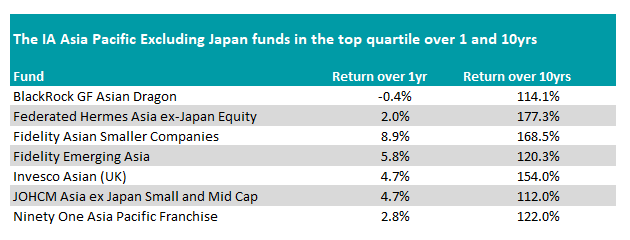

Boasting both long- and short-term excellence is not an easy task, but a number of standout Asian portfolios are in the top-quartile of their sector over both one and 10 years.

Starting with the IA Asia Pacific Excluding Japan sector, the largest vehicle to achieve the feat is the £2.3bn Invesco Asian fund, run by William Lam since 2017. It is up 154% over 10 years (the fourth best return in the sector) and has made a 4.7% gain over 12 months.

Lam takes a contrarian approach, sticking to the ‘value’ style of investing, buying unloved companies in out-of-favour sectors.

Analysts at Square Mile, who rated the fund an ‘A’, said that this approach can lead to the fund underperforming during certain market conditions but that its long-term approach should benefit investors.

Lam is also co-head of the combined Asian and emerging markets equity team, which means he has some additional responsibilities away from the fund, but the researchers said: “We hold him in high regard and believe him to be a very capable investor.”

The top performer on the list over the past decade has been the Federated Hermes Asia ex-Japan Equity fund, making 177.3% over 10 years.

FE fundinfo Alpha Manager Jonathan Pines has headed up the fund since 2012. Like Lam, he aims to take advantage of under-priced stocks, but mitigates risk by taking larger positions in companies where there is a degree of downside protection.

He invests across different styles and also invests up and down the market capitalisation spectrum. To allow it to continue investing in the smaller end of the market, the fund has soft closed to new subscribers in the past when its assets under management (AUM) have risen, although it has been open since September 2020. Square Mile analysts also gave this portfolio an ‘A’ rating.

Source: FE Analytics

The best performer over one year has been the Fidelity Asian Smaller Companies fund, run by Alpha Manager Nitin Bajaj. Over 12 months it has made 8.9%, while over 10 years it is up 168.5%.

Bajaj looks for future winners in the region, spreading holdings across some of the largest countries in Asia including China, India and South Korea.

It is recommended by fund pickers on Fidelity’s investment platform who included it on their Select 50 best-buy list. They said: “Asian economies are growing at faster rates than more mature, developed markets and this should enhance the opportunity. Investing in smaller companies increases risk, but also potential return.

“This fund would be a useful addition, as a small weighting, to the riskier allocations within any diversified portfolio. A long-term view of 10+ years is needed.”

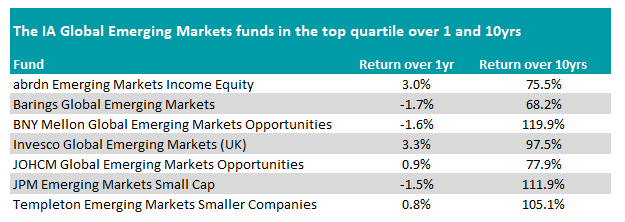

Turning to IA Global Emerging Markets, which Asian countries dominate, seven portfolios also top the sector over both one and 10 years.

The standout has been BNY Mellon Global Emerging Markets Opportunities, which has made the highest return of any fund in the sector over the past decade, up 120%.

It has been run by Ian Smith and Paul Birchenough since 2020. The pair joined BNY Mellon from AXA, taking over from former manager Rob Marshall-Lee.

They have continued to outperform, with the fund in the top quartile of the sector over three years. The managers invest predominantly in the technology, consumer staples and financials sectors, with large weightings to India and China, which between them make up more than half the portfolio.

It made the list despite making a small loss over 12 months of 1.6%, as this was significantly less than the 4.4% loss for the average peer.

Source: FE Analytics

Top over one year is the Invesco Global Emerging Markets fund run by Lam, Ian Hargreaves and Charles Bond. The £274m, five FE fundinfo Crown-rated fund has made a rare gain in the sector over 12 months, rising 3.3%.

Abrdn Emerging Markets Income Equity, run by Adam Montanaro and Matthew Williams, is the only other fund to make a gain of more than 1% over the past year, up 3%.

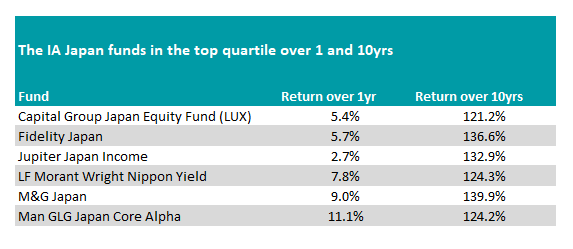

Lastly, we turn to Japan, where all of the funds on the list have made between 120% and 140% over the past decade. However, the clear winner over 12 months has been the £1.3bn Man GLG Japan Core Alpha portfolio run by Jeff Atherton and Adrian Edwards.

It comes recommended by the analysts on the FE Investments team, who said Atherton and Edwards have been focused on reducing the fund’s volatility since former manager Stephen Harker retired in 2021.

“This has been achieved by increasing the number of stocks in the portfolio (from 45 to 50) while decreasing the portfolio concentration,” they said.

The managers sell the fund’s winners and buy more of its losers, which can keep it out of favour for periods, but the long-term record “highlights the managers’ ability to, on average, outperform peers”, FE Investments’ analysts noted.

Source: FE Analytics

Also of note is the £981m Jupiter Japan Income fund, managed by Dan Carter and Mitesh Patel, which was the top performer on the list over the nine years from 2013 to 2021, but has slipped slightly over the past year (although it still made a top-quartile return).

It has been given an ‘A’ rating by Square Mile analysts, who said: “We consider this fund to be an attractive long-term choice for investors seeking broad exposure to some of Japan's leading companies.”

Previously in this series we have also looked at small-caps, income funds, UK specialists, broad global strategies and multi-asset ranges.