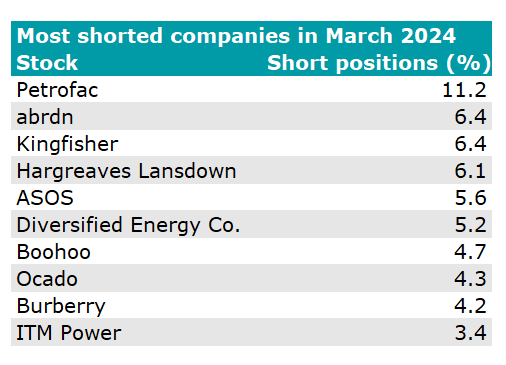

Short-sellers including Millennium International Management and GLG Partners bet against Kingfisher last month, making it the third-most shorted UK stock in March 2024.

Approximately 6.4% of Kingfisher’s share capital is in the hands of short sellers, who placed even larger bets against Petrofac and abrdn, according to data from the Financial Conduct Authority.

Kingfisher unveiled a subdued set of results last Monday (25 March 2024) for the year to 31 January 2024. Adjusted pre-tax profits were 25% lower than the prior financial year.

Although Kingfisher reported positive sales and “consistent market share gains” in the UK and Ireland, these were offset by a “more challenging consumer backdrop” in France and Poland.

Chief executive Thierry Garnier said: “In the UK and Ireland, B&Q, TradePoint and Screwfix each delivered resilient sales and market share growth – in particular very strong gains at Screwfix.”

Screwfix is pressing ahead with expansion plans and will open up to 40 new stores in the UK and Ireland this year, as well as 15 in France.

“In France, where the market has been impacted by low consumer confidence, we have made significant adjustments to the cost base and started to embed e-commerce marketplace and trade customer initiatives similar to those successfully implemented in the UK,” Garnier said.

He intends to improve the performance and profitability of Castorama France by restructuring and modernising its store network.

“And in Poland, where we faced strong comparatives and a tough economic backdrop, sales trends are gradually improving in line with the consumer environment,” he continued. Castorama Poland has a five-year target of up to 75 medium-box and compact store openings.

Garnier sounded a wary note for the year ahead. “We are cautious on the overall market outlook for 2024 due to the lag between housing demand and home improvement demand,” he explained.

The DIY behemoth maintained its dividend at 12.4p. It has commenced a new £300m share buyback programme to replace the previous £300m initiative completed in 2022 and 2023.

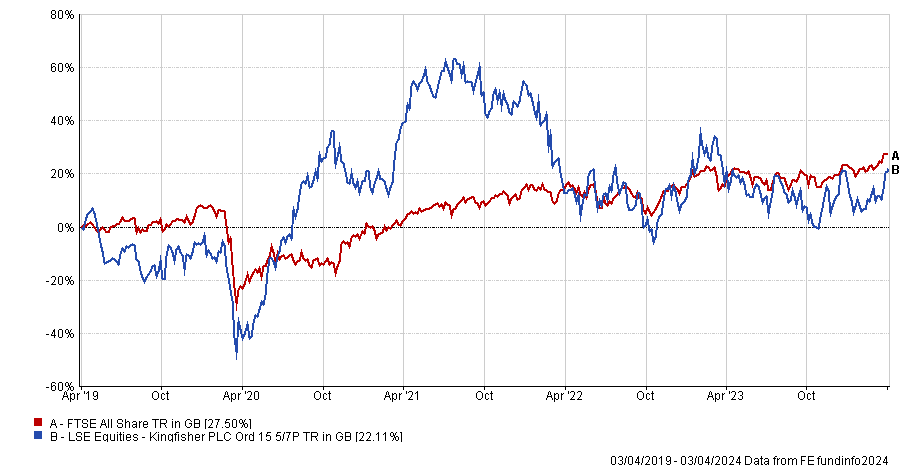

Kingfisher’s shares have fallen by about 40% from their high of summer 2021. The home improvement giant benefitted from a DIY boom sparked by Covid lockdowns, said Russ Mould, investment director at AJ Bell.

However, “that all changed when inflationary pressures took hold, higher borrowing costs hit the property market and the combination of these two factors hit consumers’ ability to spend on DIY and do-it-for-me projects”.

Performance of Kingfisher shares vs FTSE all Share over 5yrs

Source: FE Analytics

Mould continued: “In the UK, the company has done a decent job of putting its B&Q and Screwfix operations back on track, taking market share as it gets the basics of managing stock levels and getting the right product to the right people at the right time. The company has also drastically improved its online presence, though it still expects a lag between a slight improvement in housing market conditions to fully feed through to demand.”

Kingfisher now hopes to emulate its domestic success by adopting similar measures in Europe, but if international sales do not pick up, “questions may be asked about the role these businesses play for the wider group and if the geographic diversification is worth maintaining in the long term,” he added.

One prominent investor to lose faith along the way was FE fundinfo Alpha Manager Alex Wright, manager of the £930m Fidelity Special Values trust and the £2.8bn Fidelity Special Situations fund.

He sold out of Kingfisher last year when his investment thesis – that people would spend more on DIY because they were going out less after Covid – did not materialise.

“Kingfisher’s market share has been pretty stable and declined a little bit in continental Europe. We've sold out because the upside isn't there and probably lost about 10% to 15% on that position,” Wright told Trustnet.

Chris Beauchamp, chief market analyst at IG Group, was more optimistic about Kingfisher's prospects. “The near 5% yield means it will crop up on many investors’ radars,” he pointed out.

“There is plenty of room for improvement in the UK and eurozone economies, especially if (more likely when) central banks cut rates and give the housing market some room to get better. Crucially, the shares seem to have halted their decline, and even a little profit upgrade later this year could see big upside, particularly if a short squeeze gets going.”

Besides Kingfisher, the UK’s 10 most shorted stocks last month included three energy companies (Petrofac, Diversified Energy Company and ITM Power), three fashion retailers (ASOS, Boohoo and Burberry) the online supermarket Ocado and two financial services firms (Hargreaves Lansdown and abrdn).

Source: Financial Conduct Authority