Over the year-to-date investors have taken their money out of global active funds and put it into passives instead, data from FE Analytics showed.

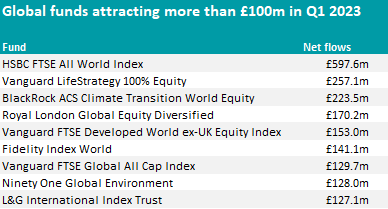

Of the nine funds in the IA Global and IA Global Equity Income sectors attracting more than £100m of investors’ money in the first quarter of 2023, six were passively managed while two had a focus on environmental, social and governance (ESG) principles, as the table below illustrates.

Source: FE Analytics

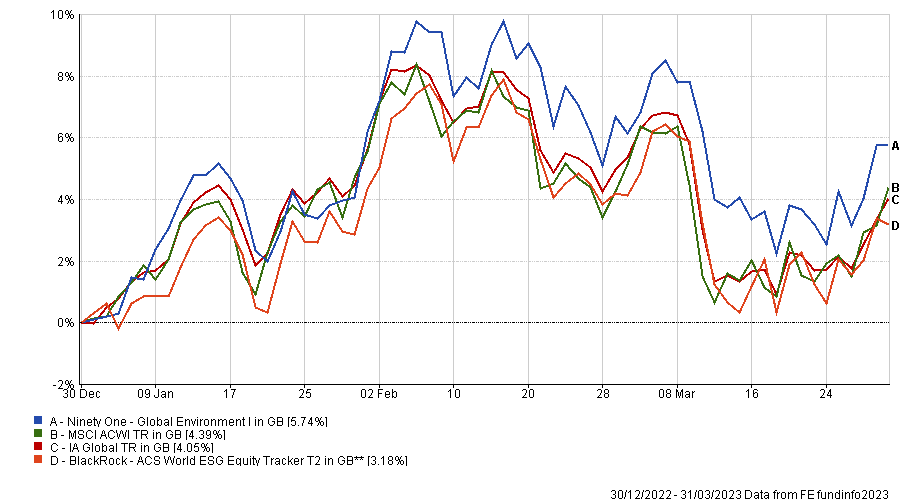

This continues the trend highlighted in 2022, when investors who chose to do good with their money piled £3.4bn into ethical investments, despite these being loss-making at the time. So far this year both ESG vehicles in the list – the BlackRock World ESG Equity Tracker fund and Ninety One Global Environment – made positive returns, although only the latter managed to outperform the index and sector, as shown in the chart below.

Performance of funds over the year to date against sector and index

Source: FE Analytics

Researchers at Square Mile said Ninety One Global Environment is a “well-considered” ESG strategy “set up to deliver a high environmental impact”, although “we are yet to see how it performs over a full market cycle, inclusive of when the broader decarbonisation theme is out of favour for a prolonged period of time.”

People added £128m to it, while £268m of the new money were added to BlackRock World ESG Equity Tracker.

The largest inflows went into HSBC FTSE All World, which attracted £598m, while £140m was added to Fidelity Index World. The two vehicles compare in terms of their ongoing charge figure (OCF) at 0.13% and 0.12%, respectively, and are highly correlated to each other (0.99%). Vanguard FTSE Global All Cap Index is also similar.

Vanguard proved a popular investment house with two more vehicles making the list – Vanguard FTSE Developed World ex-UK Equity and Vanguard LifeStrategy 100% Equity, which are also highly correlated to the three funds mentioned above, despite being slightly more expensive (0.23% and 0.22%, respectively).

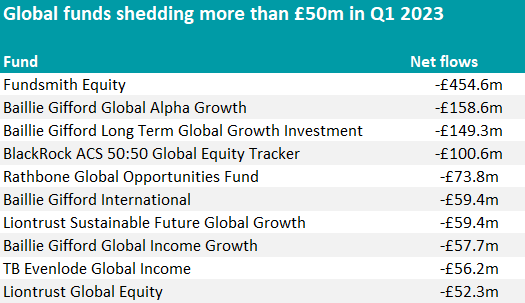

As for the funds that didn’t convince investors, the biggest loser was Fundsmith Equity, despite gaining £1.5bn from performance in the first three months of the year. People, however, withdrew about £454.6m from the fund.

This was against the recommendation of experts last month when asked by Trustnet for their views on the fund. They were largely positive on the fund, with some suggesting now was a good buying opportunity, while others suggested investors should hold on despite challenges ahead.

Four funds out of the 10 that made it in the list of global funds that shed more than £50m in the first quarter of 2023 were managed by Baillie Gifford. The investment house has been struggling since last year, when the growth-focused investing style, for which it is famous, fell out of favour.

The management company filled in both the second and third position in the table, with investors withdrawing approximately £150m from both the Baillie Gifford Global Alpha Growth and Baillie Gifford Long Term Global Growth Investment funds, while Baillie Gifford International and Baillie Gifford Global Income Growth also appeared further down the list, as shown below.

Experts were mixed on the potential future fortunes of the firm’s suite of portfolios when asked earlier this year. Some suggested holding on, with the long-term performance of the portfolios exceptional despite the recent fall, but not all were convinced.

Source: FE Analytics

Focusing on under-the-radar growth companies, the rotation to value didn’t spare Rathbone Global Opportunities, which lost £73m despite its attention to valuation. Other shrinking equity funds included Liontrust Global Equity and TB Evenlode Global Income, which made up the remaining two slots on the list.