Fidelity UK Smaller Companies’ Jonathan Winton has said he is not surprised that UK small caps have done so badly since the inflation shock hit markets at the end of 2021, saying valuations in some areas had reached “exceptionally high levels” that left them vulnerable to a correction.

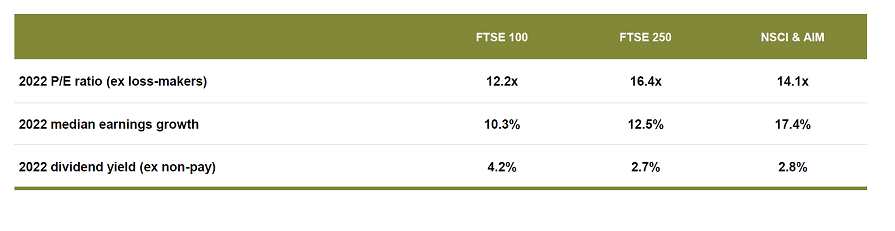

While the FTSE All Share has performed relatively well over the past 18 months, making 9.9%, the Numis Smaller Companies ex ITs index is down 14.8%. The IA UK Smaller Companies sector has fared even worse, falling 26.4%.

Performance of indices vs sector over 18 months

Source: FE Analytics

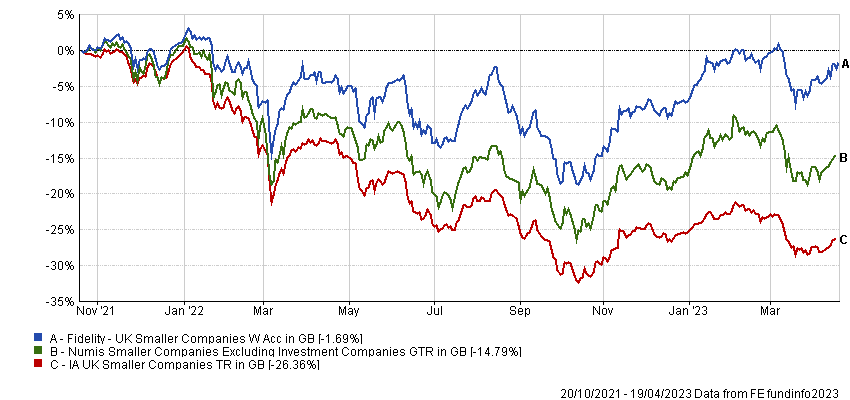

While small-cap valuations at the start of this period didn’t look excessive in general – price-to-earnings (P/E) ratios on the NSCI & AIM indices stood at 14.1x in September 2021 – Winton said that the overwhelming growth bias of UK small-cap funds led a narrow area of this market to become stretched.

September 2021 ratios

Source: JPMorgan Asset Management

“If you compared them to the normalised valuations that they should really have been trading on, they looked incredibly expensive,” he said.

“Calling when they would come off was very difficult, but you only needed a catalyst like interest rate rises to cause a significant sell-off.

“Given the inflation that we've seen, it's not a surprise that smaller companies have struggled to pass that on, either because they don't have the pricing power, or because there's a mismatch in terms of when they've been able to put the pricing through versus when they've had to take that cost inflation.

“In that context, I'm not surprised they've come back down to more normal levels and sold off significantly.”

Unlike most of his peers, Winton takes a value approach to investing in small-caps. This helps to explain why Fidelity UK Smaller Companies has limited losses to 1.7% over the past 18 months while its sector is down more than 20%.

Performance of fund vs sector and index over 18 months

Source: FE Analytics

He said that, because so few fund managers take a value approach to this area, there is a “genuine market inefficiency” to take advantage of. He also said that the growth bias means that when things go wrong, as they have done over the past 18 months, out-of-favour stocks can quickly fall to extremely depressed levels, creating a further tailwind for his strategy.

Yet he said few of his peers have been motivated by these conditions to move from growth to value.

“It will probably take some time for people to be persuaded,” he continued.

“Historically, value has been a strategy that has worked over very long periods of time, but when we look at the post-financial crisis environment, it really struggled, particularly during the first year of Covid.

“When people think monetary policy might turn they will probably go back to a lot of these growth names again: they're not willing to give up on some of the leaders that led the previous bull market. People haven't lost faith in growth investing.”

Winton added that what separates him from other managers who take a value approach is that he doesn’t just look for cheap stocks. Instead, he looks for companies that have recently taken a turn for the worse but where this is a catalyst for improvement on a three- to five-year horizon.

He said that the good news for all UK small-cap managers, whatever strategy they use, is that the domestic market has fallen so far out of favour, it contains numerous stocks that would be strong contenders for both value and growth strategies. In this way, he said investors are spoilt for choice.

While the UK has become significantly cheaper ever since it voted to leave the EU, Winton is optimistic it will eventually re-rate higher when international investors follow the “continual drumbeat of M&A” as Brexit falls “further into the rear-view mirror” and it becomes apparent that the impact on businesses has been relatively muted.

“A month or two ago, I probably would have said there's a decent chance of a hiatus because the funding environment has become more difficult,” he continued.

“But actually, in the last few weeks, we've seen quite a bit of M&A activity, which suggests that private equity is willing to look through the current uncertainty because of the valuations on offer.”