Merchants Trust has earned back the market’s confidence, with Investec recently switching its recommendation for the investment company from ‘sell’ to ‘buy’.

But should investors in other income trusts eschew their current holdings and move into the newly resurgent trust? A good comparison is The City of London Investment Trust, which tops the dividend heroes table, having increased its dividend for 56 consecutive years.

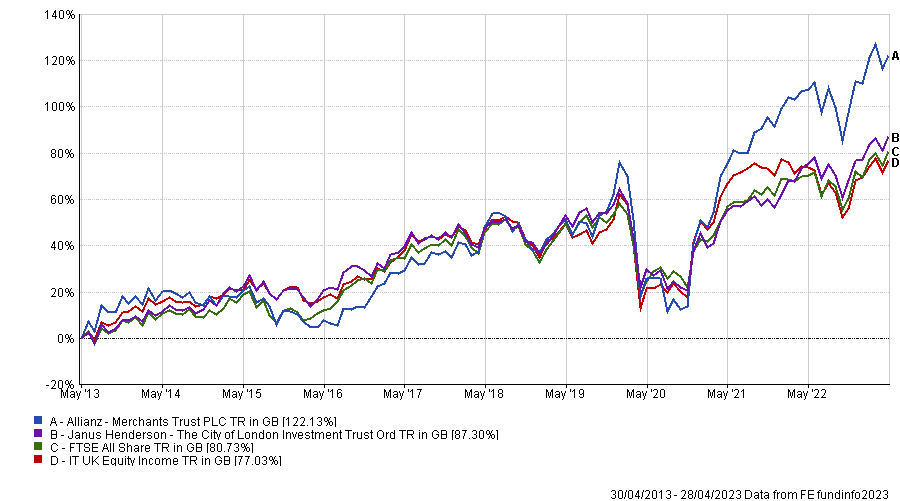

Over 10 years, Merchants Trust has done better than City of London in terms of performance, although both trusts have outperformed their sector and benchmark.

Performance of trusts vs sector and benchmark over 10yrs

Source: FE Analytics

While Merchants Trust looks to be a more compelling offer based on performance alone, the trusts differ in their structure and the benefits they bring to a portfolio.

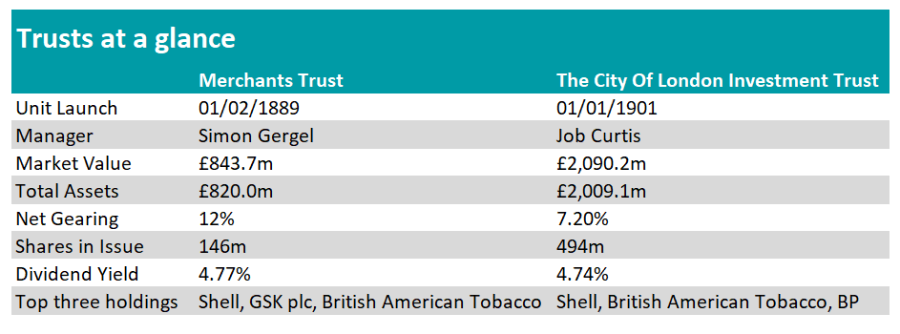

Gavin Trodd, associate of investment companies research at Numis, said Merchants Trust has a greater exposure to FTSE 250 businesses, while City of Lonodn focuses on large-caps.

Merchants Trust also has a more concentrated portfolio, with 53 holdings currently, while City of London has 88.

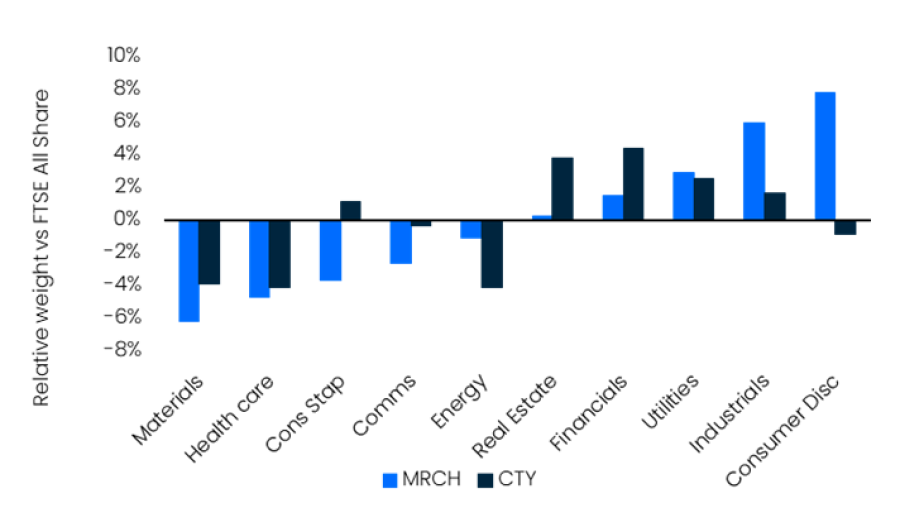

Trodd added: “On a sector basis, Merchant’s largest overweight exposure is consumer discretionary which City of London is underweight. Both are underweight energy, but Merchants has a notably higher absolute exposure.”

Relative weightings of the trusts vs benchmark

Source: Numis

There is also a difference in the investment style of the managers.

Gavin Haynes, investment consultant at Fairview Investing, said: “The key difference is style, with Merchants having a deeper value approach, which has seen exceptional outperformance over the past two years (previously the performance records were very similar).

“Job Curtis is very much a stock picker and will look for opportunities across both quality and value income stocks.”

However, the two trusts also share some strengths, which make it harder to choose one of them.

For instance, both have long-term stable managers, with Simon Gergel having run Merchants Trust since 2006 and Curtis having managed City of London for 32 years.

They are also backed by large asset management firms: Allianz for Merchants Trust and Janus Henderson for City of London.

Both trusts are not too dissimilar in pricing either, with Merchants Trust closing price at 579p and City of London 421.5p on 28 April, while both trade at slight premiums (1.4% versus 2.5%).

Merchants Trust has, however, a slightly higher ongoing charges figure (OCF) currently at 0.59%, while City of London charges investors 0.45%.

Doug Brodie, chief executive of Chancery Lane, said: “Both trusts prove active managers do indeed beat the index and costs do not harm the investor – it’s value that counts.”

They also both have long track records of dividend growth. While Merchants Trust has a shorter history of raising its dividend than City of London, it still has done so for 40 consecutive years. Therefore, Brodie said that both trusts are equally well positioned going forward.

Experts’ recommendations

In spite – or because of – their differences, experts found it difficult to choose between the two trusts.

Haynes said: “I believe that both can have a place in a portfolio if you are looking for actively managed blue-chip UK equity income exposure.

“If I was to choose one for core exposure, I would go for City of London, but if I wanted to have a deeper value approach then Merchants would be favoured.”

He added that City of London has a lower OCF and provides therefore “very good value”.

Brodie also said that the two trusts are worth having and that Chancery Lane frequently holds both in clients’ portfolios.

He added: “For income investors it is imperative to split holdings across multiple trusts, and these two should always be in the armoury.”

Trusts at a glance

Source: FE Analytics

Trodd did not have any strong preference either, saying that both options are solid picks for investors seeking income. Yet, he found other investment trusts within the IT UK Equity Income sector more attractive.

He said: “We prefer Troy Income & Growth and JPMorgan Claverhouse, the latter of which offer exposure to both growth and value stocks through a barbell approach.”