Funds and trusts each come with their own advantages, but these unique qualities may give one a significant edge over the other in different asset classes.

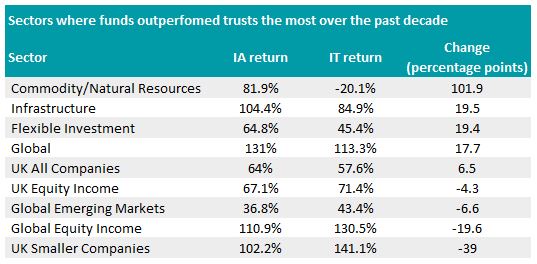

Here, Trustnet has compared nine like-for-like Investment Association (IA) and Association of Investment companies (AIC) investment trust sectors (containing eight or more portfolios) to see where the long-term return of each structure diverged the most.

Total return of like-for-like IA and IT sectors over the past 10 years

Source: FE Analytics

Funds in the Commodity/Natural Resources sector delivered the highest outperformance, climbing 101.9 percentage points ahead of their closed-ended counterparts over the past decade.

Investment Association funds had an average return of 81.9% over the period, whilst investment trusts were down 20.1%.

The BlackRock World Mining and BlackRock Energy and Resources trusts led the closed-ended sector over the past decade, climbing 97.8% and 76.2%, but this was offset by poor performance from their peers.

For example, the Golden Prospect Precious Metals and Baker Steel Resources trusts dragged down the group average, with each falling 51.2% and 46.2% respectively over the past 10 years.

Total return of the best and worst Commodity/Natural Resources trusts over the past 10 years

Source: FE Analytics

On the open-ended side, the Guinness Sustainable Energy fund outperformed the rest of its active peers over the past decade with a total return of 207.6%.

Ben Yearsley, co-founder of Fairview Investing, said that although the Guinness fund delivered a “cracking performance,” he will continue to hold his long-term position in BlackRock World Mining.

He said that the outperformance of funds in the sector was not due to a structural advantage, but a difference in underlying holdings.

Performance of the open-ended commodities sector is spread across 29 funds, which tend to stick to broad themes such as energy, agriculture, water and resources. The closed-ended side meanwhile is reliant on just eight trusts, meaning the average group return is more vulnerable to one poor performer.

Yearsley said: “I would say the reason for that outperformance is that there’s just a broader spread within the IA universe versus the IT universe.”

“The trust ones are more specialised – one bad apple will massively skew performance. Funds are a more homogenous group where you expect trusts to outperform, versus an esoteric one where there’s so many factors at play.”

He added that one area where holding one structure over the other makes a sizable difference is UK smaller companies.

Investment trusts investing in UK smaller companies beat open-ended funds doing the same by 39 percentage points over the past decade, with the average return climbing 141%.

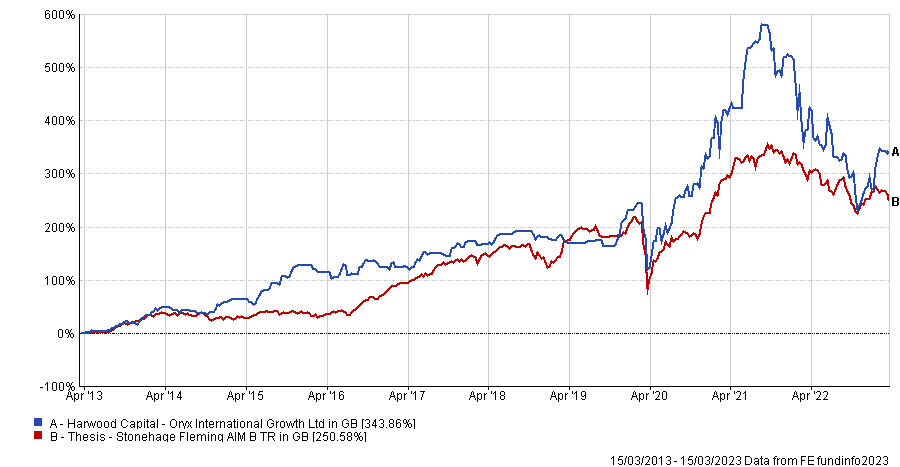

Oryx International Growth was the best performing trust in the sector, up 343.9% over the past decade, while the highest-returning fund – Thesis Stonehage Fleming AIM – was up 250.6%.

Total return of best IT and IA UK Smaller Companies portfolios over the past 10 years

Source: FE Analytics

This outperformance was driven by trusts’ ability to use gearing, which allows them to borrow more capital for investment, according to Yearsley.

He said: “If you have two identical smaller companies funds – one trust and one fund – you'd expect the trust to outperform because it’s got gearing.”

Indeed, the fact that trusts are listed companies that separate shares from the net asset value (NAV) gives them more flexibility when investing in illiquid assets, Yearsley added.

If open-ended funds need to return investors’ capital, there can be difficulties if they are heavily invested in illiquid assets such as property or private equity because redemptions come straight from the pool of investable money.

Yearsley said: “If you can buy trusts, I think they should ultimately deliver you a better return on funds over the long term in these kinds of illiquid assets.

“Of course, if there’s low gearing and large liquid assets like FTSE 100 stocks, it’s not really going to make a difference.”