Banking stocks are offering some of the best risk/reward opportunities in the UK market, according to Martin Walker, manager of the Invesco UK Opportunities fund.

He scaled back risk in his £1.3bn portfolio over the past year as high inflation and tightening monetary policy created challenging conditions for investors, but remains bullish on banks.

“The warning lights on the dashboard are flashing, which may or may not come to pass as anything, but nevertheless, it's probably something that we should pay attention to,” Walker said.

“That’s informed the narrative of the portfolio positioning at the moment, so I’ve taken my foot off the pedal a little on risk while we get some idea of how things pan out for the rest of the year. I feel that bit of caution is warranted.”

The Invesco UK Opportunities fund manager reduced exposure to cyclical areas such as industrials, yet banks are an area where he felt he had to take some risk.

Financials have undergone a turbulent few months, with the collapse of European giant Credit Suisse and US firm Sillicon Valley Bank earlier this year sending shockwaves throughout the sector.

However, banking stocks are undervalued following the crisis and many UK names could have strong futures ahead of them, according to Walker.

He said: “I still want to hold some cyclicality in the portfolio, but only where I'm being paid to do so.

“If I had a cyclical such as Spirax-Sarco, which is trading at a high multiple, I'd be really worried, but banks are trading below book and have the potential to offer share buybacks and dividends. That seems like it’s a risk worth taking.”

NatWest, Lloyds and Barclays are the three banks Walker holds in the fund, accounting for 7.7% of all assets. He said that investors can expect “great levels of income and share buybacks” from them moving forwards.

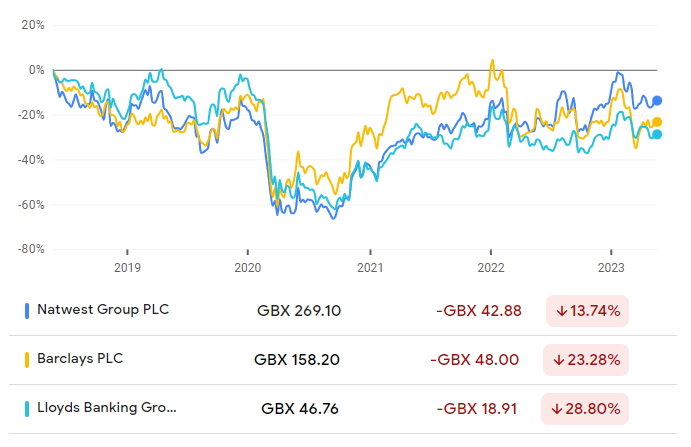

Share price of NatWest, Barclays and Lloyds over the past five years

Source: Google Finance

“There’s a clunking fist of cash generation coming from the banks, a large part of which will find its way back to shareholders. This, in and of itself, should generate a decent return,” Walker added.

This is also true of the insurance companies he holds in the portfolio – Prudential, Aviva and Phoenix – as they are also geared into financial markets.

“It's not the same level of gearing that you get from banks, but they are highly cash generative and as someone who wants to express value as a factor within their portfolio, financials is an area where I want to be,” Walker explained.

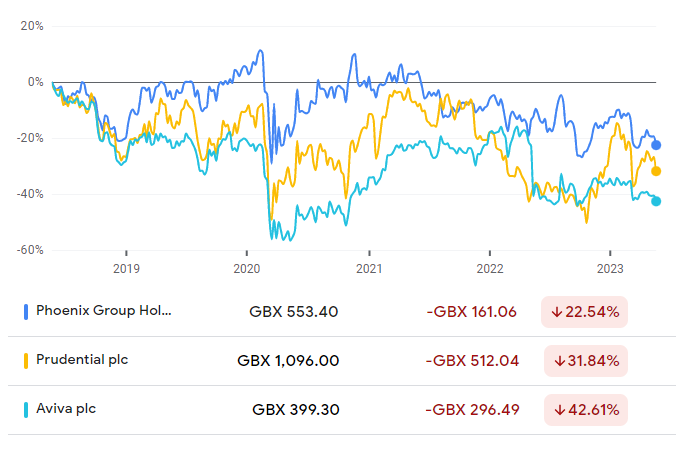

Share price of Phoenix, Prudential and Aviva over the past five years

Source: Google Finance

Despite holding these companies, the Invesco UK Opportunities fund’s 16.8% exposure to financials is just short of the IA UK All Companies sector average.

This is largely because Walker does not own one of the biggest players, HSBC, as he prefers domestic UK banks. Most of HSBC’s revenues come from mainland China.

Exposure to the sector may be slightly below average because of this technicality, but Walker said he would increase allocations to financials if further volatility brought valuations down to even more appealing levels.

“If we saw a big setback in the sector on the back of sentiment, then I would happily go overweight – I think the banks in the UK are in a really strong position,” he added.

“With rates having gone up, their profitability has increased significantly. They're well capitalised and have lots of liquidity even though liquidity is being drained from the system through quantitative easing.”

While more instability in the sector could make share prices more affordable, it would come with added risks. Even so, Walker said that the potential returns on UK financials were too alluring to miss, even with his more cautious stance on markets.

“It's an economically sensitive sector and if sentiment turns more negative, that may undermine the shares – I don't know which of the two of those opposing forces is going to win,” he said.

“I don't know how that's going to pan out, but I would feel very uncomfortable owning nothing in the sector given the potential value play here.”