Homeowners do not like rising interest rates and in the US the Federal Reserve has lifted rates much more sharply than other central banks in its bid to tame inflation.

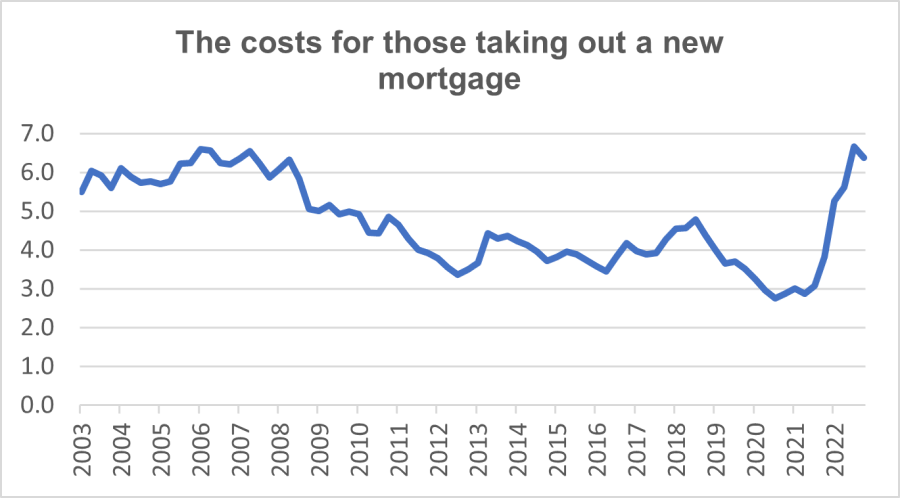

The average 30-year fixed-rate mortgage taken out today is 6.4% – the highest since 2008 and more than twice what it was in 2021 (see below).

Source: St. Louis Fed 30-year fixed-rate mortgage average (mortgage3OUS)

To get a feel for what that means to ordinary Americans taking out a mortgage, run those numbers through a mortgage calculator. They might make you wince. For someone buying an average-priced US home ($436,800) with a decent 20% deposit, interest payments rise from $1,800 a month to $2,500 – $700 extra (or over £500). Multiply that by 12 and you take a supersized 15% bite out of the average annual salary.

Little wonder that house prices have fallen – the average figure is down close to 9% in just one quarter, according to data from the St. Louis Fed. So why is the US not in deep recession? Well, the house price fall needs to be put into context. Prices rose 46% between the end of the first quarter 2022 – the peak – and the end of the calendar year. Some recalibration was to be expected.

More important is the financial miracle of the 30-year US fixed rate mortgage. Well over 90% of existing mortgages in the US are locked into these long-term rates – typically charging between 3% and 4% currently (though they can refinance if interest rates fall). As long as householders continue to stay in their existing homes on the same mortgage they are not impacted by rising interest rates.

On the other hand, anyone moving house or in the process of moving from rental accommodation to their own home will be directly impacted by today’s relatively punitive mortgage rate.

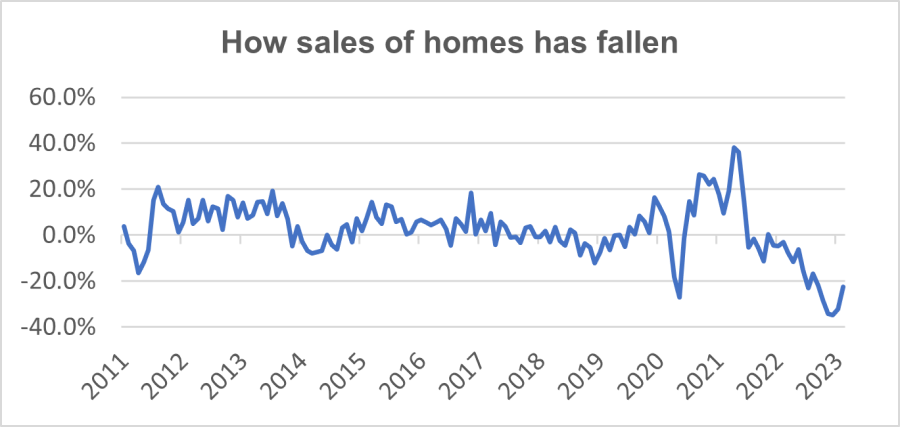

Source: St Louis Fed YoY change (%) in new and existing single-family sales

In the chart above you can see the effect rising mortgage costs have had on sales of existing and new homes. They fell more than 30% year-on-year before recently staging a modest recovery.

Last month, one of the leading homebuilders in the US, DR Horton, offered commentary that shed light on this recent recovery and gave confidence in its sustainability.

On their first-quarter conference call, management reminded us that, as the Federal Reserve started raising interest rates, there was a shortage of housing supply to meet pent-up demand. This is due to the cautious behaviour of homebuilders following the 2008/2009 housing crisis. DR Horton, like other homebuilders, adapted to the new reality by offering higher incentives to stimulate demand and building smaller homes. To offset pressures on profitability, it was also able to reduce the construction cycle time by 12 days – necessity is the mother of invention. On the call the team mentioned the word “stabilised” several times to reflect their view of the current housing market.

A picks-and-shovels approach to construction

This is encouraging. But it is not enough to persuade us to buy – yet. We think there is a better way of gaining exposure to this important sector. Our largest and most direct housing exposure is to a company called Builders FirstSource, which is the US’s biggest supplier of structural building products. For example, it pre-fabricates lumber roof structures and ships them to construction sites, saving builders both time and money. It also offers things like staircases, doors, windows, cabinets and countertops.

The reason we bought a supplier rather than a homebuilder is that, during a slowdown in demand, suppliers can reduce investment in inventory, which enhances their free cash flow. This approach has enabled Builders FirstSource to buy back a significant portion of its shares, which will boost earnings per share when the housing recovery comes. In addition, the business also benefits from people who stay in their existing home and decide to repair or remodel it. This continues to be a healthy market.

Another attractive aspect of Builders FirstSource is that it is an active acquirer of other, smaller suppliers in what is a very fragmented industry. It can fold them into its network, broadening its addressable market. We believe this strategy will sustain growth for some years to come and it can pick up these companies at more attractive prices currently.

Across our funds, other stocks that are at least partially exposed to a housing recovery include aggregates producers Vulcan Materials and Eagle Materials – think sand, gravel, asphalt and ready-mixed concrete. These two companies should also benefit from the huge investment in infrastructure being planned by the US. Similarly, Ferguson Construction – which offers pre-construction services such as feasibility studies, planning, design and estimating – could enjoy a pick-up from several quarters.

Interest rates off the roof?

Many believe interest rates are near their peak in the US – with inflation now just 5%, compared with more than 10% in the UK. A fall in rates will be good for the housing sector, but we should not assume that inflation will remain beaten.

The decade of quantitative easing that followed the Great Financial Crisis was an anomaly. Historically, we have seen central banks have to wrestle repeatedly with inflation. Interest rates have risen and fallen in waves, depending on how well that battle is progressing. We believe we may return to this scenario.

Homebuilding had a difficult 2022 in the US. The sector has historically bounced back strongly from setbacks. Our approach enables us to have exposure to it while mitigating some of the risks associated with more economically volatile times.

Cormac Weldon is head of US equities at Artemis. The views expressed above should not be taken as investment advice.