Exposure to alternative assets could play a pivotal role in investors’ portfolios, according to Mike Bell, global market strategist at JP Morgan Asset Management.

Last week, he told Trustnet why income investors should consider alternatives despite higher yields in the fixed income market taking much of the limelight.

Here, industry experts share their best funds offering exposure to each of the main alternative asset classes.

Private equity

Analysts at JP Morgan expect private equity to deliver the highest growth of any alternative asset class in future, forecasting an annualised return of 7.8% over the next 10 to 15 years.

The best way to access the asset class is through the Literacy Capital trust according to Ben Yearsley, director of Fairview Investing.

This £241m portfolio invests primarily in UK smaller companies, which Yearsley said allows father and son managers Richard and Paul Pinder to be “much more hands on”.

“It’s only small but that marks it out as very different to most the other private equity trusts today,” he added.

It has 18 holdings in total, with charitable business collective RCI Group taking the top position. The company accounts for more than a quarter (26.6%) of the trust’s net asset value (NAV) worth £67m.

Literacy Capital has been active since 2017 but only listed in 2021 – since then, it is up 123.3%, outperforming its peers in the IT Private Equity sector by 109.8 percentage points.

Total return of trust vs sector since public listing

-1.png)

Source: FE Analytics

Yearsley added: “A unique feature is that there is no performance fee, so the management isn’t incentivised to sell for a quick buck, and there is an annual donation to literacy charities.”

The trust gives 0.9% of its NAV to charity every year and has donated £5.8m since 2017, making it a potential consideration for ethical investors.

Infrastructure

Investors looking for exposure to infrastructure may want to consider the BBGI Global Infrastructure, recommended by Shayan Ratnasingam, equity analyst at Winterflood.

As its name suggests, the £1.1bn portfolio invests in infrastructure projects around the globe, with most operations based in Canada (35%) and the UK (32%).

More than half (53%) of its assets are in the transport sector, with top holdings in Ohio River Bridges and Golden Ears Bridge, which jointly account for 21% of the NAV.

Ratnasingam said that BBGI Global Infrastructure is often compared to bonds due to its contracted cashflows, but this is not the case.

Its NAV remained stable last year whilst most of the fixed income market faced a downturn and the trust today offers a 5% dividend yield.

The trust is up 113.9% over the past decade, but Ratnasingam said that one of the main appeals was the fact that it “delivers true inflation linkage, with cashflows rebased annually in line with prevailing inflation”.

Total return of trust vs sector over the past decade

-1.png)

Source: FE Analytics

He added: “If inflation remains elevated and sticky BBGI will offer good downside protection reflective of its low risk profile.”

Property

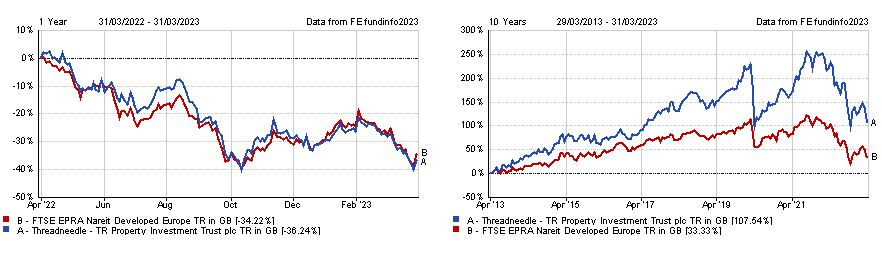

Rob Morgan, chief investment analyst at Charles Stanley, said that the TR Property Investment Trust offers the best exposure to the real estate asset class.

It has made 107.5% over the past decade from investing in UK properties and European equities, but short-term performance hasn’t been so strong.

It is down 36.2% over the past year, but Morgan said that manager Marcus Phayre-Mudge has spread risk across an array of assets, avoiding the most volatile sectors.

“The manager has continued to be adept at avoiding the most troubled areas and it offers high quality, diverse exposure to the asset class with a bias towards logistics, healthcare and residential,” he said.

Total return of trust vs benchmark over the past one and 10 years

Source: FE Analytics

Due to recent underperformance, the £885m trust is currently selling at a 9.3% discount that could provide an attractive entry point for those looking to buy in at a cheaper price.

Furthermore, its 5.3% dividend yield could make it an appealing contender for those seeking a source of income from their investments.

Commodities

Morgan also suggested the TB Amati Strategic Metals fund for those seeking exposure to commodities.

The asset class has been popular over the past few years thanks to pent up demand from pandemic supply chain chokeholds, with the fund climbing 7.5% since launching in 2021.

However, its peers in the IA Commodity/Natural Resources sector were up four fold over the same period, climbing 33.7%.

Total return of fund vs sector since launch

-2.png)

Source: FE Analytics

Even so, Morgan said managers Georges Lequime and Mark Smith have “a highly active and flexible approach to investing” that makes them stand out from their peers.

TB Amati Strategic Metals has a 43.1% exposure to ‘speciality’ assets such as lithium producers, which is an essential component in electric vehicle manufacturing.

The material may be in high demand for the time being, but Lequime said that it will lose its value over time.

“Although we expect lithium prices to ultimately fall back over the next few years, in our opinion, the lithium market should remain tight in the short-to-medium term as new supply faces difficulties in meeting rapidly rising demand,” he said.

It has exposure to other precious metals such as gold and silver, which account for 39.7% of the portfolios asset allocations.

Specialist

A notable ‘wildcard’ fund in the alternatives space is Sanlam Global Artificial Intelligence, recommended by James Yardley, senior research analyst at FundCalibre.

It invests in companies engaging in artificial intelligence, whether they are developing the technology or integrating it into their business.

Yardley said AI will have a game changing impact on how businesses work in future and the fund has the benefit of being an early player in the field.

Since launching in 2017, the £654m fund is up 148.7%, beating others in the IA Specialist sector by 123.2 percentage points.

Total return of fund vs sector since launch

.png)

Source: FE Analytics

“The AI revolution has huge implications for investors. Some businesses may be wiped out completely, others have a huge opportunity,” Yardley said.

“Those businesses which are at the forefront of AI may have a lot to gain and that is where a fund like Sanlam Global Artificial Intelligence can come in.”

Top holdings include technology companies Alphabet, Microsoft and NVIDIA, which account for 13.5% of allocations. Information technology takes up a large chunk of the portfolio (41.5%), it also includes exposure to sector such as industrials (17.3%), communication services (14.5%) and healthcare (10.7%).