Using exchange-traded funds (ETFs) to track the market at a very low cost is becoming an increasingly popular way of investing and some of these portfolios have posted some of the highest returns of their sectors since the start of the year.

While passive investing means investors will also achieve returns in line with the market, the specialised nature of ETFs means that they can outperform their actively managed rivals if their niche sector, geography or investment factor is doing well.

Below, we look at the first deciles of the five biggest equity sectors in the Investment Association universe to find out which ETFs have made the strongest returns over 2023 so far.

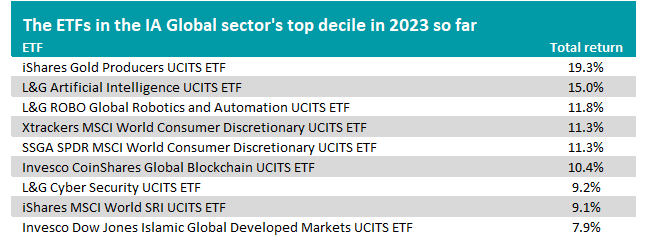

Starting with the IA Global sector, which is the largest in the Investment Association universe, there are nine ETFs that have made a top-decile total return during 2023 so far.

Source: FE Analytics

They are a bit of mixed bag but the highest ranking of the peer group’s ETFs was iShares Gold Producers UCITS ETF, which gained 19.3%. This is down to strong demand for the yellow metal sparked by the collapse of Silicon Valley Bank and subsequent a rout in banking stocks, which encouraged a move towards safe havens.

The strong performance of tech stocks in 2023 is also reflected, with the presence of L&G Artificial Intelligence UCITS ETF, L&G ROBO Global Robotics and Automation UCITS ETF, Invesco CoinShares Global Blockchain UCITS ETF and L&G Cyber Security UCITS ETF.

Information technology is leading the global stock market this year, gaining 13.4%, while Bitcoin has rallied hard and is up around 80% since the end of 2022.

Consumer discretionary stocks are also doing well – MSCI ACWI/Consumer Discretionary is up 7.1%. This has put Xtrackers MSCI World Consumer Discretionary UCITS ETF and SSGA SPDR MSCI World Consumer Discretionary UCITS ETF in the IA Global sector’s top decile for 2023 so far.

Source: FE Analytics

Only two of the IA UK All Companies sector’s 19 ETFs have made a top-decile return since the start of 2023 and both are focused on sustainable investing.

This approach is closely linked to the growth style, which suffered in 2022 amid rising inflation and interest rates. However, sustainable investing and other growth stocks have outperformed this year as investors hope that peaking inflation means central banks will ease up on rate hikes.

Source: FE Analytics

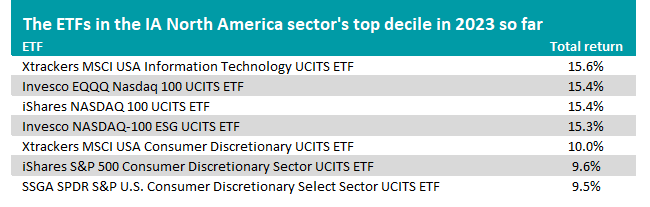

There are seven IA North America ETFs in the top decile, clustered around two main themes: tech and consumer discretionary.

The outperformance of US technology has been eye-catching: the tech-focused Nasdaq 100 is up 15.5% this year (in sterling terms) while the ‘old economy’ Dow Jones has fallen 1.6%. Xtrackers MSCI USA Information Technology UCITS ETF, Invesco EQQQ Nasdaq 100 UCITS ETF, iShares NASDAQ 100 UCITS ETF and Invesco NASDAQ-100 ESG UCITS ETF have benefited from this trend.

Consumer discretionary stocks, meanwhile, have lured investors in with their relatively attractive valuations. While they were looking expensive, they fell hard in 2022 on the back of rising interest rates and went into 2023 on better starting valuations, while peaking inflation (and hopes for a potential drop) could be positive for discretionary spending.

Source: FE Analytics

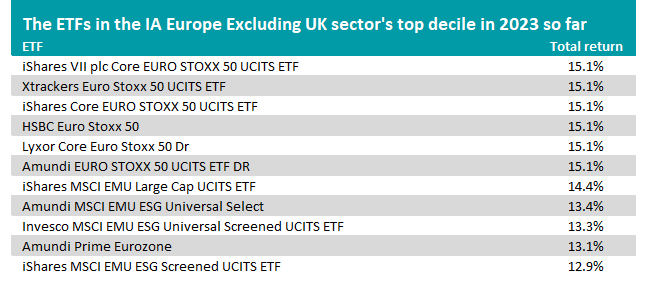

In the IA Europe Excluding UK sector, the fourth largest equity peer group, 12 of its 36 ETFs have made a top-decile total return this year.

As can be seen from the table above, the main trend here was market capitalisation rather than industry exposure: ETFs tracking large-cap stocks are those that have produced the highest returns over recent months.

But in IA Asia Pacific Excluding Japan – the fifth biggest equity sector – the opposite trend was in play. The only ETF to feature in its first decile in 2023 so far was iShares MSCI AC Far East ex-Japan SmallCap UCITS ETF.