Commodities, smaller companies and UK equity funds are among those that have joined financials funds in losing the most money in the past two weeks as markets sold off in the Silicon Valley Bank (SVB) crisis, FE fundinfo data shows.

Global stocks have sunk in recent days after a series of problems at SVB – which focused on lending money to technology start-ups and venture capital firms – caused a run on the bank. The group ultimately collapsed, representing the biggest failure of a US bank since the financial crisis in 2008.

Signature Bank, another mid-sized US bank that focused on the tech sector, also collapsed while other US regional banks have come under pressure. Meanwhile, UBS has agreed to buy Credit Suisse – Switzerland's second biggest lender – after regulators pushed for a takeover to avoid a collapse in a bank that is seen as ‘too big to fail’.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “It is not yet known exactly where more pain will emerge in the banking sector, but investors fear the problems are not yet over. Shares in Standard Chartered and HSBC listed in Hong Kong fell by 7% after immediate relief at the Credit Suisse deal evaporated. Smaller lenders will be in focus again, particularly in the US, after First Republic Bank shares tanked by more than 30% despite the $30bn lifeline given to it by large US banks.”

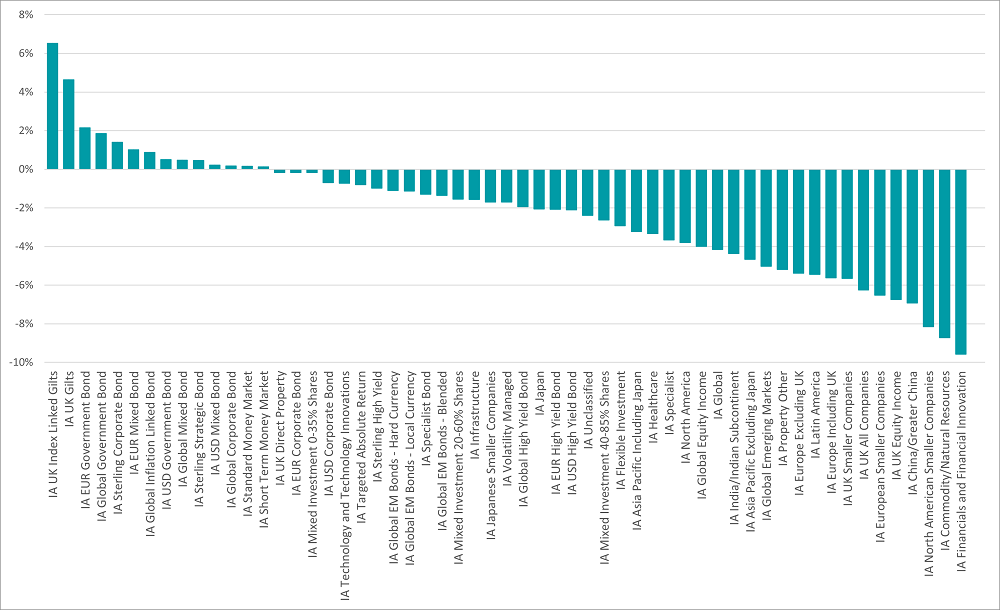

As the chart below makes clear, investors have flocked towards bonds over the past two weeks as volatility returns to stock markets.

Performance of fund sectors between 6 Mar and 17 Mar 2023

Source: FinXL

The only Investment Association peer groups with a positive average return over this period have been fixed income or money market sectors, led by government bond sectors such as IA UK Index Linked Gilts (up 6.5%), IA UK Gilts (up 4.6%) and IA EUR Government Bond (up 2.2%).

Fixed income is a classic safe haven in times of market stress and the higher yields brought about by 2022’s bond sell-off mean they currently look attractive compared with recent history. Investors also seem to be betting on the chance that central banks will ease the pace of interest rate hikes, or even cut rates, in response to the banking sector’s struggles.

However, a note from the BlackRock Investment Institute said: “Markets have slashed their expectations of interest rate paths, expecting central banks to come to the economy’s rescue by cutting rates as they used to do in episodes of financial stress. We think that’s misguided and expect major central banks to keep hiking rates in their meetings in coming days to try to rein in persistent inflation.”

It should be little surprise to see the IA Financials and Financial Innovation sector at the bottom of the chart, with a 9.6% average loss, given that the banking sector is at the epicentre of the current sell-off.

More risk-on sectors such as IA Commodity/Natural Resources, IA North American Smaller Companies and IA China/Greater China have also suffered, while the banks-heavy nature of the UK market is reflected in large falls in the IA UK All Companies and IA UK Equity Income sectors – both down around 6.5% in the past two weeks.

