Emerging markets (EMs) can be appealing to investors chasing growth as those economies have outmatched their developed peers over the past 20 years and are likely to continue to do so over the coming decades.

The Economist Intelligence Unit forecasted that EMs will grow faster than developed economies, with annual growth of 2-3% until 2050. In contrast, the US and Western Europe are set to grow 1-2% annually over the same period.

Emerging market funds can also serve as a diversifier in a portfolio, as they provide exposure to a wide range of geographies such as Asia, Latin America or Eastern Europe.

However, two countries among the emerging markets have overshadowed their peers in recent years: China and India. The IA China/Greater China and IA India/Indian Subcontinent sectors both outperformed the IA Global Emerging Markets and the IA Asia Pacific ex Japan peers, as the below chart shows.

In other words, an investor would have got better returns with their money in a specialist fund focusing on China or India than in a fund investing across the Asia-Pacific region or in a broad emerging markets fund.

A rule of thumb of investment is that you shouldn’t put all your eggs in the same basket, but does this also apply to emerging marktes? Given the dynamics of the past 10 years, one may ask whether a single-country approach is preferable to a diversified one.

Performance of sectors over 10 years

Source: FE Analytics

While the fates of China and India might change in the coming decades, there is a permanent benefit in a single-country strategy. With this approach, investors put their money into the hands of a specialist manager with knowledge of the specific markets that a global emerging market fund manager may not have. MSCI classifies 24 countries as ‘emerging’, which is a lot of markets to monitor and build an expertise in.

The downside of a single-country approach is the level of risk attached. Emerging markets can be highly volatile and potentially subject to instable political environments. Therefore, investing only in China or India adds concentration risk, which means that investors are at the mercy of a single market’s fate.

James Penny, chief investment officer at TAM Asset Management, said: “When it comes to mainstream investing, it's always a good idea to diversify one's exposure, especially in a region like EM/Asia which carries a higher risk premium.

“Obviously, there is an alpha haircut to using a broad strategy over a country specific one but there is also greater downside protection.”

A high level of volatility also makes it nearly impossible to get the entry point exactly right and both China and India have been no strangers to sharp price movements in the past 10 years.

Carly Moorhouse, equity research analyst at Quilter Cheviot: “From its peak in February 2021, the MSCI China has fallen 34% (in pounds), while the MSCI Asia Pacific ex Japan and MSCI Emerging indices have fallen just 11% and 13% respectively, simply because the returns from other countries, including India, have helped balance out overall returns for investors.

“This holds true over longer periods, as over time the return profile for regional funds has been much more stable, making this approach more appropriate and suitable for a wider range of clients.”

Performance of indices over 10yrs

Source: FE Analytics

A compromise is to hold a global emerging markets or Asia Pacific fund and combine it with a country specialist one. This approach spreads risk across different countries or regions while also enabling investors to reflect a strong conviction in the prospects of one of the two Asian giants.

Moorhouse said: “Allocating to a single country fund alongside your global emerging markets or Asia fund allows you to express an even larger overweight to these areas should you want it.

“Additionally, you can diversify your manager line up with regards to teams, processes and styles et cetera in a way that can help further reduce volatility and risk with the right blend of funds.”

However, Jasper Thornton-Boelman, investment director at Parmenion, said that if investors want specific exposure to China, the fund they pick should invest in the A-Shares market.

Chinese A-Shares are listed in mainland China, on either the Shanghai or Shenzhen stock exchanges. They are quoted in Yuan and only accessible to Chinese citizens.

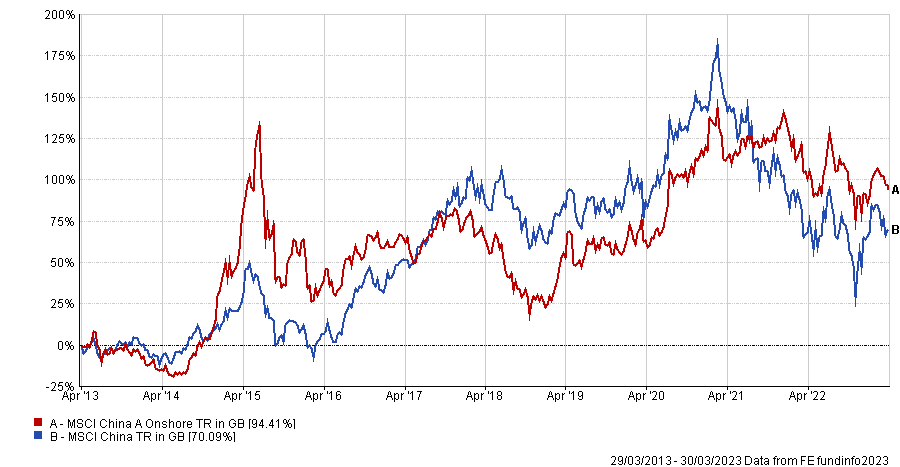

Performance of indices over 10 years

Source: FE Analytics

Thornton-Boelman said: “The A-Share market is quite uncorrelated to the wider emerging market universe. Therefore, it gives us a way to improve diversification, particularly in our higher risk models. Where the investment landscape is clearly differentiated, I think there can be more merit in using a specialised fund.”