The funds that made some of the Investment Association universe’s heaviest losses in 2022 are those that can boast of the highest returns in 2023 so far, analysis by Trustnet shows.

Last year was characterised by a violent shift in market leadership, as surging inflation and rising interest rates put investors off the growth stocks that had dominated the previous bull run. The MSCI AC World Growth index was down close to 20% in 2022 because of this, while value stocks – which had been unloved for most of the prior decade – rose 4%.

However, signs that inflation has peaked in the US and hope that this will prompt the Federal Reserve to hit the pause button on rate hikes have caused market dynamics to reverse once more in recent months: the MSCI AC World Growth index is up 10.7% since the start of 2023, while the MSCI AC World Value index is down 1.5%.

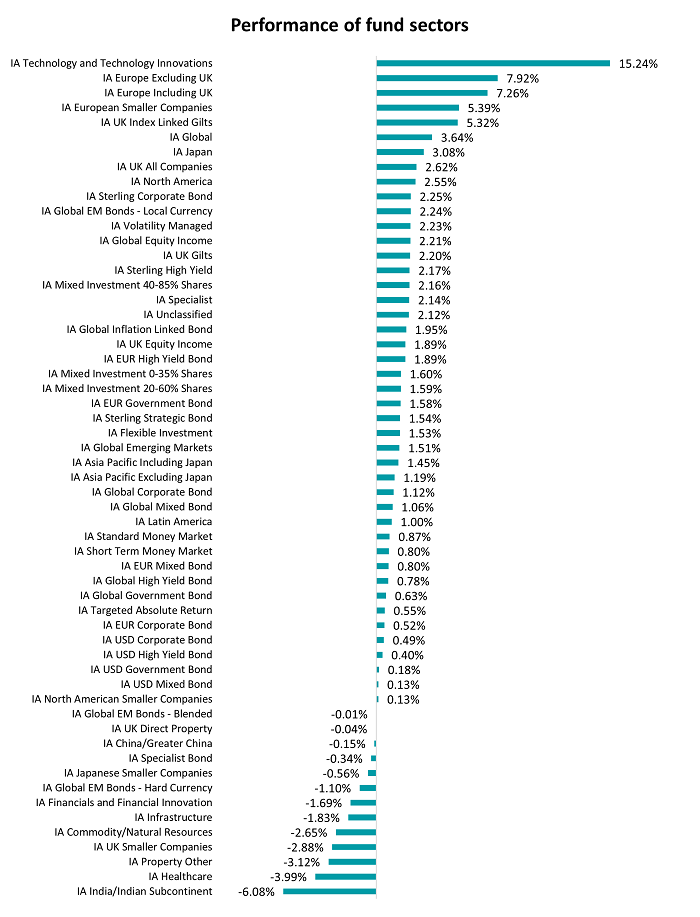

Source: FinXL

In the Investment Association sectors, this is reflected in the strong year-to-date return made by the IA Technology and Technology Innovations sector. It’s up 15.2%, close to double the return made by the IA Europe Excluding UK sector in second place.

This is quite the turnaround for the sector as its average member was down 27.5% in 2022, making it the second worst performer of the Investment Association’s 57 peer groups.

What’s more, other sectors that struggled last year – such as IA UK Index Linked Gilts (down 35.3%), IA European Smaller Companies (down 21.1%) and IA Global (down 11.1%) – are sitting towards the top of the leaderboard since 2023 started.

