Investing in smaller companies is the definition of risk versus reward. On the one hand, small-caps have the potential to deliver higher returns than their large-cap peers over the long term for patient investors.

To illustrate this, using the UK stock market as an example, the FTSE Small Cap has outperformed the FTSE 100 over 10 years.

Total return of indices over 10yrs

Source: FE Analytics

However, small-caps sectors are also riskier areas as they are subject to a higher volatility, liquidity risks and a greater exposure to their domestic economy.

Another difficulty is to choose between the different regions. The Investment Association has four geographic categories for small-cap funds: UK, Europe, Japan and North America.

Total return of sectors over 10yrs

Source: FE Analytics

There are also drastic differences in the definition to what constitutes a small-cap company depending on the region.

The largest small-cap in the Numis Smaller Companies index of 714 UK small-caps has a market capitalisation of £1.6bn. In comparison, Iridium, the largest small-cap company in the Russell 2000 index, the US equivalent, has a market cap of $7.8bn (£6.3bn).

Below, experts discuss the specificities of small-caps in IA small-cap sector and pick their favourite fund within them.

Starting with the UK, the IA UK Smaller Companies sector has been the worst performer over 10 years among the four small-cap regions. Year-to-date, the sector is down -2.9%.

UK equities have been unloved for a long time and the return of inflation last year has made things worse. Yet, Rob Morgan, chief analyst at Charles Stanley, said it makes sense to top up in this area during difficult times.

He added: “The pessimistic outlook for the UK economy and steady stream of outflows from the sector has left valuations in attractive territory.

“A catalyst for re-rating may not be close at hand, but earnings resilience and the scope for M&A activity could help underpin values, so it could be an opportune time to build exposure and await better times.”

In terms of fund selection, Morgan opted for an active fund, BlackRock UK Smaller Companies.

He said: “There are some decent passive options where charges can be kept to a minimum, but it’s an area where attention to fundamentals and proprietary research can realistically deliver longer term alpha.

“BlackRock UK Smaller Companies is a strong option in this regard. It is pragmatically managed with an emphasis on quality. The portfolio is built of companies with good management, strong market positions, sound balance sheets and a demonstrable ability to convert earnings into cash. In other words, it steers away from highly cyclical, excessively leveraged, or blue-sky companies.”

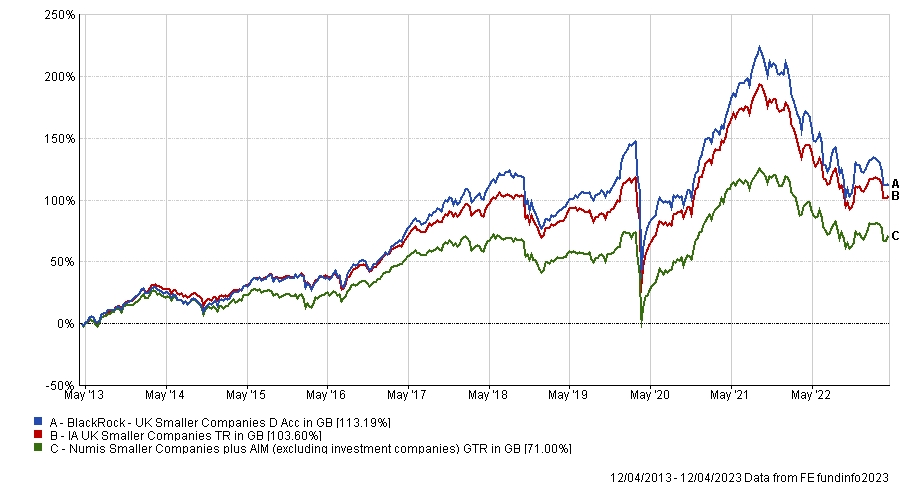

Performance of fund over 10 years against sector and index

Source: FE Analytics

In terms of performance, the fund has generally swung between the second and third quartile over the past decade depending on the period. It invests at least 70% of its total assets in equities in UK-listed smaller companies.

Similar to their UK counterparts, European equities have been out of favour with investors for a long time. Over 10 years, the IA European Smaller Companies sector has still done better than the UK but trails behind North America and Japan.

Ryan Hughes, head of investment partnerships at AJ Bell, said: “Concerns over the fragility of the European economy, anti-business policies from governments and a lack of perceived dynamism when compared to the technology-focused US smaller companies sector have all been headwinds for European small-caps, which has resulted in many UK investors ignoring the sector all together.”

Hughes selected Barings Europe Select Trust, which has been in the second quartile of the IA European Smaller Companies sector over 10 years for total returns but has beaten its benchmark by a small margin in the same period.

Performance of fund over 10 years against sector and index

Source: FE Analytics

The reason Hughes picked this fund is the experience of the manager, Nick Williams, who has been in charge for 18 years.

He said: “The approach is disciplined with a clear buy and sell process that ensures the fund is highly diversified, with holdings currently at 100 – more than many other small-cap funds.

“It focuses on the bottom 30% of the market cap and therefore does include some mid-cap names in the portfolio, which can mean it lags a little if the smaller end of the market really takes off, but this also means that it typically doesn’t fall as much when small-caps fall out of favour. For an area where investors will typically only select one fund, this profile is an appealing one.”

Japan is another market investors have been shunning for a long time, but the IA Japanese Smaller Companies sector is the second best performing small-cap sector over 10 years just behind North America.

However, Japan is currently less affected by inflation as the two previous markets, with an inflation rate of 3.3% as of February 2023.

Darius McDermott, managing director of Chelsea Financial Services, added that valuations of Japanese small-caps are attractive and governance good practices improving.

