The relationship between risk and return has long been a given but a handful of global funds have upended this widely accepted notion over the past decade, by making high returns with lower volatility.

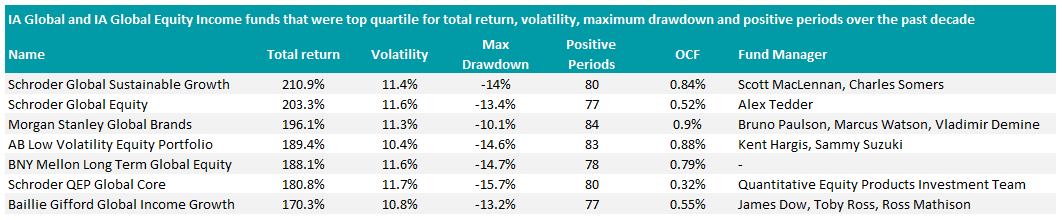

As part of our ongoing series looking at funds making high returns with lower risk, Trustnet found that just a few IA Global and IA Global Equity Income funds have made top quartile returns over the past decade whilst also ranking lowest on volatility.

We also filtered for those with the shallowest maximum drawdowns over the period and the highest number of positive months, leaving just seven funds that ticked all four boxes.

We’ve previously looked at the highest performing funds with the lowest risk in the US, UK, emerging markets and Europe.

Source: FE Analytics

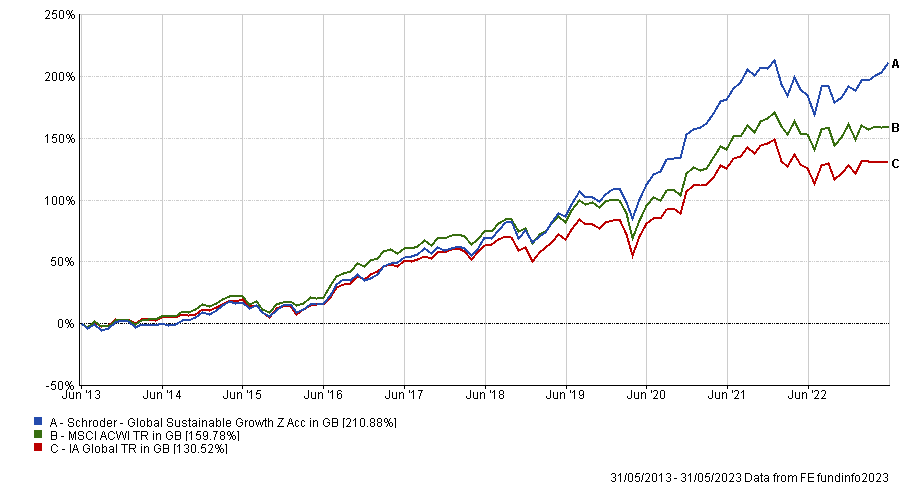

The highest returning fund on the list was Schroder Global Sustainable Growth, which climbed 210.9% over the past decade, beating its peers in the IA Global sector by 80.4 percentage points.

This five crown rated environmental, social and governance (ESG) fund was previously managed by Katherine Davidson, who departed the firm for Baillie Gifford last year. She was replaced by Scott MacLennan and Charles Somers, but Schroders confirmed the fund’s investment strategy will remain unchanged.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

A fellow Schroders fund – Schroder Global Equity – took the runner-up spot, with its total return of 203.3% over the past decade. The £1.3bn fund, managed by FE fundinfo Alpha manager Alex Tedder since 2014, beat the IA Global average by 72.8 percentage points over the period.

It shares four of its biggest positions in Microsoft, Alphabet, Booking Holdings and Schneider Electric with the sustainable growth fund, so both may have benefited from the sizable gains made by these companies in the 2010s.

However, Schroder Global Equity’s positions in these companies were lower than that of Schroder Global Sustainable Growth. Tedder’s fund is diversified across 147 holdings, whereas the other fund is concentrated in 42 positions.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

