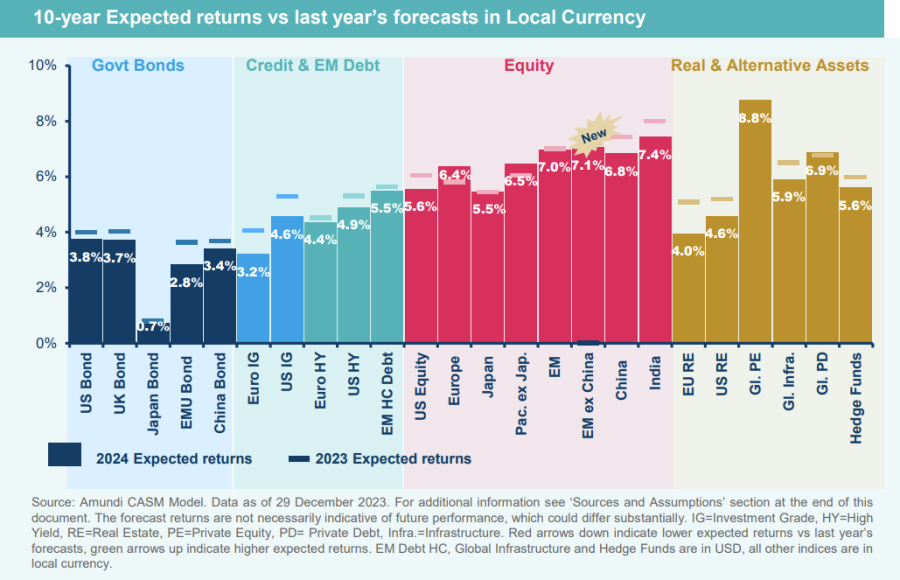

US stocks will make the second-lowest returns of all major markets over the next decade, according to data from Amundi, which forecasts expected returns over 10 years based on current valuations.

It downgraded its expectations for future US gains compared to last year’s forecast “on the assumption that, although the US could continue generating solid earnings per share growth, the market has almost entirely priced in growth expectations, particularly in certain parts of the market (mega caps)”, said Viviana Gisimundo, head of quant and multi-asset solutions at Amundi.

She suggested investors will “have to look deeper within markets in the search for the most appealing opportunities”.

The US is anticipated to make 5.6% per year for the next decade, but other regions such as Europe (6.4%) and Asia Pacific excluding Japan (6.5%) could be a better place to invest thanks to higher earnings per share growth and dividend yields.

However, the US is not expected to be the worst performing market. That falls on Japan, which has been a darling of late as investors have rushed in to take advantage of corporate governance reforms, stock market gains and the improving economic backdrop.

“With regards to Japan equity, although new corporate governance rules are supportive, the Japanese market maintains lower growth potential compared to other developed markets,” Gisimundo said.

The big winner was emerging markets, where Amundi has retained its slight preference versus developed peers, although she warned that performance can be volatile.

“Within the emerging market basket, we anticipate a shift in preferences, as potential growth will be driven by countries other than China,” Gisimundo said.

Indeed, Amundi has added an emerging market excluding China index for the first time into its analysis, which is expected to make 7.1% per annum, bolstered by India, which is the highest returning market on the list at 7.4%.

“We remain cautious about Chinese fundamental and macro assumptions (reflecting the most recent update on the long-term inflation environment),” she said.

“While acknowledging China’s elevated uncertainty, we assume extreme valuations can provide a partial tailwind, particularly for the onshore market.”

The research looks at asset class return expectations in local currencies without considering foreign exchange, which can significantly alter the performance profile.

Turning to bonds, Gisimundo noted that yield curves remain inverted but she expects these to steepen in the medium term as monetary policy normalises.

“More expensive valuations should cause reductions in bond indices’ expected returns and term premiums (particularly in core Europe), while they have slightly improved in Japan, however, where expected returns remain at the low end of the spectrum,” she said.

In credit markets, spreads are “significantly narrower” than their long-term levels and, as such, she expects this to widen out over the medium-to-long term, which should lead to lower returns than had been expected a year ago.

“Overall, the outlook for fixed income assets remains positive, particularly relative to the other asset classes and notably for the high-grade segment and emerging market bonds,” Gisimundo said.

