Although they’re not the most exciting strategies on the market, gilt funds have demonstrated what they can add to an investor’s portfolio during the pandemic, according to Rathbones’ Alex Moore.

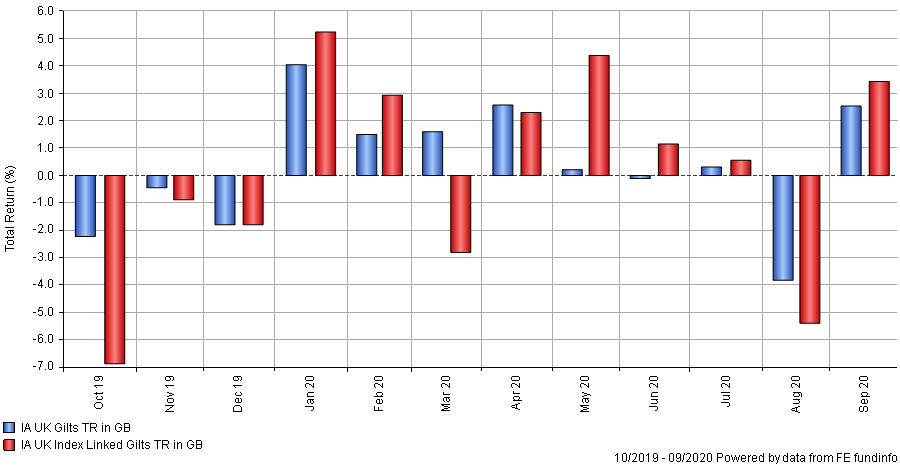

Over the past year, the returns of the gilt sectors have swung out to extremes: sometimes among the best performers, other times sitting at the foot of the performance table.

Performance of gilt fund sectors over 1yr

Source: FE Analytics

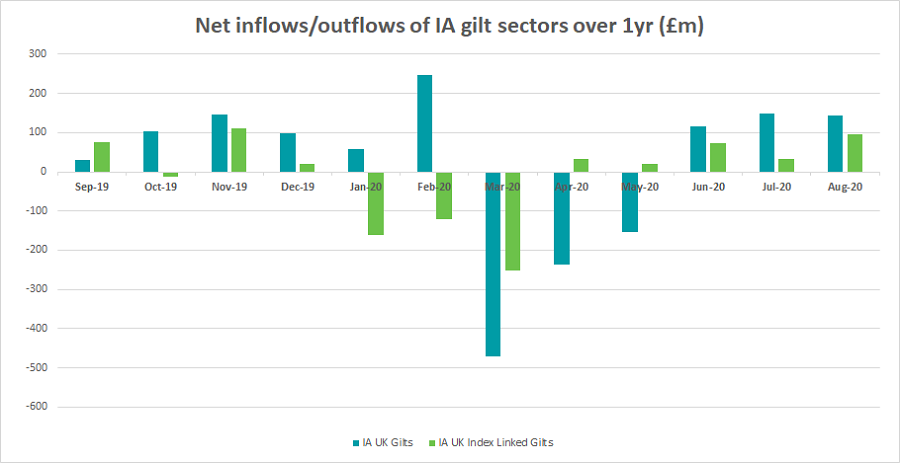

However, while the low-rate environment – and further cuts as part of the Bank of England’s coordinated response to the pandemic – has put further pressure on yields, they have continued to be utilised by investors.

Over the past 12 months, the IA UK Gilt sector has seen bursts of inflow activity.

The strategies saw increased interest in the run-up to last December’s general election between a Jeremy Corbyn-led Labour Party and Boris Johnson’s Conservatives and earlier this year as talks between the UK and EU faltered in February/March.

The onset of the pandemic, the imposing of lockdown conditions and the stimulus-fuelled rally of Q2 saw outflows for the sector as investors looked to redeem from more liquid holdings.

Nevertheless, the increase in the number of Covid-19 cases and the lack of progress on a post-Brexit trade deal has seen some inflows return to the sector more recently

Source: Investment Association

Meanwhile, the inflationary impact of the government’s UK economic response has seen net inflows for the IA UK Index Linked Gilts sector over the past five months.

Yet, the strategies have performed their role in investors’ portfolios perfectly, according to Rathbones’ head of collectives research Moore.

“The interesting thing about gilt funds – and gilts generally – even though returns were low they demonstrated brilliantly how holding them can really improve portfolio diversification,” he said.

“People understand the return profile of gilts quite clearly: you can see how they’re priced and you can see what their coupon is.

“But in times of economic stress, with the flight to safety in a low-yielding environment, gilt funds have been able to return to a client’s portfolio.”

However, as the Covid-19 pandemic and the search for a vaccine continues, the UK economy remains frail and the Bank of England has been unable to raise rates.

Further pressure on the economy from the protracted and fractious trade negotiations with the EU has led the Bank to investigate the possibility of negative rates.

As such, it’s become a more taxing environment for gilt funds, said Moore (pictured).

“Whereas people have been using gilts as a means of supplementing income, now that is proving difficult,” he said. “If you’re looking for a cash proxy even short-duration Treasuries are yielding between 0.1 and 0.5 per cent and that is extremely low.”

Despite a more challenging outlook for UK gilts, however, managers do have other means at their disposal to add value, Moore noted.

“As with every fund there is the ability to go off benchmark,” he said. “Whether it be investment grade credit funds buying high yield or UK equity income funds having the ability to go overseas, gilt funds [also] have an allocation they can use to supplement returns.

“Common off-benchmark positions have historically been index-linked bonds. They can have relationships with gilts and being able to understand those dynamics is important.

“Some gilt funds also like to buy overseas sovereign bonds of comparable credit quality.”

He continued: “You’re obviously paying a fee to utilise their [the fund manager’s] skill and utilise their ability to analyse markets but they do have means of finding incremental returns on top of gilts.”

One of the biggest challenges for UK government paper at the moment, however, is the increasing correlation between gilts – and other areas of fixed income – with equities, said Moore.

“Those longer-term defensive qualities and liquidity qualities we’ve seen with gilts is – at the margin – deteriorating,” he explained. “It doesn’t always happen for very long, it happens in short bursts.”

Moore finished: “In a time like this when corporate bonds and high yield were extremely illiquid, those markets that you can transition and position in and out of effectively can make very efficient tactical asset allocation calls.

“So, [gilts] can still serve a purpose, but it’s important to understand at the moment given how low rates and yields are and how much return they have had this year, the challenge for active managers in gilt funds has got a bit trickier.”