There are three standout options for investors wanting to pick up a bargain, according to Tillit’s head of fund selection Sheridan Admans, ranging from behemoth giants to relatively under-the-radar picks.

Now could be a good time to snap up a cheap investment company, as the average trust is trading at an almost 13% discount, according to data from Numis Securities.

Investment trusts can trade above or below their net asset value (NAV) when investors buy or sell and cause the share price to change without any movement in the underlying holdings. While it is punishing for sellers, new investors can take advantage of a big discount.

Below, Sheridan Admans, head of fund selection at Tillit, picks his three favourite investment trusts currently trading at a discount.

For global exposure, Admans picked Baillie Gifford’s Scottish Mortgage Investment Trust. It invests in businesses with structural growth potential in both public and private markets and has a bias toward tech, with a habit of taking high-conviction bets in key holdings.

Admans said: “One of the key advantages of this investment trust is its purist approach to high-growth investing with a bias towards disruptive companies regardless of the market environment, that have shown tremendous growth potential.”

Another advantage is its ability to invest in both private and public companies, which is made possible by its investment trust structure.

Admans added: “This is a crucial advantage, as it enables the trust to identify and invest in companies that have the potential to deliver significant growth over the long term.”

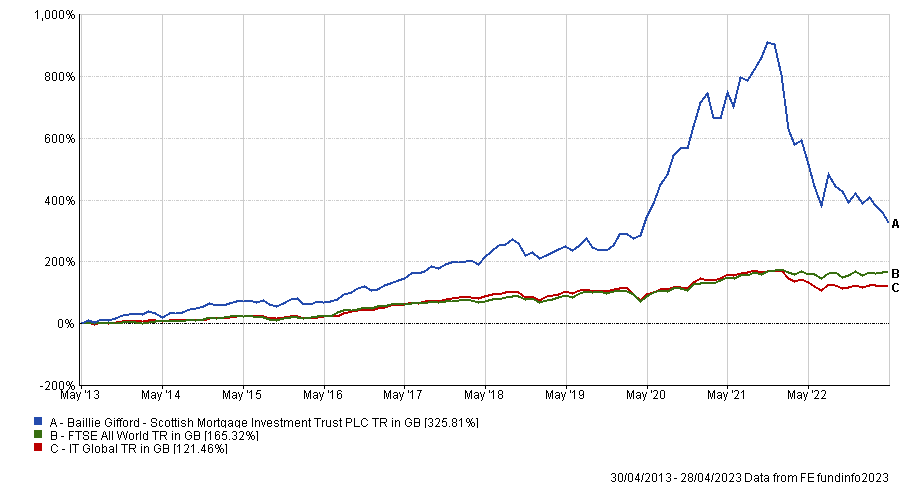

Performance of the trust vs sector and benchmark over 10yrs

Source: FE Analytics

The fund has largely outperformed both its sector and benchmark over a decade but has collapsed in the past two years as a result of the market rotation due to rising interest rates.

As a result of this fall from grace and a recent spat at the board level, the trust is currently trading at an almost 20% discount.

The extent of the trust’s investments in private companies has come into question recently with fears that the trust might experience the same fate as the Woodford Equity Income fuind.

Yet, manager Tom Slater has dismissed those comparisons, noting the difference in size of the unlisted stocks held by the two strategies and Admans remains confident in the investment company’s prospects.

He said: “While commentary continues to engulf the trust of clashes in the boardroom and fears over its private equity holdings we remain confident the managers of the trust have the structure and capability to manage its unlisted assets.

“The investment trust is very competitively priced for its style and track record. It is currently trading at a significant discount to its net asset value, which makes it an attractive investment opportunity for those looking for exposure to high-growth companies.”

Closer to home, Aberforth Smaller Companies Trust invests in UK-listed small companies that are out of favour with the market.

Admans said that the trust’s focus on turnaround stories, or value investing, is a “refreshing” alternative to the more popular growth-focused funds in the small-cap market.

He added: “What sets Aberforth apart is its team-based approach as well as its emphasis on dividends and a company's ability to pay them.

“This approach has proven successful in the past and the trust has a deep experience in this particular approach and part of the market.”

