Investors can find an array of resilient stocks in the repair, maintenance and improvement (RMI) sector that can buck the trend of consumers spending less, according to Dan Ekstein, manager of the Liontrust Income fund.

These companies specialise in the preservation and enhancement of properties and historically have had more durable earnings and dividends over previous downturns than the rest of the market.

Ekstein said: “The RMI industry benefits from a relatively resilient and stable end-market. Whilst the UK consumer is facing into a period of belt tightening, we are relatively sanguine the home improvement market isn't walking towards a cliff-edge.”

Demand is somewhat reliant on the housing market but volumes of RMI work fell 14% during the financial crisis whilst housing transitions dropped 50%.

Here, Ekstein shares his top three stocks – which account for 10% of Liontrust Income, worth around £37.4m in invested capital – for investors seeking reliable long-term income.

The FE fundinfo Alpha manager added: “Each addresses a distinct sub-segment of the market, but with the common thread of a superior value for money proposition, which is helping them to win market share during these more straitened times.”

Dunelm

Home furnishing retailer Dunelm is the leading force in the sector with an 11% market share, which gives it a unique advantage against its peers, according to Ekstein.

He estimates that sales in the £2.2bn company were up 16% last year while the rest of the market trailed behind at a more modest 3%.

“As the largest player in a fragmented market, Dunelm can achieve low unit costs across its value chain,” Ekstein added. It is the third largest holding in the Liontrust Income fund, accounting for 4% of all assets.

Despite the challenges posed by rising inflation and steep interest rate hikes, Dunelm’s profits were up 34.9% in 2022, with the company raking in £212.8m.

Although the special dividend was cut by 43.1%, but core dividend growth remained steady regardless of headwinds, with pay-outs climbing 14.3%.

Susannah Streeter, senior investments and markets analyst at Hargreaves Lansdown, said these reported earnings are impressive as most consumers are limiting their spending amid the cost-of-living crisis.

“As consumers tighten their belts, discretionary purchases have been coming under pressure, but Dunelm has shown hardiness amid the headwinds and its product mix should ensure sales continue to be resilient,” she said.

Streeter did warn that “a deeper than expected recession would still be painful,” but the company’s vast number of products suitable for differing budgets “bodes well for Dunelm”.

Although its balance sheet was strong in 2022, shares in the company dropped 23.9% throughout the year along with most of the stock market.

In the better conditions of 2023, however, its share price has climbed 15.8%, soaring 15.4 percentage points ahead of others in the FTSE 250 index.

Share price of Dunelm vs the FTSE 250 in 2023

Source: FE Analytics

Ekstein also noted that Dunelm’s family-run nature gives it an attractive edge. Founder Bill Adderley is no longer actively involved in the running of the company, but his son Sir Will Adderley sits on the board as deputy chairman.

The Adderley family still owns over 40% of the business, which ties their interests directly in line with shareholders, according to Ekstein He said: “A founder mentality permeates the business, which is run with tight purse strings and a conservative, consistent strategy.”

Howden Joinery

Like Dunelm, kitchen supplier Howden Joinery is the largest in its field, accounting for 25% of the UK kitchen market. The £3.7bn business is double the size of its nearest competitor, which Ekstein says has given it the advantage of growing around 10% a year compared to 3% by its peers.

“Its buying power and in-house manufacturing allow it to drive down unit costs, meaning it can generate much better margins than its competitors,” he added.

Howden Joinery only operates with tradespeople, meaning it can rely on reoccurring and frequent sales from its customer base.

Ekstein said: “Marketing costs are therefore low, and expensive showrooms are swapped for lean trade depots.”

Operating profit was up 3.2% last year, climbing to £415m. This year-on-year hike may appear mild, but it is more than double (111.7%) the amount reported in 2020.

Dividends dropped 13.9% to £115m last year but may have been offset by increased share buybacks – the firm spent £250.5m on this in 2022, up from £50m the year before.

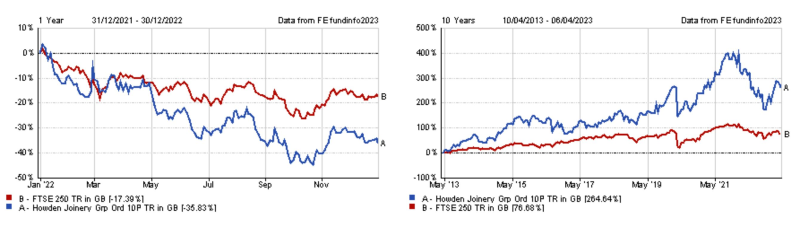

Shares in Howden Joinery were down 35.8% last year, but it has performed well over the long term, climbing 264.6% over the past decade and beating its peers in the FTSE 250 by 188 percentage points.

Share price of Howden Joinery vs the FTSE 250 in 2022 and over the past decade

Source: FE Analytics

Although recessionary concerns remain, Ekstein said that he is confident in the company’s future, stating: “Traditionally seen as a fit for purpose option, Howden is increasingly penetrating the mid-tier kitchen market, broadening its offer to include higher-spec finishes. We are optimistic about the multi-year growth potential this can sustain.”

B&M European Value Retail

Discount retailer B&M European Value Retail, which specialises in general merchandise, homewares, garden and grocery products, is another RMI company that Ekstein has a strong conviction in.

The £4.9bn company’s affordable prices and diverse range of products gives it a unique advantage against some of the larger supermarkets it competes with, he said.

As an essential retailer it remained open during the pandemic, so it continued to take in an income while many retailers were forced to remain closed.

Net cash flows from operating activities were up 44.5% in 2020, reaching £543m while many physical stores struggled. This lowered to £491m in 2022 but is still more than 30% higher than pre-pandemic levels.

Ekstein said: “This has improved B&M's sales densities, which has driven margins to sustainably higher levels and created a virtuous circle: higher sales volume drives greater buying power, allowing B&M to lower prices, so attracting more footfall.

“In previous economic downturns discount retail models took market share – we expect history to rhyme this year.”