Evenlode’s Hugh Yarrow, Unicorn’s Peter Walls and Buffettology fund manager Keith Ashworth-Lord have been inducted into the FE fundinfo Alpha Manager Hall of Fame, taking the total number of members to 49.

The list recognises fund managers who have kept their FE fundinfo Alpha Manager rating for each of the past seven years. To gain the rating in the first place is no easy feat, with managers judged on their track records since 2000.

It is based on three components: risk-adjusted alpha; consistency of outperformance versus their benchmark; and outperformance in both up and down markets. Extra weighting is applied to those with longer track records to highlight the benefits of their experience.

Charles Younes, research manager at FE fundinfo, said: “As we come out the other side of the Covid pandemic we’ve seen extreme fluctuations in the markets which has led to the recent rise in inflation and interest rates.

“Given they have been performing on the back of such turbulent times, the performances of these 49 managers in the Hall of Fame demonstrates what an outstanding job each has done.”

Yarrow headlines the group of new entrants. He has run the £3.6bn TB Evenlode Income fund since 2009, having previously been in charge of the Rathbone High Income fund from 2006-2009. Deputy manager Ben Peters has been on the fund since 2012.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

Since its launch, the fund has made a 296.3% return, the fourth best performance in the IA UK All Companies sector and more than double that of the FTSE All Share index and average peer.

Analysts at FE Investments said: “The fund has protected well when equity markets sold off, as in 2018 and early 2020. Performance has mainly been driven by stock specifics. Stock picking should continue to be the main driver of performance. However, due to the managers’ strict screening process and search for companies that have few assets and low debt, the fund has inherent anti-cyclical sector bets.”

Also joining the Hall of Fame, Ashworth-Lord has run the £717m CFP SDL UK Buffettology fund since its inception in 2011 and has intermittently overseen the smaller CFP SDL Free Spirit portfolio since 2019.

Performance has been enviable: the portfolio has made 207.9% since its launch, the sixth highest in the IA UK All Companies sector and more than double the average peer.

Total return of fund vs sector and FTSE All Share since launch

Source: FE Analytics

However, some analysts have soured on the portfolio over the past year and its assets under management have more than halved since its £1.8bn peak in 2021.

It was removed from interactive investor’s Super 60 list last year over concerns that it was too large to benefit from buying smaller companies, which had helped returns, while there were also musings about key-person risk.

Away from UK equities, David J. Eiswert made the Hall of Fame. He has run the T. Rowe Price Global Focused Growth Equity and TRP Global Focused Growth Equity funds since 2012.

The latter has the longer track record and has made 356.4% since he took charge, the fourth best return in the IA Global sector over the period.

Total return of fund vs sector and benchmark since manager start

Source: FE Analytics

Analysts at Square Mile Investment Consulting & Research give the fund an ‘A’ rating, noting that the asset manager has access to company management from around the world due to its “prestige”.

“This fund has a distinct bias towards largely capitalised growth stocks, but it operates within sensible parameters that should provide investors with broad regional and industry exposure to companies in both developed and emerging countries,” they said.

“Given the type of company sought to meet the aggressive performance objective, we believe this fund is perhaps best suited for investors with an appetite for risk.”

Jonathan Pines from Federated Hermes is the only Asia fund manager to make the Hall of Fame this year. He has managed the Federated Hermes Asia ex-Japan Equity portfolio since 2012, with deputy Sandy Pei joining him in 2017.

Total return of fund vs sector and FTSE All Share since launch

Source: FE Analytics

Since launching, the fund has made 211.6%, the third-highest return in the IA Asia Pacific Excluding Japan sector and more than double the MSCI AC Asia ex Japan benchmark.

Square Mile analysts, who rated the fund an ‘A’, said investors will need “a degree of patience” with the portfolio, as it can underperform over shorter timeframes as it focuses on unloved areas of the market, but noted that its long-term performance makes it a good option in Asia for investors who want a value bias.

“Pines is also deeply aware of the potential loss for any investment and hence looks for a margin of safety before any purchase is made; the fund's largest positions tend to be where the riskreward is assessed to be positively asymmetric, which have the lowest downside risk and therefore demonstrate a high margin of safety,” they said.

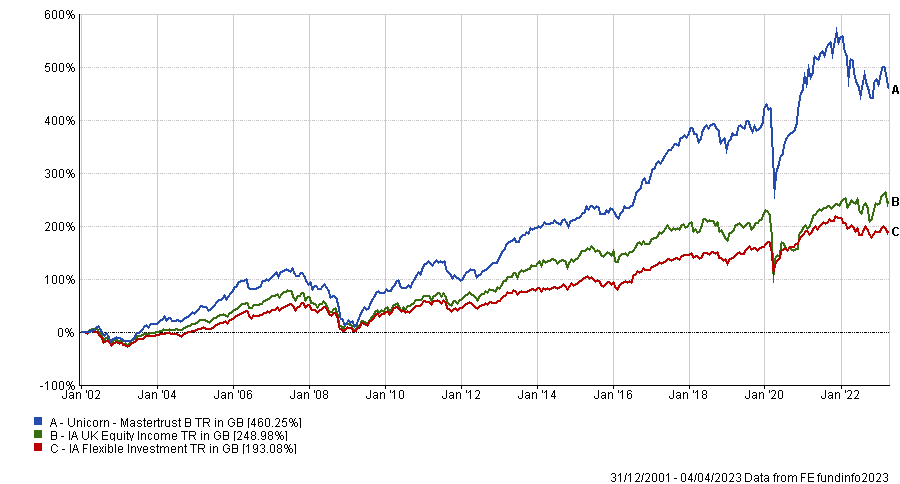

Last up is Walls, manager of the Unicorn Mastertrust fund since 2001. Since launch, it has made 460%, the third best performance in the IA Flexible Investment sector.

Total return of fund vs sectors since launch

Source: FE Analytics

The £118m fund is a portfolio of investment trusts, with top holdings including private equity specialists Oakley Capital, HarbourVest Global Private Equity and Abrdn Private Equity Opportunities alongside listed equity portfolios Alliance Trust, AVI Global and Herald Investment Trust.

Last year he told Trustnet that, although he “loves” investment trusts, he could not manage one himself as he is “not clever enough” and defended the fund’s 0.82% ongoing charges figure, urging investors to look at returns net of fees before making a decision on where to put their money.