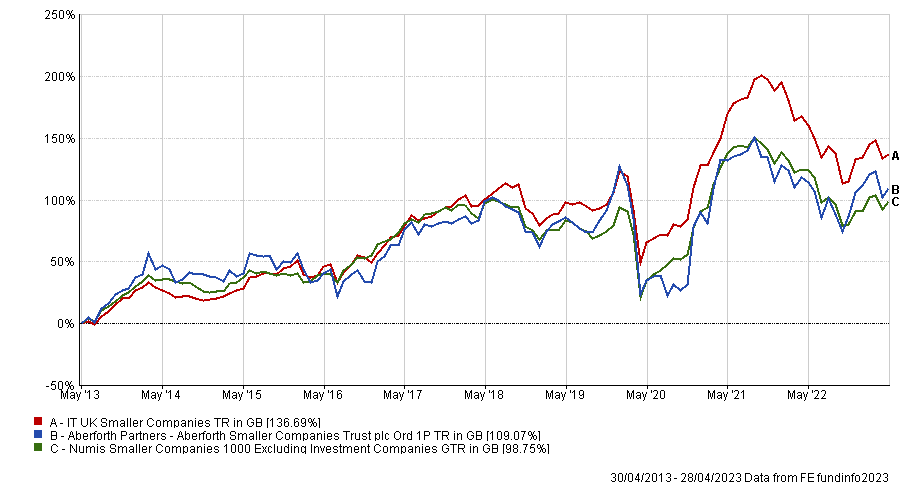

Performance of the trust vs sector and benchmark over 10yrs

Source: FE Analytics

Aberforth Smaller Companies currently trades at an approximately 14% discount and has beaten the Numis Smaller Companies 1000 Excluding Investment Companies over 10 years but has trailed behind the sector average.

It has, however, been a top-quartile trust in the IT UK Smaller Companies sector over three years and one year.

Admans said: “Despite its success, it is currently trading at a significant discount to its net asset value. This presents a great opportunity for investors who are looking for exposure to Aberforth’s specific niche (deep value, UK small-caps).”

Admans’s third pick is BlackRock Frontiers Investment Trust, which invests in less well-known emerging markets: its three largest country allocations are Indonesia, Saudi Arabia and Vietnam.

He said: “One of the key advantages of the BlackRock Frontiers Investment Trust is its focus on frontier and small emerging markets. These markets tend to be less mainstream and can offer higher growth potential compared with more established markets.

“By investing in a diversified portfolio of more than a dozen idiosyncratic countries, the trust can reduce risk and provide exposure to a range of different economies.”

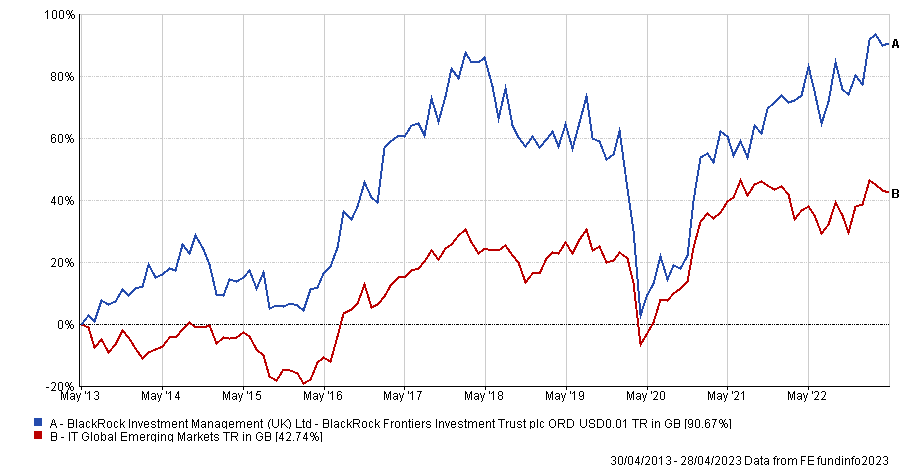

Performance of the trust vs sector over 10yrs

Source: FE Analytics

The trust is currently trading at an almost 10% discount despite performing better than the IT Global Emerging Markets sector over 10 years and sitting in the top quartile among its peers over one, three and 10 years.

Admans said: “Another advantage of the trust is its focus on high-quality companies that prioritise paying dividends. This provides an income angle to the investment, which can be particularly appealing for investors looking for income-generating opportunities.”