with some impressive jumps up the rankings being made. Baillie Gifford European, for example, has moved from being the 107th most-viewed factsheet to the 18th.

The group’s funds have delivered strong performance for several years thanks to their quality-growth approach and preference for ‘disruptors’, especially in the tech space. These factors have led the market in 2020 as well and have led to Baillie Gifford funds topping the performance tables of several Investment Association sectors.

The increase in attention on Baillie Gifford’s funds is even more apparent if we look at how the Trustnet research share of individual funds changed over the third quarter.

Ten of the 25 funds with the biggest growth in pageviews are in the Baillie Gifford stable, including all of the top seven spots.

Baillie Gifford American came out in the lead here as well as it accounted for 1.76 pe cent of all Investment Association factsheet views on Trustnet in Q3 (up from 0.96 per cent for the previous 12 months).

But aside from Baillie Gifford's offerings, other funds that were being researched to a greater degree over the third quarter included Rathbone Global Opportunities, Allianz Strategic Bond, Polar Capital Global Technology, LF Blue Whale Growth and LF Ruffer Gold.

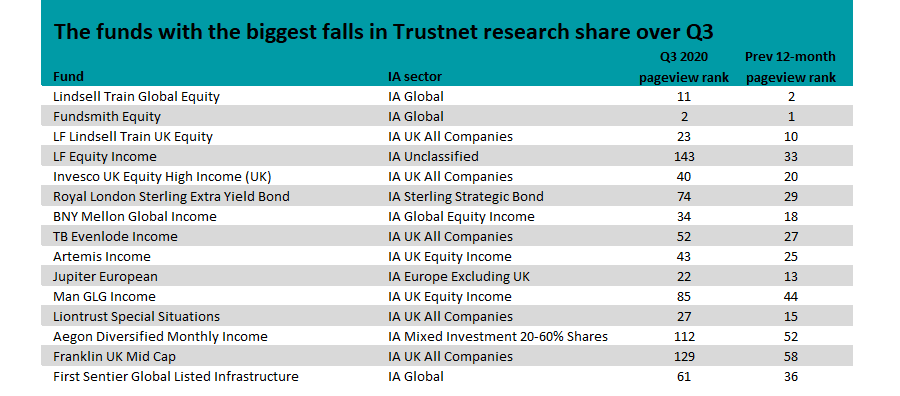

Source: Trustnet

However, the funds that were being researched less than they were over the previous 12 months can be seen above.

It’s important to note that some of these continue to be very popular – as mentioned above, Fundsmith Equity is still the second most-viewed factsheet on Trustnet.

Lindsell Train’s funds, however, have seen a bit of slide in research over recent months and have fallen out of the top-10.

Over the 12 months to the end of June 2020, Lindsell Train Global Equity was the second most-viewed factsheet on Trustnet but it dropped into 11th place in the third quarter. Likewise, LF Lindsell Train UK Equity has gone from 10th place to 23rd.