Size is becoming an increasingly important factor in the investment trust market. A larger war chest has always had its advantages because it implies – but not always means – that a closed-ended fund benefits from a stronger liquidity profile, a broader shareholder register, easier access to borrowing facilities, more firepower in terms of discount control and better capital allocation policies.

Moreover, bigger funds can spread their fixed costs over a wider asset base and therefore reduce cost ratios, while scale gives them headroom for share buybacks.

However, another factor contributing to the preference for bigger market capitalisations is the consolidation of wealth management firms. As they are now managing larger sums of money, it can be challenging for them to buy and sell smaller investment trusts.

Elliott Hardy, an investment trust analyst at Winterflood, said: “Wealth managers and institutional investors are better able to invest in larger investment trusts across multiple portfolios/strategies without becoming too large a part of the share register, while funds that see their market caps grow sufficiently to enable inclusion in FTSE indices can benefit from further improved liquidity and passive inflows as a result.”

What is considered sub-scale?

A market cap of £200m is commonly considered to be the bare minimum for an investment trust.

In fact, Winterflood’s latest industry survey revealed that only 62% of investors would consider a closed-ended fund below £200m, whereas a decade ago almost all respondents (99%) were prepared to look at smaller trusts. Meanwhile, 8% of investors now require a size of £400m or more.

Those figures echo the preferences of discretionary investment management firm Quilter Cheviot, which considers anything below £200m as sub-scale and tends to prefer a market cap of at least £250m.

While also seeing £250m as its threshold, Killik & Co indicated that others may even require a size of £500m, if not £1bn.

Few closed-ended funds can pretend to match the latter requirements. Data from Peel Hunt shows that out of circa 300 investment trusts, approximately 50 of them boast a size of £1bn or larger, while 200 have a market capitalisation below £500m and 120 under £200m.

Anthony Leatham, investment companies research analyst at Peel Hunt, said liquidity can be an issue. “The average daily traded value of the trusts above £1bn market cap is c.£6.5m (including 3i Group). For the remaining trusts, the average drops to £670,000 per day.

“This can have a big influence on what is considered sub-scale as it is not just an investment decision but also a risk-management decision.”

Why size can be a misleading indicator

While size has become crucial for many investors, it can be deceptive. For example, size alone does not say enough about the composition of the shareholder register.

Hardy said: “Take for instance a fund with a market capitalisation of £500m but a shareholder register of only five large institutional investors, each with 20% ownership.

“Those incumbent investors may find it difficult to exit the fund without significantly moving its share price – relative to investors within a £250m fund with a diverse shareholder register across institutional and retail investors, each with different investment horizons and motivations for buying and selling at certain times.”

Moreover, a larger size can be a problem for investment trusts focusing on the lower end of the market capitalisation scale.

Leatham said: “In a previous role, I looked at the deterioration of alpha generation from a very large open-ended equity fund and, after detailed analysis, we found the reason – the strategy generated the majority of its historic outperformance from investing in small-caps and, as the fund size expanded rapidly, the ability for the fund to participate in the smaller end of the market reduced and the proportion of the small-cap exposure also reduced.

“Investment trusts are unlikely to experience the same level of growing pains but there is a risk that very large, multi-billion-pound vehicles can become unwieldy and struggle to deploy capital into smaller, less liquid investment opportunities.”

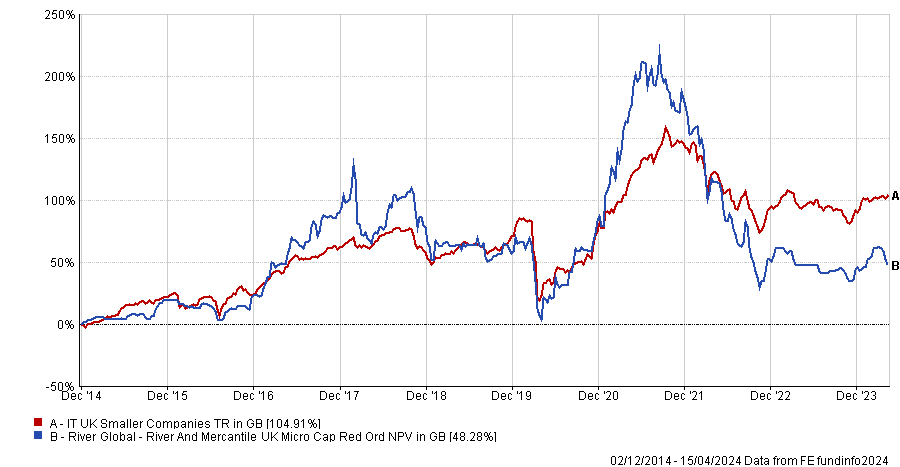

Some investment trusts are aware of this potential issue and try to come up with solutions to avoid building too large positions in their underlying companies. For instance, River & Mercantile UK Micro Cap returns capital to shareholders when its net asset value exceeds £100m.

