Active funds are underperforming their passive rivals in some of the strongest sectors in 2023 so far, research by Trustnet shows, with one investor warning that big asset allocators could be exacerbating short-term swings in the market.

While funds across the board suffered significant losses in 2022, this has reversed in the new year with 39 of the sectors in the Investment Association universe making a positive return in 2023’s opening four months.

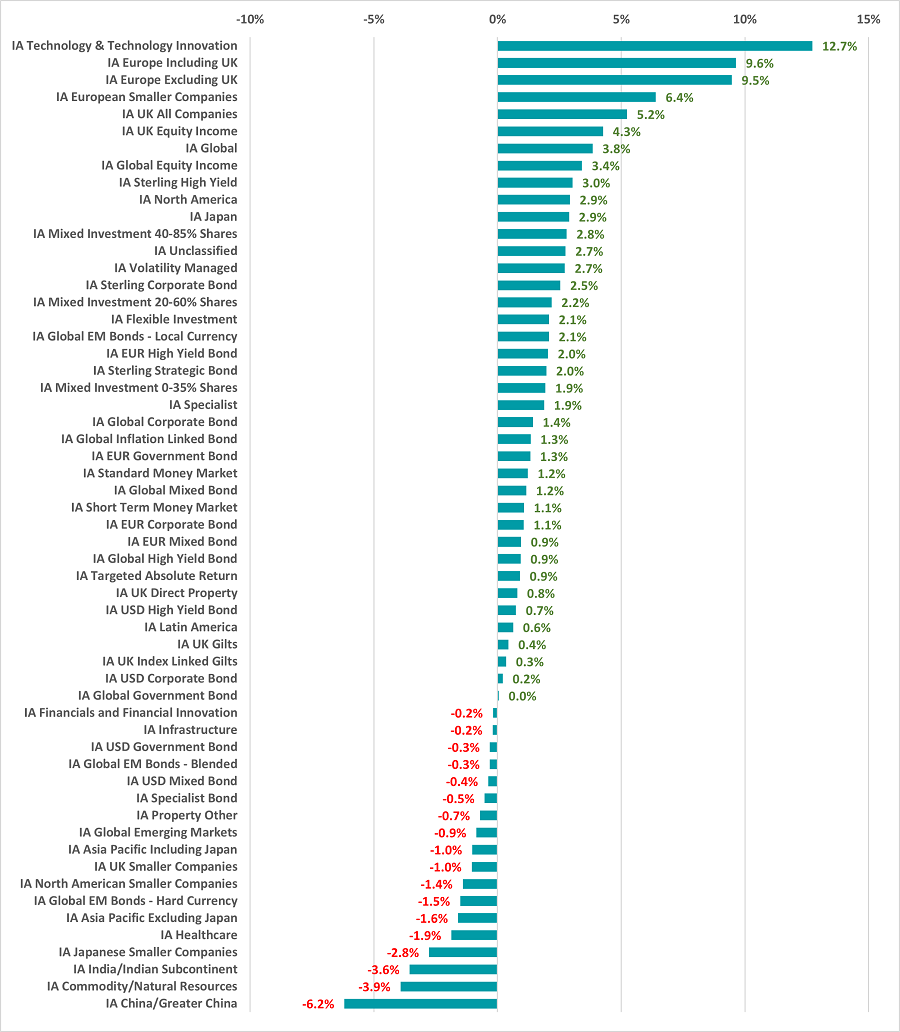

As the chart below shows, the strongest returns have come from the IA Technology & Technology Innovation sector, where the average fund is up 12.7%.

This represents a stark turnaround from 2022. Then, high inflation and rising interest rates pushed investors out of growth stocks such as tech and this peer group was the second worst in the Investment Association universe after losing 27.5%.

Performance of fund sectors over 2023 so far

Source: FE Analytics

Indeed, many of the sectors that are making the highest returns in 2023 faced a tough time last year. The average IA European Smaller Companies fund, for example, was down 21.1% in 2022 while the average loss in the IA Global sector was 11.1%.

But stocks have rebounded this year after inflation started to look like it had peaked and investors began to anticipate a pause in interest rates hikes. Some are even asking when central banks will cut interest rates in response to weakening economic growth.

