Investors with exposure to the UK market are in danger of having fewer options to choose from if a swathe of companies decide to list overseas.

While this might not seem like an immediate threat, it is something that should be of concern, according to Simon Gergel, manager of the Merchants Trust, who said that some of the UK’s largest names could leave for the US market.

He noted that several FTSE 100 constituents are considering shifting their listing because “many businesses want to get a higher valuation”.

British American Tobacco (BAT) is one of the UK giants that could seek listing on the other side of the pond. GQG Partners, one of the firm’s top-five shareholders, has pressured the cigarette maker to move to the US. This UK blue-chip company is one of Merchants Trust’s top 10 holdings.

If companies do decide to move abroad, the manager said he would consider upping the trust’s allocation to overseas holdings. Currently the investment company can only have up to 10% of its portfolio outside of UK and European equities, but Gergel noted that “there's nothing stopping the board allowing us to expand our allocation in the USA if large parts of the portfolio would be listing there”.

“We could say: ‘we want to hold on to BAT and CRH, can you allow us to own some US company please’. That's a discussion we could have, although we are not there yet.“

What would stop these companies from de-listing from the UK and finding a home elsewhere is if the valuation gap between the UK and the US starts to narrow, something that Gergel is hopeful will happen.

This started last year, with the UK among the best performing markets in 2022. And despite a slow start to this year, there are reasons for optimism.

Firstly, despite a range of challenges for the UK market, including the risk of recession, higher interest rates and uncertain consumer demand, Gergel said that much of this bad news is already priced in.

He added: “That means that valuations are interesting and, within that, there’s a huge spread of valuations. As a stockpicker, we can buy lots of really good businesses at attractive prices, which we care about more than anything.”

Gergel also noted that UK political picture is clearer than it was at the end of last year, and is more “middle of the road”, which improves foreign investors’ perception of the UK market.

He said: “Overseas investors are going to look at the UK gradually and see it's more stable and predictable. If money comes to the UK market, that will lead to a normalisation of valuations.”

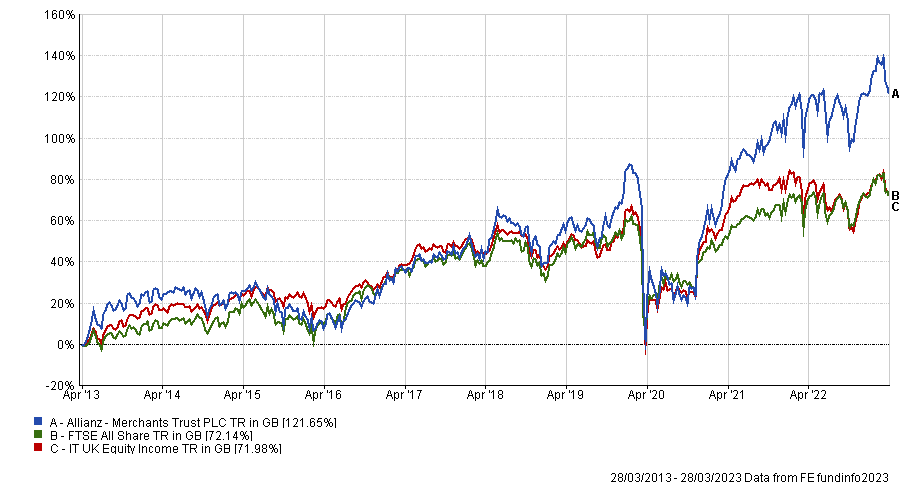

Merchants Trust is one of the Association of Investment Companies’ dividend heroes, having raised dividend annually for 40 consecutive years. It has been a top performer in the IT UK Equity Income sector over 10 years, five years and three years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

The portfolio is currently built around six longer term themes, including nutrition and wellbeing, wealth accumulation, sustainable living, normalisation of interest rates, driving energy transition, and the digital economy.