James Anderson is returning to fund management, a year after retiring from Baillie Gifford, at a new investment firm to be chaired by former chancellor George Osborne.

Lingotto Investment Management, which is owned by the Exor NV holding company of Italy’s Agnelli family, was launched with $3bn in funding. French insurance group Covéa has contributed a significant portion of the initial assets under management.

Lingotto said it aims to provide talented investors with “a home in which they can pursue their passion for investing, without the bureaucracy of most large organisations or the loneliness of standalone funds”.

Anderson has been hired for “his specialist experience of investing in companies with the potential for exponential innovation in technologies and business models”. Lingotto noted that he was an early backer of tech successes such as Amazon, ByteDance and Tesla.

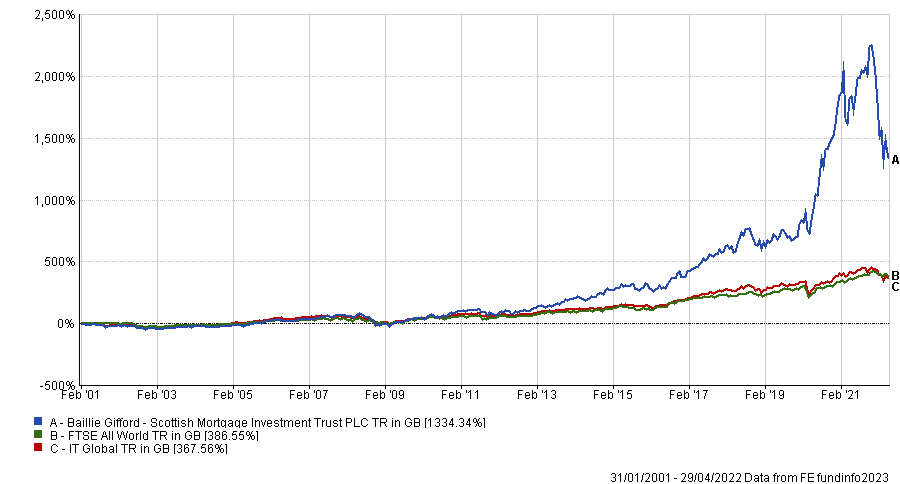

He was previously a partner at Baillie Gifford and was best known for managing the Scottish Mortgage Investment Trust, before retiring in April 2022. Under Anderson’s tenure, the trust – which is one of the most popular in the UK – made a 1,334% total return, compared with 368% from its average peer.

Performance of Scottish Mortgage under James Anderson

Source: FE Analytics

Source: FE Analytics

However, the trust has struggled of late after the high growth companies it prefers, especially ‘disrupters’ in the tech space, sold off aggressively when central banks started hiking interest rates to curb inflation.

Lingotto’s investment offering includes an ‘Innovation’ strategy, which like Scottish Mortgage invests primarily in public markets with some private equity exposure. Similarly, its global investment approach is based on identifying “rare structural winners”, using a concentrated portfolio with a long-term commitment.

Anderson said: “I’m excited to be joining Lingotto at this stage of its journey. The opportunity to be part of an entrepreneurial project that aligns with my own view of what investing should be was difficult to resist. Lingotto brings together a highly attractive combination of autonomy and structured support, as well as colleagues of great calibre, and I look forward to playing my part in achieving their purpose.”

The firm also announced that George Osborne, the chancellor during David Cameron’s premiership, will become its non-executive chairman and use his “extensive professional experience” to support the firm’s development.

Osborne has chaired the Exor Partners Council for the past five years, a position he will stand down from upon taking up his new role. He is a partner at boutique investment bank Robey Warshaw and was formerly a senior adviser at the BlackRock Investment Institute.

Osborne said: “I’m delighted to be joining the team here, which offers something new and unique in the investment management space. It’s been a privilege to chair the Exor Partners Council since 2018 and I now look forward to working with the Lingotto team, helping them to build a great company.”

Lingotto also appointed Matteo Scolari and Nikhil Srinivasan as managing partners.

Scolari’s experience is in investing in public markets with a global, fundamental approach focused on high-conviction long-term positions. Srinivasan’s expertise is in finding special situations in global private markets, with a focus on larger European economies and Asia.

Enrico Vellano, chief executive of Lingotto, said: “It’s a pleasure to welcome James and George to the team. To be able to attract leaders of their quality and experience is a testament to the ambition of Lingotto and our determination to build a great investment management company.”