A 60/40 portfolio is a staple in the investment world, with many advisers using the rough asset allocation split of 60% equities and 40% bonds as a base for balanced investors.

The equity side of the portfolio is typically allocated across geographies, sectors and sometimes themes, and is the area that can dominate focus but, although smaller, the bond portion is also crucial to get right.

Generally, investors can choose between two types of bonds: sovereign (government) and corporate bonds, which is split between investment grade and high yield.

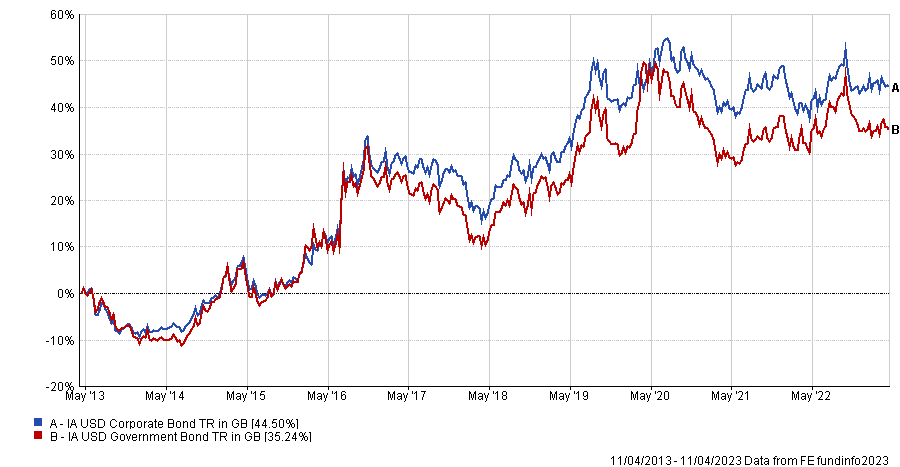

Over the long term, corporate bonds tend to perform better. Looking at the US, for example, we take the IA USD Corporate Bond and the IA USD Government Bond sectors as proxies for corporate and sovereign bonds, the former has delivered higher returns over 10 years.

Total return of sectors over 10 years

Source: FE Analytics

As a result, corporate bonds may appear as the better choice, but David Coombs, multi-asset fund manager at Rathbone Investment Management, said that they do not have a place in the 40 side of the portfolio.

He said: “Fundamentally, what you're trying to do with the 40% is to reduce the risk of the portfolio, but I think a lot of people get caught up with thinking that the 40% is here to generate return.

“It's great if it does and it probably will most of the time, but ultimately, the job of the 40% is to reduce risk, not to add extra return.”

Coombs added that corporate and government bonds are two distinct asset classes with stark differences in liquidity, with the exception of AAA and AA+ corporate bonds that he puts in the sovereign basket.

He said: “Corporate bonds are more correlated to equities in economic slowdowns whereas government bonds tend to do better.

“Government bonds provide greater diversification and more negative correlation than corporate bonds do. That's why we see government bonds as being the 40% and corporate bonds as part of the 60%.”

However, sovereign bonds have not fulfilled their role as a counterbalance to equities for much of the post-financial crisis era, as interest rates were kept low to stimulate growth.

That is, up until recently, when rates began to rise and bond yields were enticing enough to bring investors back to the asset class.

Frédéric Taché, head of fixed income at St. James’s Place, said: “Using the period between 2008 and 2021 as an example, trying to get a yield above 2% with sovereign bonds was challenging. In this context, a lot of portfolios have been invested more heavily towards corporate bonds to generate a more attractive yield.

“Considering what happened last year and the impact of hawkish policies from the different central banks, sovereign bonds could now be incorporated differently as you don't need as much credit risk to achieve a decent level of yield.”

Credit spreads, which represent the extra return received from lending to companies rather than governments, have been tight in recent times. There are, therefore, few incentives for investors to lend their money to corporates now as they are not being well rewarded for taking this extra risk.

David Henry, investment manager at Quilter Cheviot, said: “Spreads are relatively tight in most regions of the world and therefore you aren’t receiving much extra in terms of yield through lending to companies, rather than countries.

“In previous recessions, signs of financial distress have manifested through wider credit spreads – it is for this reason that corporate bonds have typically exhibited higher correlations with equities during difficult times. With current concerns around economic slowdowns globally, credit spreads look a little complacent to me.”

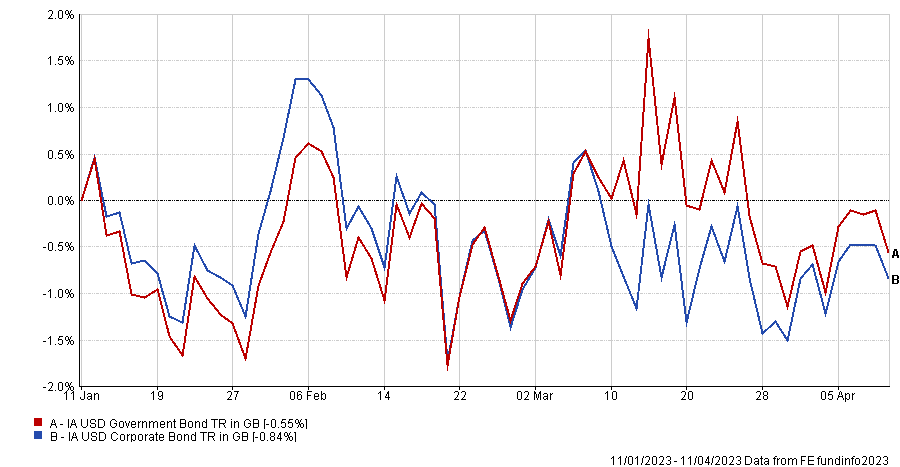

There are signs that the tide is turning. Taking the IA USD Corporate Bond and the IA USD Government Bond sectors as proxies again, government bonds have got the upper hand over three months and have delivered higher returns in this period, as the below chart shows.

Total return of sectors over 3 months

Source: FE Analytics

As a result, Henry said that at least two thirds of the fixed-income allocation should be in government bonds.

For others, the question is not to choose between sovereign or corporate but rather to look at duration, interest rate sensitivity and credit quality.

Graham Bentley, chief investment officer at Avellemy, said: “We consider correlation, long-term historic returns and volatilities in order to optimise exposure to various classes of bonds at a strategic level, depending on the risk target we are trying to match.

“We consider high yield bonds as a growth asset and therefore include it as a growth asset, i.e. within the ’60%’ bucket, in addition to equities. We select managers and securities to represent the bond classes (e.g. conventional and index-linked gilts, global bonds, high yield and Sterling non-gilt) with a diverse spread of exposures to duration, coupon and credit risk.”