Fundsmith Equity is on the rise after a difficult year in 2022 when the portfolio failed to bear its average IA Global sector peer – the first time that has happened since the fund launched.

Returns this year place the fund back in the top quartile of its peer group over the year-to-date, but experts remain divided on whether it is worth adding to a portfolio.

While long-term performance has been stellar, there were concerns raised about the fund’s size (£24.1bn) and the relatively high charges – two things manager Terry Smith has rebuffed in the past.

The good news for investors is that the IA Global sector houses more than 540 funds, which is broad enough to offer alternative solutions to investors who worry Smith will struggle to replicate the same excellent performance from the past decade going forward.

Evenlode Global Equity is one of the options for investors looking for a younger fund or worried of Fundsmith Equity’s size.

The portfolio was launched in July 2020 and has a size of £65m. Downing uses this fund to play the “holding midfielder” role in their portfolios.

Alex Paget, manager of the fund of funds team at Downing, said that the fund has a “huge amount” of headroom to grow without impacting capacity.

He added: “Like Fundsmith, they take great care in trying to identify and hold businesses that can prosper in both good and bad economic conditions. This means they tend to avoid cyclical, capital-heavy businesses, and have a higher exposure to capital-light businesses with high levels of intangible intellectual property, and that also have high barriers to entry that make it hard for competitors to take their market share.

“They are growth focused, but pay attention to valuations, and will try to avoid egregiously over-valued stocks even if they are high quality.”

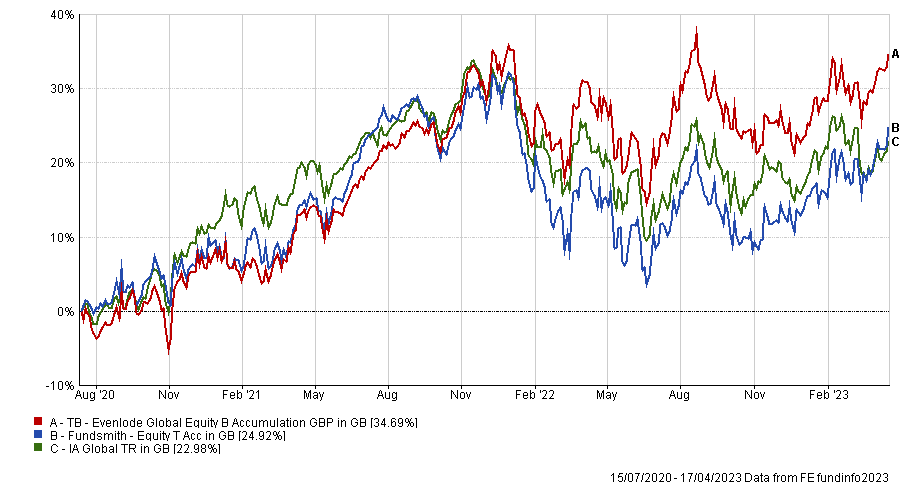

Performance of funds vs the sector since the launch of Evenlode Global Equity

Source: FE Analytics

In addition to its smaller size, Evenlode Global Equity’s ongoing charge figure (OCF) at 0.85% is one of the cheaper in the sector.

A much larger alternative is Seilern World Growth, which has £1.8bn in assets under management and is the fund that Rob Morgan, chief analyst at Charles Stanley, picked as a good alternative to Smith’s portfolio.

He said: “This is a direct, actively managed replacement. It has beaten Fundsmith Equity over three, five and 10 years and takes a similarly fastidious approach to stock selection.

“The managers prize high-quality businesses with sustainable competitive advantages, high returns on invested capital and low or no net debt.”

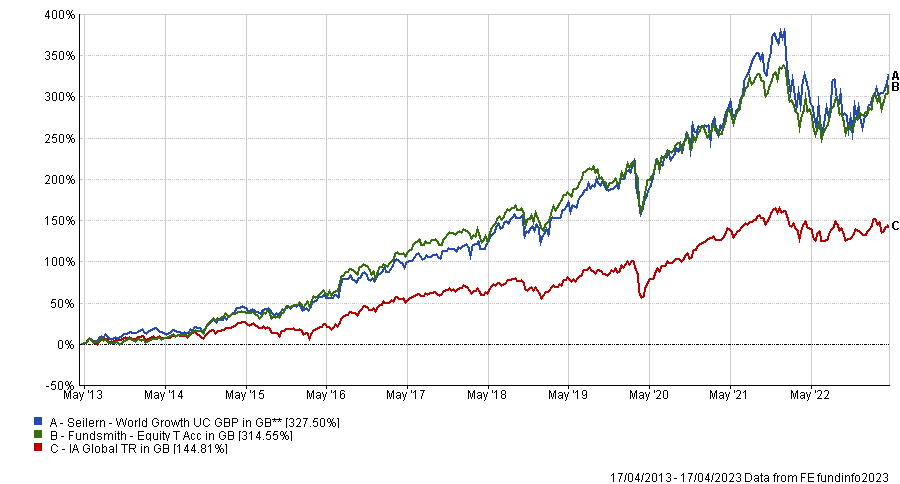

Performance of funds vs the sector over 10yrs

Source: FE Analytics

However, Seilern World Growth has higher charges, with an initial charge of 5% while Fundsmith Equity has none. The former also has a higher OCF (1.14%).

For sustainable investors, Dzmitry Lipski, head of funds research at interactive investors, chose Stonehage Fleming Global Best Ideas. The ISS ESG ratings of both funds is four out of five, meaning they both have similar environmental, social and governance (ESG) credentials.

Lipski said: “It focuses on ‘sustainable growth’, looking for characteristics such as strong management, free cash flow, and the ability to grow dividends every year.

“Like Fundsmith, it buys predominantly large-cap businesses, with a buy and hold approach, but also has a sell discipline when valuations go up too much.”

Performance of funds vs the sector since the launch of Stonehage Fleming Global Best Ideas

Source: FE Analytics

Stonehage Fleming Global Best Ideas was launched in August 2013 and has been a top-quartile fund over five years in the IA Global sector. However, the fund has trailed Fundsmith Equity since its launch.