Income-paying assets are an attractive investment in a high inflationary environment, but some of the most popular dividend stocks could make for volatile holdings, according to Ken Wotton, manager of the LF Gresham House UK Multi Cap Income fund.

He said that many income investors in the UK will have a significant allocation to high-yielding large-caps, but these companies offer little dividend growth and could be at risk of reducing payments.

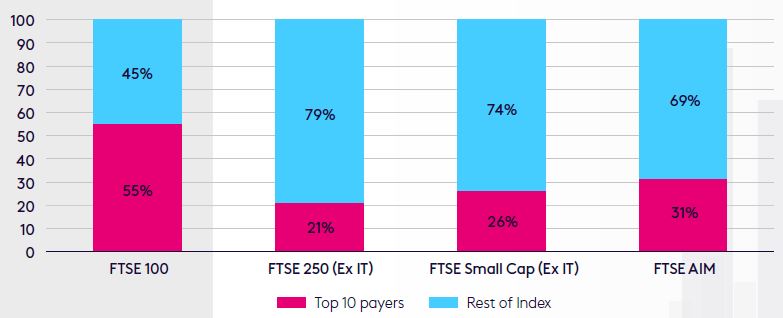

Analysts at Octopus Investments estimate that 10 companies in the FTSE 100 will account for more than half (55%) of all dividend payments from the index, leaving a lot of responsibility on a small number of businesses.

However, the top 10 dividend payers in the FTSE 250 and FTSE Small Cap are forecast to have a more even spread, accounting for 21% and 26% of their respective indices.

Dividend concentration by index in 2023

Source: Octopus Investments

Wotton prefers to avoid large-cap companies, instead holding 78.1% of his fund’s assets in small- and mid-cap companies, which he says offer higher dividend growth and more reliable payments.

Here, the FE fundinfo Alpha manager shares three of his favourite small-cap income stocks that investors may not have heard of.

Smart Metering Systems

Energy infrastructure and technology company, Smart Metering Systems, is a top 10 holding in the LF Gresham House UK Multi Cap Income fund, accounting for 3.1% of all assets.

Wotton said that the smart meter provider’s steady revenue streams are one its most attractive qualities, with the company’s contractual nature ensuring a source of income even in times of volatility.

“It is important to assess both visibility and predictability of future income streams by unpicking a company’s revenue line,” he said. “Recurring or repeat revenue is ideal, as opposed to transactional business, which can be less predictable.

“Smart Metering Systems exemplifies the type of contracted, long-term visible income streams we look for.”

The company announced a 25% rise in revenue throughout 2022 in its most recent annual report, increasing to £136m despite high inflation and monetary tightening creating a hostile environment for many businesses.

Indeed, the government’s commitment to reaching net-zero emissions is likely to support Smart Metering Systems’ revenues over the long term, according to Wotton.

He said: “Backed by the government’s 2024 target for installing smart meters in every British home and the country’s net-zero aim, we are comfortable the smart meter business can continue to grow over the next five years.”

Its market cap is estimated to be worth around £1.1bn and shares in the company are currently offering a dividend yield of 3.73%.

Share price of Smart Metering Systems over the past year

.png)

Source: FE Analytics

XPS Pensions Group

Pensions consultancy business, XPS Pensions Group, is Wotton’s second largest holding, with 3.5% of the £409m fund held in its shares.

He said that the company “enjoys an attractive market position and competitive advantage” thanks to its independence, while many of its main rivals are owned by larger multinational groups.

Its advantageous market position may play a part in its investment case, but strong revenues also make XPS a noteworthy company, according to Wotton.

Like Smart Metering Systems, it receives a steady flow of income from ongoing contracts – XPS reported an 8% rise in revenue in 2022, reaching £139m throughout the year.

Wotton said: “It operates with a business model that does not require significant capital – XPS boasts attractive profit margins and has the cash generation potential to support a high and sustainable dividend yield.”

The £315m company has a dividend yield of 4.93% and investors who held shares in XPS over the past year would have seen its value climb 23.5%.

Share price of XPS Pensions Group over the past year

.png)

Source: FE Analytics

Although its share price is up considerably over the past year, Wotton said that XPS is attractively valued and on a larger discount than many of its peers.

Inspired

Investors looking to buy income-paying shares at a discounted price may also want to consider energy consultancy business, Inspired.

Shares in the company are down 36.6% over the past year, providing an opportunity to “exploit the increased dislocation between share prices and business fundamentals,” according to Wotton.

It may have undergone a derating over the past 12 months, but Wotton said that the opportunity for strong performance in future make it attractively valued.

Share price of Inspired over the past year

.png)

Source: FE Analytics

“It has an attractive financial profile – its model features high margins, low capital intensity and growing revenue and profits,” he added. “It is also cash generative with an attractive and growing dividend per share.”

Inspired currently offers shareholders a dividend yield of 2.6% and big moves in the sector could have a sizeable impact on the share price in future.

There is a lot of consolidation happening among its peers, so Inspired could benefit from growing the business through acquisitions or being acquired itself by private equity, according to Wotton.