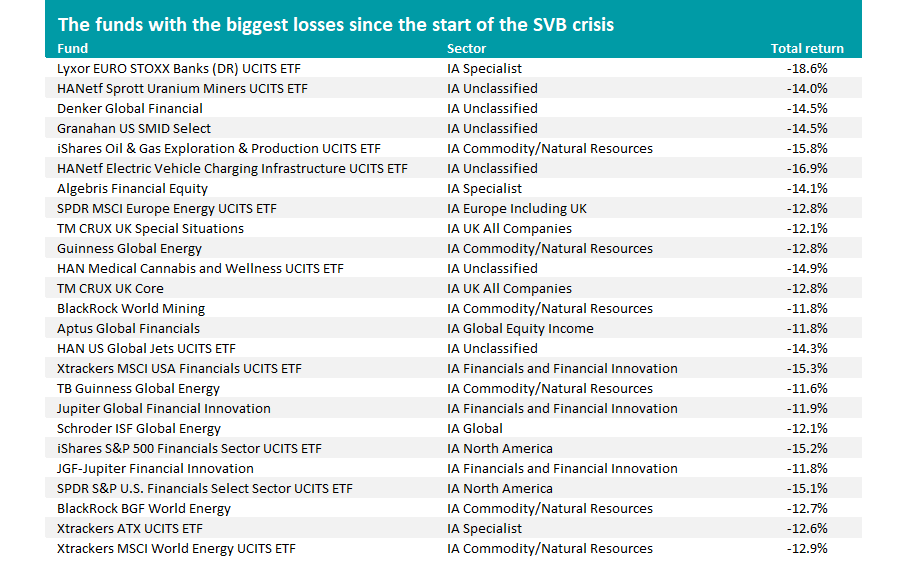

Source: FinXL

The list of individual funds making the biggest losses over the sell-off is topped by Lyxor EURO STOXX Banks (DR) UCITS ETF, which is down 18.6%. It tracks the performance of eurozone banks, meaning its biggest holdings are BNP Paribas, Banco Santander and ING Group.

Other financials funds with heavy losses include Denker Global Financial, Aptus Global Financials and Xtrackers MSCI USA Financials UCITS ETF. There are only 15 funds in the IA Financials and Financial Innovation sector and all have made a loss in the past two weeks, although T. Rowe Price Future of Finance Equity has held up the best with a 4.3% fall.

Commodities funds are also well-represented among the worst-hit funds (iShares Oil & Gas Exploration & Production UCITS ETF, Guinness Global Energy) as investors start to worry about the onset of a recession, as this would imply a drop in demand – and therefore prices – for many key raw materials.

Thematic funds such as HANetf Electric Vehicle Charging Infrastructure UCITS ETF and HAN Medical Cannabis and Wellness UCITS ETF reflect the risk-off stance of investors in the current climate, while the presence of TM CRUX UK Special Situations in the list show how the UK has been one of the weakest countries in recent days.

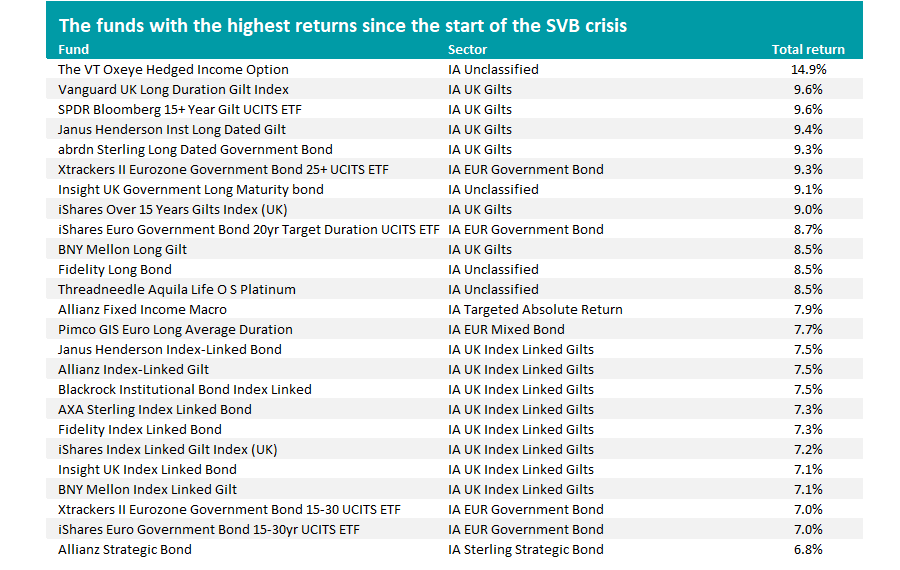

Source: FinXL

However, some funds have been able to make positive returns in the turmoil, especially those that invest in long-dated bonds such as Vanguard UK Long Duration Gilt Index, SPDR Bloomberg 15+ Year Gilt UCITS ETF and abrdn Sterling Long Dated Government Bond.

As long-dated bonds are more sensitive to changes in interest rates, this may indicate that investors are betting on central banks cutting interest rates sooner than expected in order to stave off a recession. Some market analysts think banks may well pause on rates hikes in the near future before resuming tightening later to quash inflation.

Fixed income funds dominate the list of those with the best returns over recent weeks although a few IA Targeted Absolute Return funds such as TM Neuberger Berman Absolute Alpha and JPM Global Macro Opportunities can be found among the top 100.