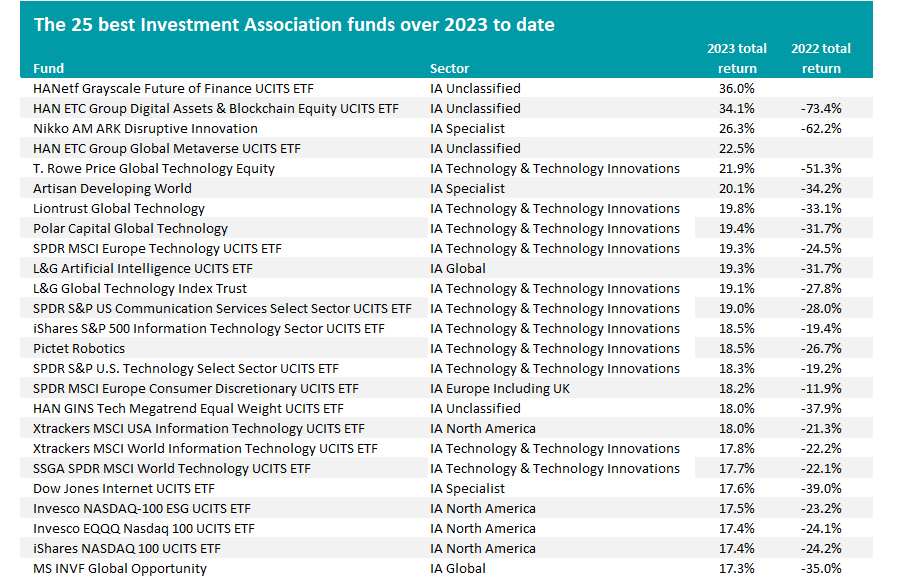

This becomes more clear when the best funds of 2023 so far are considered; the top 25 are shown in the table below, which includes their 2022 returns as well as those year to date.

Source: FinXL

All of the funds with a track record for 2022 posted a double-digit loss last year and all aside from SPDR MSCI Europe Consumer Discretionary UCITS ETF were in the bottom 25% of the entire Investment Association universe.

The majority of funds featured in the table have a focus on tech stocks. There are 11 members of the IA Technology and Technology Innovations sector on the list while 12 funds from other sectors have a bias to this part of the market, including the top three: HANetf Grayscale Future of Finance UCITS ETF, HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF and Nikko AM ARK Disruptive Innovation.

Fidelity’s Graham Smith said: “Markets reasoned that tech companies have probably done just enough in terms of cost cuts to stave off sharp falls in profits, with new products and developments in services still to look forward to.

“Undoubtedly, the tech engine never stops. Advances in AI and the metaverse along with the increasing need for data centres and cybersecurity are just some of the reasons to expect growth in the technology sector that exceeds the world average out into the future.”

However, Smith reminded investors that the outlook continues to be highly uncertain and, to a large degree, dependent on the Federal Reserve. While there’s a chance 2023’s first quarter could be start of new tech bull market, this would need more evidence that the interest rate cycle is nearing a peak – which “remains in doubt”.

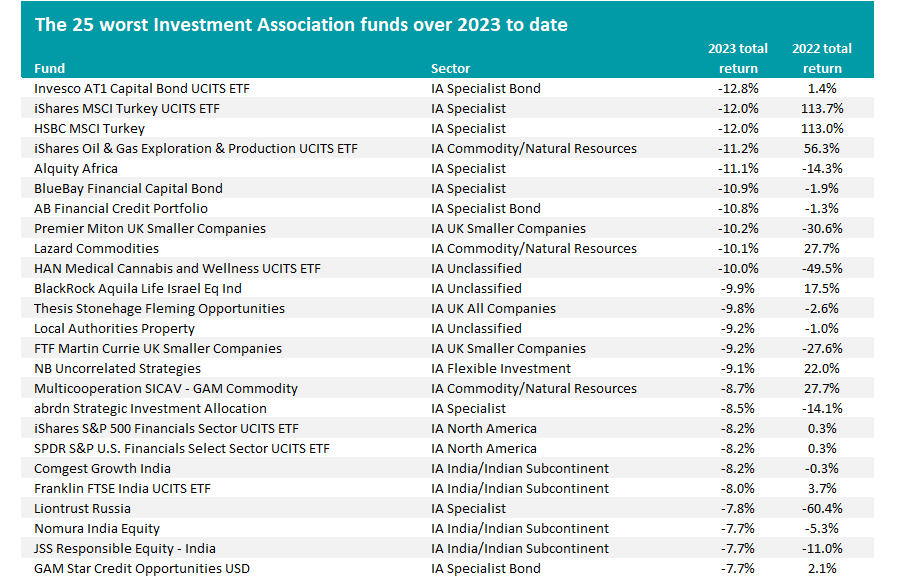

Source: FinXL

There’s less clear-cut trends when it comes to the quarter’s worst performers.

Invesco AT1 Capital Bond UCITS ETF posted the biggest loss after it fell 12.8%. This is down to investors fleeing AT1 bonds after these bonds took the brunt of the pain when struggling bank Credit Suisse was suddenly sold to rival UBS.

Meanwhile, iShares MSCI Turkey UCITS ETF and HSBC MSCI Turkey are notable because they made the highest returns of the whole Investment Association universe in 2022 when they rocketed as Turkish citizens flocked to the stock market to try and beat sky-high inflation.

Commodities funds were also some of the best performers last year when prices were shooting upwards but have come under pressure over recent months as rising output and slowing demand have caused raw materials to come down from their highs.