However, she cautioned that although return expectations are greater for high yield than for investment grade bonds, this relative advantage “does not compensate for the higher intrinsic risks”, particularly in the US market.

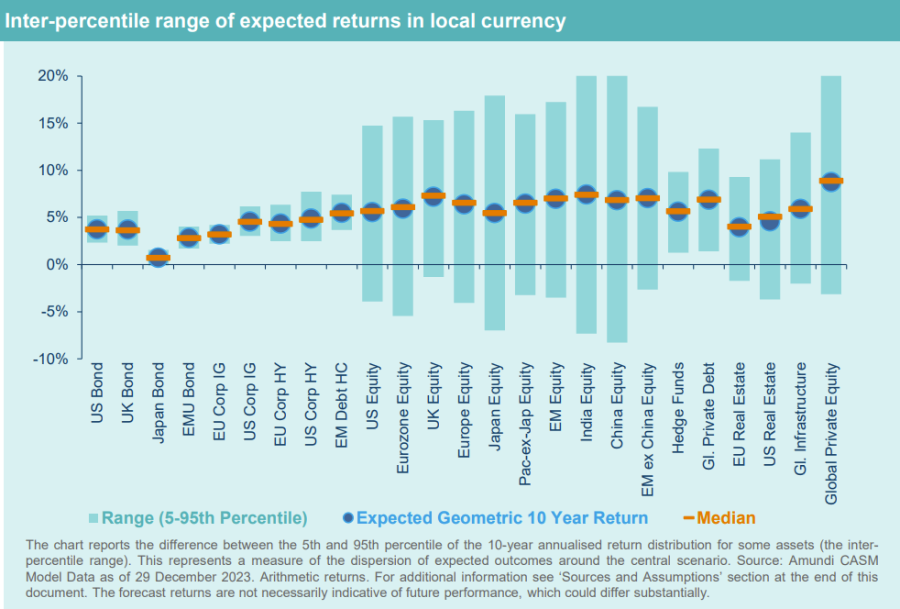

The firm also produced a chart to highlight the potential range of outcomes that could take place over the next 10 years, as well as the average. Here, although the US has a lower upside than some of the other markets, it has a much better downside.

Japanese, Indian and Chinese equity have the greatest potential downside risk, according to Amundi’s calculations. “Dispersion increases notably when comparing single emerging countries such as India and China versus emerging market aggregates,” said Gisimundo.

“It is key for investors to understand that for some equity and alternative assets, there is a 5% chance of experiencing negative returns over the next decade.”

Bonds typically have a narrower range in comparison to riskier assets such as equities and alternatives.

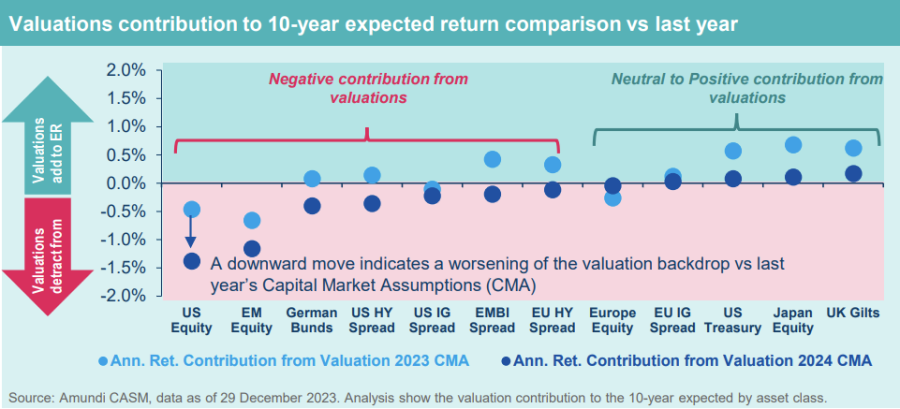

Lastly, on the economic front, Amundi said fundamentals have slightly improved from last year, but noted the new 10-year expected returns are, on average, slightly lower than last year’s forecasts after taking starting valuations into account, which are now “more stretched”.

Overall, she said bonds will continue to be a “key engine” for portfolio returns, while in equities diversification will be key as markets will be more volatile. Emerging markets excluding China are favoured here, while private equity could also be considered for those with a higher risk appetite.