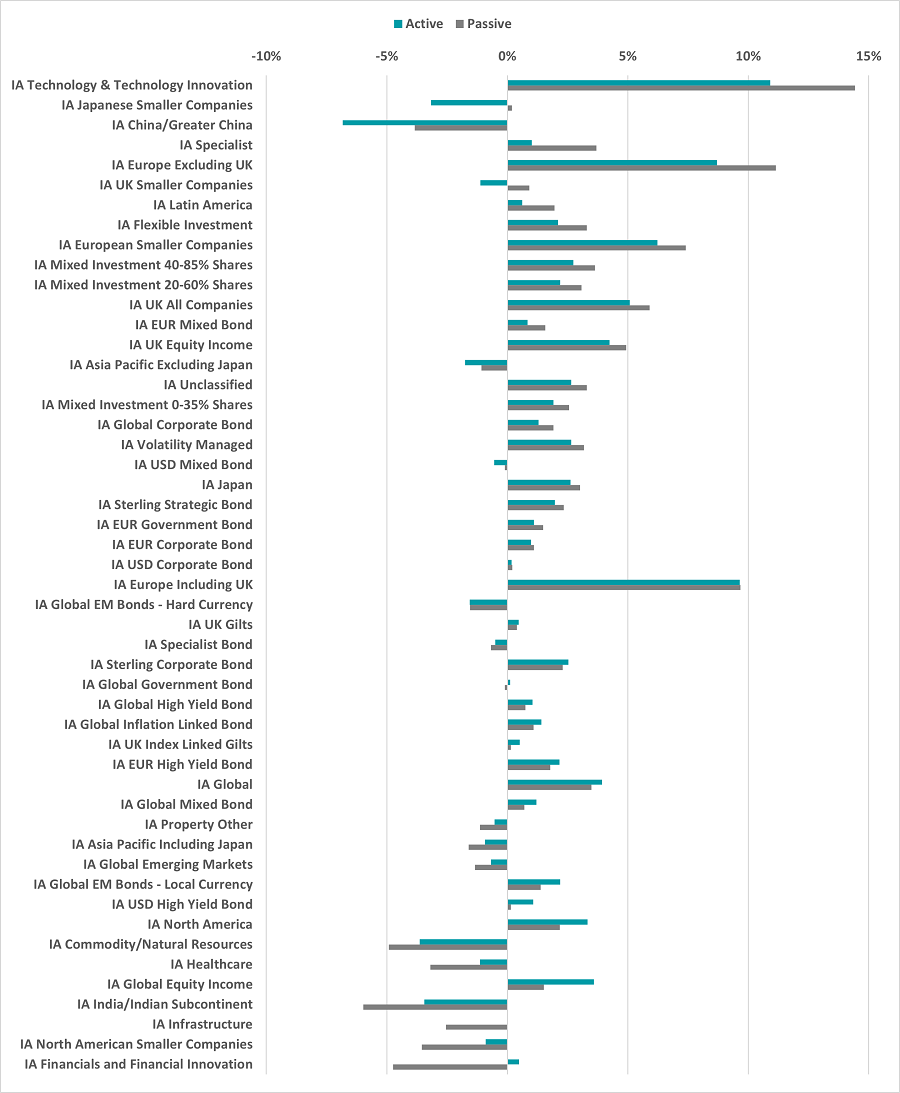

This would benefit growth stocks, which explains why tech funds have jumped to the top of the leaderboard in 2023 so far. However, our analysis shows this is also the sector where the average passive fund has beaten the average active fund by the widest margin.

According to FE fundinfo data, the average active fund in the IA Technology & Technology Innovation sector made a 10.9% total return in the first four months of the year.

While this is a decent result, it is significantly behind the 14.4% return made by the average passive – as shown in the chart below, which is ranked according to how much passives have outperformed active.

Performance of active and passive funds over 2023 so far

Source: FinXL

Of the 15 active funds in the IA Technology & Technology Innovation sector, only three have beaten the 14.4% made by the average passive. These are Liontrust Global Technology, the UK-domiciled T. Rowe Price Global Technology Equity fund and the Sicav version of the T. Rowe Price fund.

Active funds are also underperforming passives in areas including the IA Europe Excluding UK, IA European Smaller Companies, IA UK All Companies and IA UK Equity Income sectors, which are among the peer groups with the highest returns over 2023 so far.

Some of the well-known active funds from these sectors that are beating the average passive are Artemis Income, LF Lindsell Train UK Equity, CT UK Equity Income, Royal London Sustainable Leaders Trust and BlackRock Continental European.

Simon Evan-Cook, manager of the recently launched Downing Fox multi-asset range, said: “As investors in active funds, we live these passive versus active swings in markets every day. There are loads of variables that can swing it, such as which market you’re looking at and what that market-weighted benchmark has concentrated exposure to.”

Equal weighted UK index and funds relative to market-cap index since 2013

Source: Downing, FE Analytics

The manager point out that active funds tend to do better when equal-weighted indices are outperforming the standard market-cap index, as this suggests the market is being led by stocks other than the most dominant index constituents, and vice versa. This correlation is reflected in the chart above.

Overall, however, Evan-Cook warned that the market could also be moving in the short term because of knee-jerk buying and selling by giant institutions rather than because of fundamentals, which suggests investors should overlook near-term movements and focus on the long run.

“To me, it feels like there are increasingly large asset allocators in the market who move money in and out of market trackers and ‘baskets’ of thematically-related stocks based on macro theories, and not on the individual fundamentals of companies,” he explained.

“This means that their moods can move markets in the short term based on newsflow and narratives, and not on what is actually happening on the ground, as their flows will be directed towards liquid large-caps based on their macro view and not towards individual companies based on stock-specific considerations.

“2023 has, so far, felt like summer last year, when large-caps rallied, driving markets higher, but small- and mid-caps didn’t join in, making it a tough couple of months for active funds. This reversed later in the year as it became clear interest rates were going higher and large-caps ‘caught down’ to the small- and mid-caps that had remained attached to the real economy.”