He said: “Japanese smaller companies tend to be more domestically focused and the IPO market is healthy – there are usually about 100 new listings each year. Demographics are often flagged as a problem but it’s an issue the country has known about for a long time and actually fertility rates are no worse than China, Taiwan, Singapore, and some European counties. Japan has just been thinking about solutions for longer.

“All in all it’s a region with potential and one that is under-researched by analysts so good stock pickers can really add value.”

To invest in Japanese small-caps, McDermott selected Baillie Gifford Japanese Smaller Companies.

He said: “The team looks to aim to identify smaller businesses that offer above-average growth prospects.

“It targets companies with innovative business models and the potential to disrupt their industries, those that challenge traditional Japanese practices and companies with strong overseas growth prospects.”

Performance of fund over 10 years against sector and index

Source: FE Analytics

Baillie Gifford Japanese Smaller Companies has been the third best performer over 10 years in the IA Japanese Smaller Companies sector behind M&G Japan Smaller Companies and Janus Henderson Horizon Japanese Smaller Companies.

It has, however, delivered negative performance over five and three years.

North America is an outlier in the small-cap world as it is the only region where small-caps have not outperformed their large-cap peers over the long term.

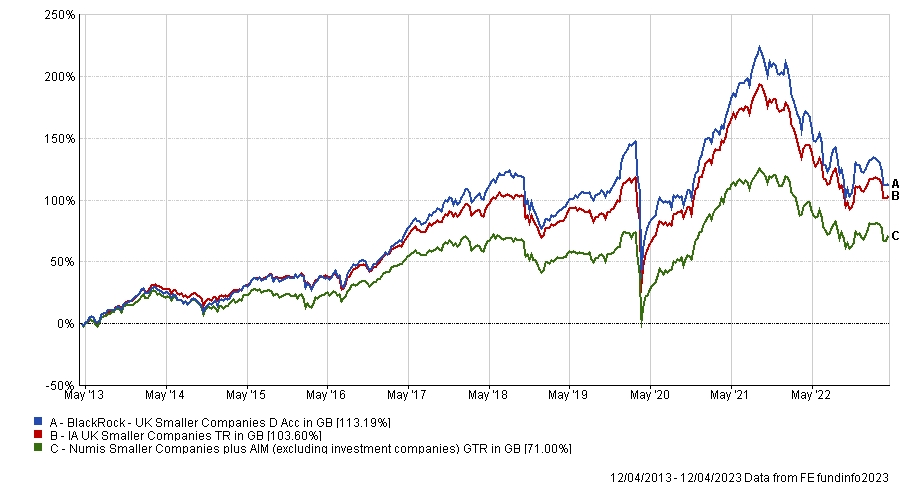

Performance of sectors over 10 years

Source: FE Analytics

However, the IA North American Smaller Companies sector was the best performing region for small-caps over 10 years.

Jason Hollands, managing director of Bestinvest chose Federated Hermes US SMID Equity for the sector.

He said: “We like this fund because it has a clear and consistent investment philosophy, which leads to a diversified portfolio across US economic sectors and growth and value stocks.

“The fund has typically outperformed in down markets but lagged strongly rising markets or those led by lower quality companies. However, for those looking for a sector neutral, more valuation-sensitive approach to US small and mid-cap investing, this is a core product.”

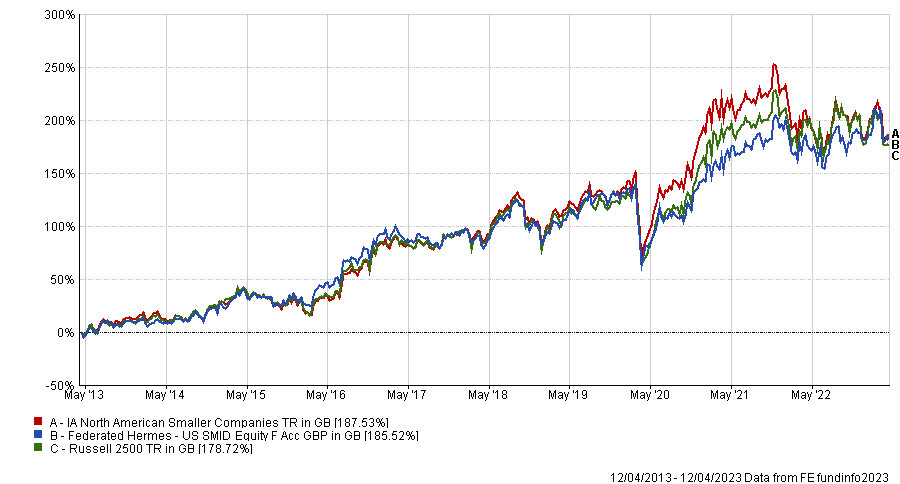

Performance of fund over 10 years against sector and index

Source: FE Analytics

In terms of performance, the fund has been in the third quartile over 10 years but has moved up to the first over the past year.

While there is no specific sector for global smaller companies, funds investing in small-caps around the word do exist and should not be ignored, according to Alex Watts, investment data analyst at interactive investor.

He picked Montanaro Better World for investors looking for both smaller companies across the globe and sustainability.

The fund invests in listed small- and mid-cap companies that work towards supporting the UN’s Sustainable Development Goals.

Performance of fund over 10 years against sector and index

Source: FE Analytics

Watts said: “The style bias towards ‘growth’ companies has been a headwind of recent, as the style has fallen from favour in 2022. Accordingly, the fund has underperformed over the shorter term.

“Nonetheless, the fund diligently adheres to a strict investment process, long followed by Montanaro, in order to leverage the longer-term growth opportunities that smaller companies afford in a manner that furthers the UN’s sustainable goals.”