Where investors can benefit from a smaller market capitalisation

A small market capitalisation is a double-edged sword and can be an advantage for fund managers who may be better positioned to uncover hidden gems.

Leatham said: “If we look at our datasheet and focus on performance by the smaller trusts (<£200m market cap), the top performing 40 trusts have delivered an average share price total return of 22% over the last 12 months, outperforming the FTSE All-Share return of c.7% over the same period.”

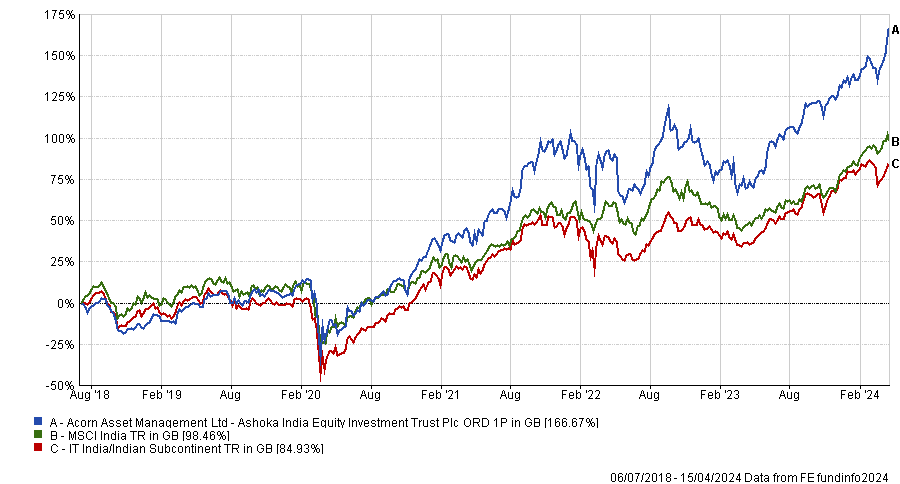

An example he provided is Ashoka India Equity, which launched in July 2018 with a market cap below £50m, but a “clear and differentiated” investment approach and “robust structuring” in terms of fees and discount control.

Fast forward to today, the trust has delivered approximately 22% annualised share price total return compared to 13% for the MSCI India index and boasts a market cap of £378m.

Leatham added: “Investors with a strict size-based exclusion criteria risk missing out on some exceptional investment opportunities.”

Performance of investment trust since launch vs sector and index

Source: FE Analytics

Based on the success of Ashoka India Equity, Mick Gilligan, head of managed portfolio services at Killik & Co, sees good prospects in its stablemate Ashoka WhiteOak Emerging Markets, which follows the same investment process but applied to the whole emerging markets universe.

The trust was launched last year and currently has a market cap of £35m.

Gilligan also likes the previously mentioned £51m River & Mercantile UK Micro Cap to fish into the smaller echelons of the UK stock market.

Performance of investment trust since launch vs sector

Source: FE Analytics

Finally, smaller investment trusts tend to trade on wider discounts as larger institutional players may be reluctant or unable to invest in those trusts effectively.

As a result, investors may be able to take advantage of such price dislocations or benefit from corporate activity.

Leatham said: “We have seen a notable pick-up in M&A activity recently, particularly combinations with larger or better-rated peers – often including a full or partial cash exit opportunity and often involving a common management entity.

“If size continues to be of importance to investors, then we expect to see further consolidation across the investment trust universe.”

Recent mergers in the investment trust space have included the combination of JPMorgan UK Smaller Companies and JPMorgan Mid Cap, the acquisition of abrdn China by Fidelity China Special Situations and the absorption of Atlantis Japan Growth Fund and abrdn Japan Investment Trust by Nippon Active Value Fund.