Liontrust Special Situations has offered attractive exposure to UK equities over the long term, but underperformance over the past three years has led some investors to question its place in their portfolios.

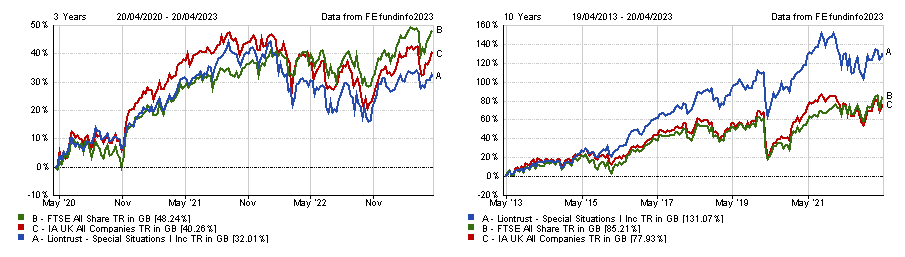

The £4.9bn fund has soared 53.2 percentage points ahead of its peers in the IA UK All Companies sector over the past decade, making a total return of 131.1%.

However, it has failed to beat its peers in the challenging conditions of the past three years, dropping 8.3 percentage points behind the sector over the period.

Investors would have been 16.2 percentage points better off with a passive fund tracking the FTSE All Share index for a much lower fee.

Total return of fund vs benchmark and sector over 3yrs and 10yrs

Source: FE Analytics

In the past year alone, investors removed £764m from Liontrust Special Situations after this period of underperformance.

Gavin Haynes, co-founder of Fairview Investing, said its struggle to beat the market in recent years is unsurprising given its focus on quality-growth companies.

These types of businesses have been particularly vulnerable to higher inflation and interest rates, with value investing instead coming to centre stage in this environment.

Haynes also noted that the large proportion of UK mid and small-caps in the portfolio have hindered performance in this tighter monetary environment.

Less than half (43.3%) of the fund is made up of FTSE 100 companies, with mid-caps and listed alternatives accounting for 51.6% of all assets.

FE fundinfo Alpha Managers Anthony Cross and Julian Fosh also run the Liontrust UK Smaller Companies and Liontrust UK Micro Cap funds together, so a preference for the smaller end of the cap spectrum is baked into the ‘Economic Advantage’ process they built.

Despite these parts of the market currently being out of favour, Haynes said it is good that Cross and Fosh have stuck with their investment strategy.

“The focus will remain on looking for companies that have a strong franchise and can demonstrate a competitive advantage and high barriers to entry,” he added.

Given this approach has garnered a high return over the long term, Gaynes said that it is worth holding onto the fund so long as investors “monitor closely” for any changes in the market or management.

Analysts at Square Mile Research added that the thorough process used by the managers leads to a low turnover within the portfolio and considerably less volatility than its peer group.

They said: “What is clear here is that the team operates with a disciplined adherence to their investment process, with the managers being fully prepared to exit those companies that lose their idiosyncratic advantage or fail to translate it into superior returns.

“Nevertheless, the thoroughness of the approach and experience of the team, mean that stock turnover in any given year tends to be on the low side.”

Although Cross and Foss’s quality-growth approach hasn’t held up well in the value-led markets of the past few years, GDIM director Tom Sparke said it could do well in a recessionary environment.

“The managers’ quality-growth approach to UK equity prioritises the best opportunities from the FTSE 350 and this has led it to solid long-term gains,” he said.

“I would expect the earnings-led approach to do well in the current environment of tougher economic conditions and holding the fund will certainly not add much excess risk to a portfolio.”

For this reason, Sparke said investors who already own Liontrust Special Situations should hold onto the fund for the time being as it could make up for its disappointing return over the past three years.

On the other hand, Darius McDermott, managing director of Chelsea Financial Services, was very enthusiastic about the fund’s future, calling it a “strong buy”.

He said that while performance has been hindered by its below average exposure to large-caps, Cross and Foss’s stock picking skills have been proven to lead to higher returns over the long term.

“The team is really strong - Anthony and Julian have been together for years and built a strong track record on this their flagship fund,” McDermott added.

“It’s a process that has worked consistently well for years and I see no reason why it wouldn’t work going forward.”