Nick Train, manager of the Finsbury Growth and Income trust, said he was “hugely grateful” to the shareholders who held tight through a challenging period.

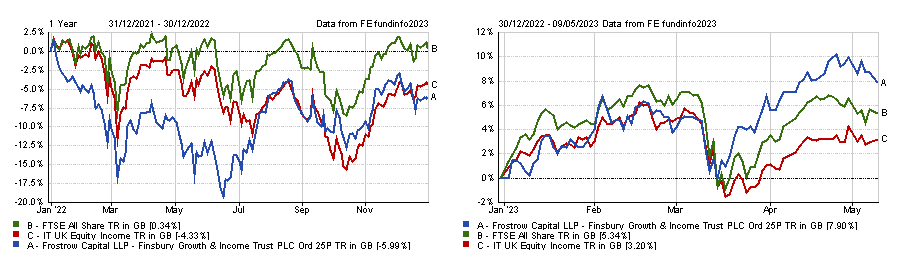

Returns dropped 6% in 2022, leading some panicked investors to remove more than £1bn from the trust over the past year.

Train said: “I want to thank investors in the Finsbury Growth and Income trust for their patience because I am acutely conscious of the fact I am only just emerging from a two-year back-to-back period of underperforming our benchmark.

“Mercifully that hasn't happened too often in the 22 years and counting of our responsibility for Finsbury. Nonetheless, I can assure you it was a disagreeable experience.”

Indeed, performance has picked up in 2023 with its 7.9% return this year beating the IT UK Equity Income sector by 4.7 percentage points.

Total return of trust vs benchmark and sector in 2022 and 2023

Source: FE Analytics

Train pointed out that this improved performance was not a result of any changes he made to the portfolio.

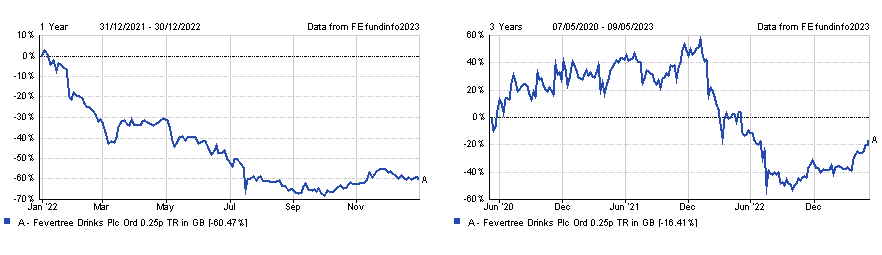

In fact, it has been three years since he last added any new names – Experian and Fever-Tree. The former’s share price is up 8.6% over the past three years, whilst the latter has fallen 16.4%.

Train revealed at the trust’s AGM earlier this year that Fever-Tree was his worst performing stock of 2022, with shares in the company dropping 60.5% throughout the year.

Share price of Fever-Tree in 2022 and over the past three years

Source: FE Analytics

However, he was positive on Fever-Tree’s growth prospects now it has overcome issues with high logistics and bottling costs, stating that the company “is going to be one of the UK’s great global brands”.

Its share price is up 40% this year, which Train wouldn’t have captured if he had laxed on his investment discipline and sold out when conditions got tough.

This is one example of why sticking to an investment approach is better than taking bets on themes – something investors can forget when markets get rough, according to Train.

He said: “Common sense is not necessarily as commonplace as you might expect in our business. Some very, very smart people are occasionally prone to being too smart.”

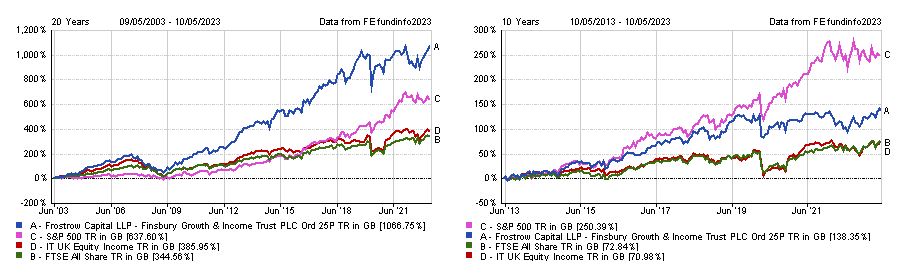

By sticking with a proven discipline, Train noted that Finsbury Growth and Income had beaten US equities in the S&P 500 by 429.2 percentage points over the past 20 years.

“Sometimes, perhaps often, the investment approach and investment principles are as important to investment returns than the geographic allocation,” he added.

The trust dropped behind the US index over the past decade, but it still had a strong lead against its FTSE All Share benchmark and peer group.

Total return of trust vs S&P 500, benchmark and sector over the past 10 and 20 years

Source: FE Analytics

Chris Salih, investment trust research analyst at FundCalibre, said Finsbury’s improved performance this year may indicate the trust has come through the worst of it.

Train’s preference for companies with strong management teams that are personally attached to its performance has helped the portfolio pass through stormy market conditions, according to Salih.

He said: “The trust has been doing well for six months now, so the style has rebounded to some extent already.

“The important thing with Train is you know the types of businesses he likes – these are family owned, family run businesses. He knows as a fellow shareholder he will be looked after due to that alignment of interest.”