The UK market is failing to attract new investors because there is a distinct lack of ‘unique’ companies, according to Douglas Scott, manager of the Aegon Global Equity Income fund.

His fund has just 5.7% in UK names, a figure that is closer to 2-3% stripping out international names and focusing purely on domestic stocks.

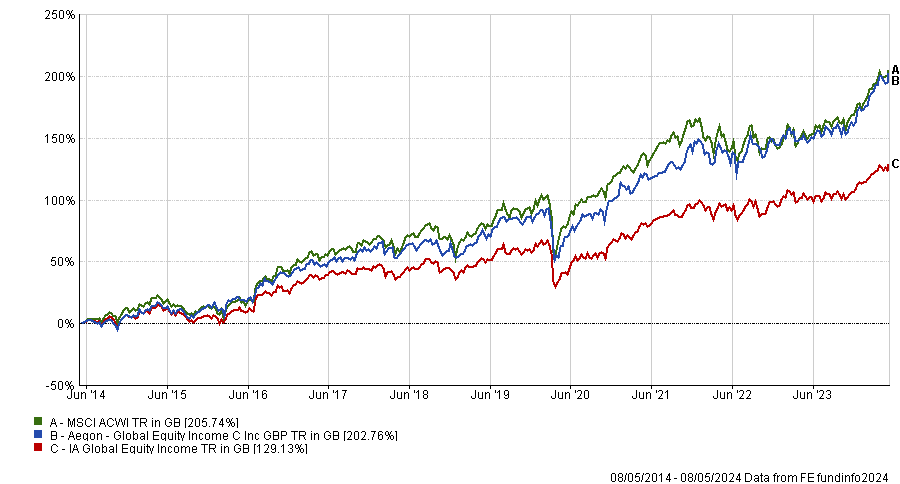

This has been a good call for the $805m fund over recent years, propelling it to the top quartile of the IA Global Equity Income sector over one, three, five and 10 years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The dire situation for the UK market will not change in the near term, he warned, as there is nothing to excite investors, who have pulled money out of UK funds in 35 consecutive months and last month removed a further £665m.

“The UK stock market is dominated by oil, mining and banks. It has no unique companies. The last one we had that was really unique in my eyes was ARM Holdings. We have nothing,” he said. ARM was taken private in 2016 by SoftBank, then acquired by NVIDIA four years later.

“We have some good companies – Experian, AstraZeneca – which are good growth companies that can do well in their field, but they are not unique,” he concluded.

Abby Glennie, manager of the abrdn UK Smaller Companies fund, agreed with Scott when it comes to larger companies.

“I think the point is probably quite correct in the large-cap space. It’s not that companies are not unique – it’s that they’ve been the same companies for a long time. When you are a large-cap, the changes you make to the business are like turning around an oil tanker. They never really change the business that much,” she said.

However, she argued the picture was different in small-caps, where companies can pivot quickly and tend to have more dynamic business models.

Thomas Moore, manager of the abrdn UK Income Unconstrained Equity and abrdn Equity Income Trust, took a different tack. He does not believe it actually matters whether or not the UK has any unique companies.

“That comment smacks of growth investing. Uniqueness is a nice high level theme but I would say the basics of investing are more important than touchy feely language,” he said.

Instead, investors should focus on a company’s cashflow, which in turn will dictate how much it can reinvest in the business, its share buybacks and its dividend payouts.

“How unique a company is doesn’t pay the dividends, whereas cashflows do. If you’re a growth investor looking for the next ARM or Darktrace, that is what you spend 90% of your time doing,” said Moore.

“As an income investor it’s knowing what will happen from one year to the next in terms of identifying cashflows. If the company surprises on growth, fantastic, that’s positive. That gives me the valuation re-rating. But it is all about the building blocks of generating a return.”

Despite Scott’s criticisms of UK plc, he is positive on certain stocks such as mining giant Rio Tinto, property firm London Metric, housebuilder Taylor Wimpey and asset management group Phoenix, although these are “the smallest holdings in the fund”.

But he warned that one option mooted by politicians to improve the prospects of the UK market – to force pension funds to up their exposure to UK companies – would likely fail.

In the early 2000s pension funds had as much as 40% in domestic stocks, a figure that has plummeted to just 4% today. Scott thinks this shift to global portfolios was “a great idea”.

“What you are buying? Although it might be quite cheap, the UK is not providing you with anything different as such,” he said.

As a result, pension funds have been doing the right thing by diversifying to other countries, Scott argued, adding that even if the government tried to force them to invest domestically, this would be met with serious pushback.

Audrey Ryan, manager of the Aegon Ethical Equity fund, had a different view and argued the government needed to go further. She said it should do more to attract new investors, warning that if it did not, companies would either continue to re-list overseas – a trend that has been ongoing for the past 18 months – or be taken out by private equity and other buyers.

“It would be lovely to see increased focus by leaders to encourage capital to the UK market and certainly encouraging companies not to relist. We have started that journey but I would love to see more impetus,” said Ryan.

Even so, there a number of reasons to be optimistic on the UK, she added. Given UK equities have been so “unfashionable”, Ryan argued that valuations are now “very compelling” both against their own history and relative to overseas markets.

She added that mergers and acquisitions – predominantly in the small- and mid-cap space but also now creeping into larger names – are evidence of this.

“For me that underpins my view that UK equities are mispriced and if we don’t as investors take advantage of that the external market will, whether that be private equity or other trade buyers,” she said.

“A number of companies I invest in are acknowledging the value is not reflective of their businesses and are increasingly doing more share buybacks, which is providing a degree of support for the market. And the UK is delivering one of the highest dividends out there globally, if income is something you are striving for.”