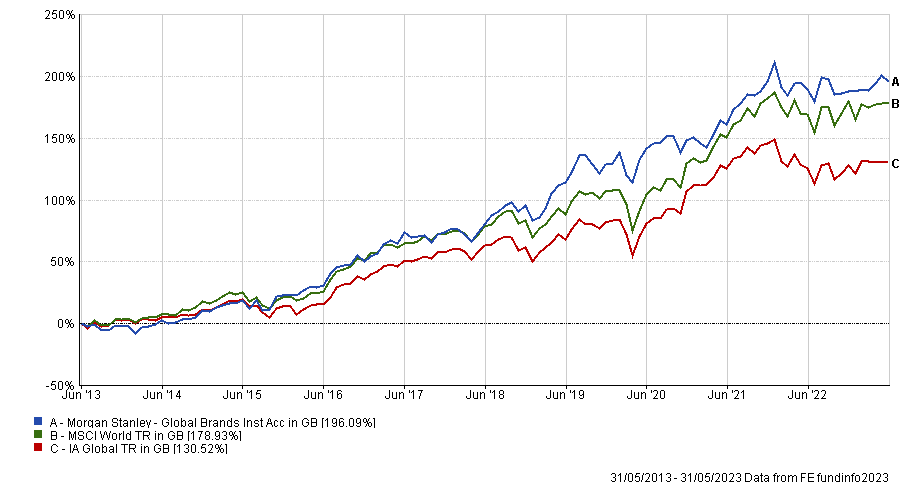

The third highest returning IA Global fund also had the lowest number of negative periods and shortest maximum drawdown.

Morgan Stanley Global Brands beat its peers by 65.6 percentage points over the past decade, climbing 196.5%. Over that period, it reported positive results in 84 of 120 months, meaning it had the least negative periods on the list.

Its worsts drop was also shallower than that of its peers - it fell 10.1% at its lowest point, compared to the 21.3% maximum drawdown from the average IA Global fund.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

Analysts at FE fundinfo said managers Bruno Paulson, Marcus Watson and Vladimir Demine (who have all run the fund since 2009) exemplified a skill for selecting defensive brands.

“The team has been running the strategy for a long time and although it may be considered a ‘steady Eddie’ type of investment, it has proved its defensive characteristics time and time again,” they said. “We’re confident in the team’s ability to pick long-term industry leaders who can defend themselves from the disruptors – that is, Amazon and Google.”

Researchers also noted the low turnover in the portfolio, with managers rarely making changes to the 32 names they hold.

Unsurprisingly, the least volatile fund on the list was AB Low Volatility Equity Portfolio. As its name suggests, managers Kent Hargis and Sammy Suzuki seek companies that “limit volatility and emphasize downside mitigation”.

It posted annualised volatility of 10.4% over the decade in question, while the IA Global average sat at 13.2%. Not only did it succeed in delivering lower volatility than its peers, but it beat the sector on performance too.

AB Low Volatility Equity Portfolio climbed 189.4% over the past decade, beating its peers by 58.9 percentage points.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

However, investors who wanted a combination of top returns and low volatility for a cheaper price tag might have preferred the Schroder QEP Global Core fund.

Its ongoing charges figure of 0.32% made it one of the cheapest in the sector, yet it beat the IA Global sector by 50.3 percentage points over the past decade with a total return of 180.8%.

The fund is managed by the Quantitative Equity Products Investment team at Schroders. Analysts at RSMR highlighted that the managers only seek “modest incremental outperformance” of the MSCI World index, which it narrowly beat by 1.9 percentage points over the past decade.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

Even so, the researchers at RSMR said investors could benefit from having this alpha against the benchmark, especially given its affordable price.

“The team are well resourced, and continually improve the process and systems, with the latest development moving the systems into the cloud to greatly reduce the time for optimisation,” they said.

“We believe the fund provides a good option to provide exposure to the index in a cost-effective manner with the ability to produce positive alpha.”

Alternatively, investors wanting a truly actively managed fund for a low price might want to consider Baillie Gifford Global Income Growth.

The fund, run by FE fundinfo Alpha managers James Dow and Toby Ross alongside Ross Mathison, charges a fee of 0.55%, making it one of the cheapest in the IA Global Equity Income sector.

It also beat its peers on positive periods, maximum drawdown, volatility and total return over the past decade. Baillie Gifford Global Income Growth climbed 170.3% over the period, beating its peer group by 62.2 percentage points.

Total return of fund vs benchmark and sector over the past 10 years

Source: FE Analytics

It was the only dedicated equity income fund to make it onto the list, which RSMR analysts suggested could be to do with its unique investment approach.

“This fund follows a different philosophy from many in the sector, with the belief that over time a growing income stream if sustained will deliver a higher overall income to investors on an annualised basis than investing in a high yielding strategy which may be hit with low or no growth,” they said.

“Focusing on growth and free cash flow should ensure the dividend stream is relatively dependable.”