JPMorgan Claverhouse became the latest Association of Investment Companies ‘Dividend Hero’ to have raised its dividends for 50 consecutive years, but there is plenty more left to run from here, according to co-manager Callum Abbot.

He was appointed to the role in 2018 and has been working with William Meadon at the helm since then. Over 10 years, JPMorgan Claverhouse has outperformed both the IT UK Equity Income sector and the FTSE All Share index, while since Abbot took charge the trust is up XX%.

Performance of the trust over 10yr against sector and index

Source: FE Analytics

Below, Abbot tells Trustnet that the UK is trading at a generational discount to other developed markets, why is investing for difficult economic conditions and why the trust is keen on both healthcare stocks and banks.

Can you explain your investment process?

Claverhouse is a best ideas investment trust composed of UK-listed companies that aims to reward our shareholders with steady growth in both their capital and income over the medium term.

We are bottom-up stock pickers with an emphasis on attractively valued companies that are high quality and have strong momentum.

Our investment process leads us to a barbell portfolio, with both value and growth stocks that we believe will produce outperformance over the index in a steady, consistent manner, irrespective of market conditions.

Why should investors have your trust in their portfolio?

We believe we are in a new cycle where inflation and interest rates will remain higher than in the previous cycle.

This is a backdrop where valuation becomes important again and the UK is trading at a generational discount to other developed markets.

For investors that are looking to increase their core UK holding and want a balance between long-term capital growth and income, then Claverhouse is a compelling option.

What macro-economic factors are you closely monitoring?

The economic backdrop is challenging at the moment but developments at the macroeconomic levels generally have less influence on the portfolio than our assessment of the fundamentals of companies themselves.

Given the uncertain macro environment, we are focused on investing in good quality companies that we believe can cope in very difficult economic conditions.

Whilst macro-economic factors remain volatile and uncertain, the cheap valuation of the UK stock market reflects much of this uncertainty.

What sectors of the UK market do you find attractive at the moment?

Our portfolio contains a barbell of growth and value stocks. From the growth side of the portfolio, we are finding attractive opportunities in the pharmaceutical sector.

On the value side we continue to like banks, despite the recent flare up in the US regional banking system, and miners, which are returning significant cash to shareholders.

Some UK names have moved their stock market listing to the US recently. Is it a trend that worries you?

It is a reflection of how undervalued the UK equity market is. The board and management of companies that are changing their listing to the US believe that the share price of the firm they manage will be rerated.

Ultimately, we want a breadth of high-quality opportunities to select stocks from, so we welcome the focus from investors and the government on how to address this trend.

What have been your best and worst calls over the past 12 months?

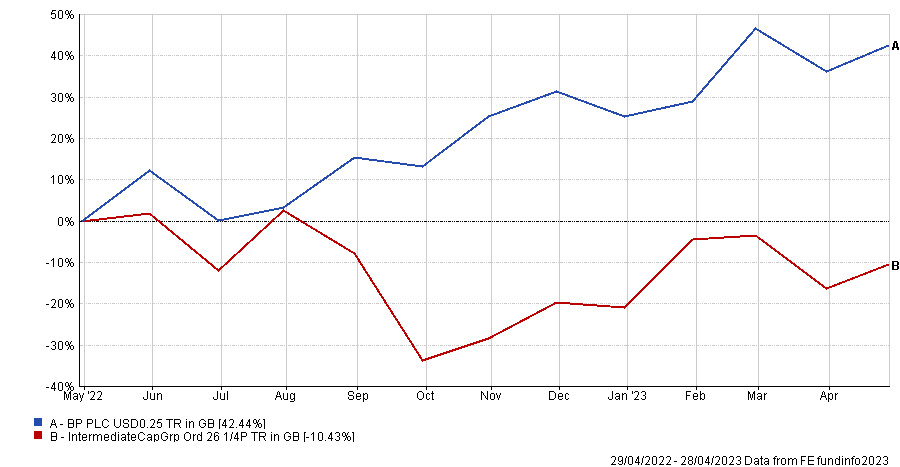

The best call over the past 12 months has been BP, adding 104 bps. It has been our significant overweight position for slightly longer than that.

Chart of both stocks

Source: FE Analytics

One of biggest detractors (81 bps) was our holding in Intermediate Capital Group. We believe that it is a long-term winner, but the market wants to see how its earnings and balance sheet perform through a downturn.

What is your view on environmental social and governance (ESG)?

Whilst Claverhouse holds stocks based primarily on companies’ fundamentals, we also consider the potential impact of ESG factors on a company’s ability to deliver shareholder value.

We assess each company’s strategy for dealing with these important matters and the consequent risks arising from them. Our analysis helps determine whether relevant ESG factors are financially material and, if so, whether they are reflected in the valuation of the company. Such analysis may influence not only our decision to own a stock but also, if we do, the size of that position in the portfolio.

As active investors, we strive to influence management in their efforts to address these important issues and we hold them accountable for their ESG targets.

What do you do outside of fund management?

I love to grill. In 2017, my wife made a terrible mistake when she purchased a Kamado BBQ for my birthday. Since then, she has barely seen me but has had to endure an array of meals cooked over fire. I also love sports, particularly rugby.