Emerging markets are known to be one of the riskiest areas to invest in, but some funds in the region have made top returns without the high stakes.

In this study, Trustnet also looked at funds specialising in China and India, which combined make up 45.3% of the MSCI Emerging Markets index, as well as portfolios in the IA Asia Pacific Excluding Japan and IA Asia Pacific Including Japan sectors, as Asia is the largest regional weighting in the emerging markets.

Political and currency concerns can put some investors off each region, but overall there were six funds that made top quartile returns in their respective sectors while taking the least risk.

They also had the lowest maximum drawdowns and highest number of positive months among their peers, so in the few months where returns were negative, their losses were relatively shallow.

Source: FE Analytics

Emerging Markets

Starting with the broader IA Global Emerging Markets sector, two funds delivered top-quartile returns for the lowest risk. Both are run by the same firm – JPM Emerging Markets Small Cap and JPM Emerging Markets Income.

They delivered a total return of 111.9% and 68.9% respectively over the past decade, beating the 41.9% average raked in by other IA Global Emerging Market funds over the period.

JPM Emerging Markets Income delivered a lower return of the period partially due to its low exposure to India, according to analysts at FE Investments.

Total return of funds vs sector over the past 10 years

Source: FE Analytics

Companies in the region do not typically pay a dividend, which can dissuade managers Omar Negyal, Jeffrey Roskell and FE fundinfo Alpha manager Isaac Thong from investing there.

Its 5% exposure to India is 8.2 percentage points lower than the MSCI Emerging Market benchmark, although FE Investments analysts said that its downside protection makes it a potential option for investors with a lower risk threshold.

They said: “In tough environments, the fund’s ability to also focus on capital appreciation provides it with resilience and the capacity to maintain total return generation in downward markets.

“The fund is best suited as a core emerging market exposure with defensive characteristics for those seeking a source of income.”

Contrastingly, JPM Emerging Markets Small Cap, managed by FE fundinfo Alpha manager Amit Mehta and Austin Forey, has a 15.6% exposure to India and returns were more than double that of the peers group.

Asia

Turning specifically to Asia, the fund that was up the most over the past decade was Invesco Pacific, which had positive returns in 79 of the past 120 months.

This £245m fund managed by Tony Roberts and William Lam was also less volatile than the other fund on the list at 12.7%, although this was likely aided by its exposure to Japan.

Unlike the other funds, it had its largest regional exposure to the developed market, with Japanese equities accounting for 31.5% of the portfolio.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

It also had the smallest maximum drawdown over the past decade of 18.8%, partly explained by its relative underweight to both China and India. Exposure to these riskier regions make up 25.2% of the fund collectively.

Over the past decade, returns were up 141.4%, outpacing the seven other funds with a 10-year track record in the sector by 36.2 percentage points.

India

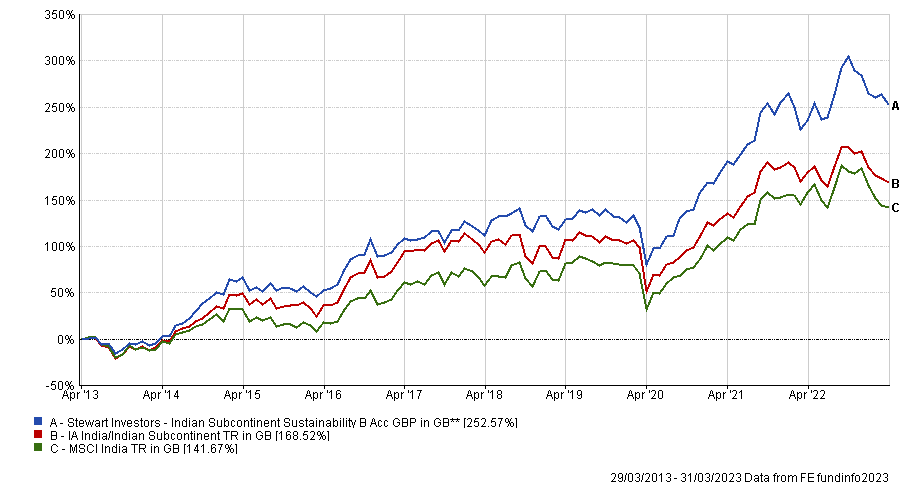

Looking at the country specific funds, starting with India, Stewart Investors Indian Subcontinent Sustainability fund made the highest return on the list, climbing 252.6% over the past decade.

The IA India/Indian Subcontinent sector was the fifth highest returning group in the Investment Association universe over the period, yet it still beat its peers by 84.1 percentage.

This £500m fund led by Sashi Reddy, who is supported by FE fundinfo Alpha manager David Gait, invests in companies contributing to or benefiting from the sustainable development of India, Pakistan, Sri Lanka and Bangladesh.

Total return of fund vs sector and benchmark over the past 10 years

Source: FE Analytics

Analysts at Square Mile Investment Consulting and Research said that the managers “should be able to achieve their objectives, but given the nature of this region, the fund can fall short of these at times”.

Indeed, the sector was the second most volatile in the Investment Association universe behind IA Latin America over the past decade, but Stewart Investors Indian Subcontinent Sustainability’s ranking of 16.7% was lower than its peer group’s 18.7% average.

This defensive quality has shielded it during downturns but led to less favourable returns in rallying markets, according to Square Mile researchers. Over the past decade, its maximum gain of 46.7% was 1.9 percentage points behind the peer group average.

However, its 22.9% maximum loss was 3.7 percentage points lower than the rest of the sector, allowing it to overtake its peers in downward markets.

This risk-averse approach has led to sectoral allocations that differ substantially to the benchmark, according to the analysts at Square Mile.

Its juxtaposition to MSCI India is most notable in the consumer discretionary space, where its 19% exposure is 9.1 percentage points higher than the index.

Square Mile researchers said that “it is unlikely to suit investors seeking indexlike returns,” although investors would have made a higher return for less volatility over the past decade.

“This is a strategy that tries to address some of the varied risks that investors face in this part of the world, through a process that focuses on the real risks of investing in this region and therefore it might appeal to longterm investors,” they added.

China

There were two IA China/Greater China funds to crack the list – Schroder ISF Greater China and Allspring Worldwide China A Focus.

The $2.9bn (£2.3bn) Schroder fund managed by Louisa Lo since 2002 delivered a higher return over the past decade, climbing 180.1% and beating its peer group by 88 percentage points.

Allspring Worldwide China A Focus had a lower total return of 151.6% over the period, but its volatility ranking of 17.3 was better than the Schroder fund’s 18.2 rating.

Total return of funds vs sector over the past 10 years

Source: FE Analytics

Its maximum drawdown was also lower at 29% compared to Schroders’ 39.1%, suggesting it held up better in declining markets.

However, they both reported positive returns in the same number of months (73 over the past decade), meaning investors would have viewed their portfolios in the red for the same number of periods.