UK equity income funds with a bias towards value stocks – which until recently were struggling – have outperformed their peers for returns, volatility and other important metrics in the past three years, Trustnet research shows.

According to FE Analytics, the average IA UK Equity Income fund has underperformed the FTSE All Share in recent years (making 3.9% over the three years to the end of 2022, compared with 7.1% from the index) while being more volatile. However, there are some funds that have done much better than this.

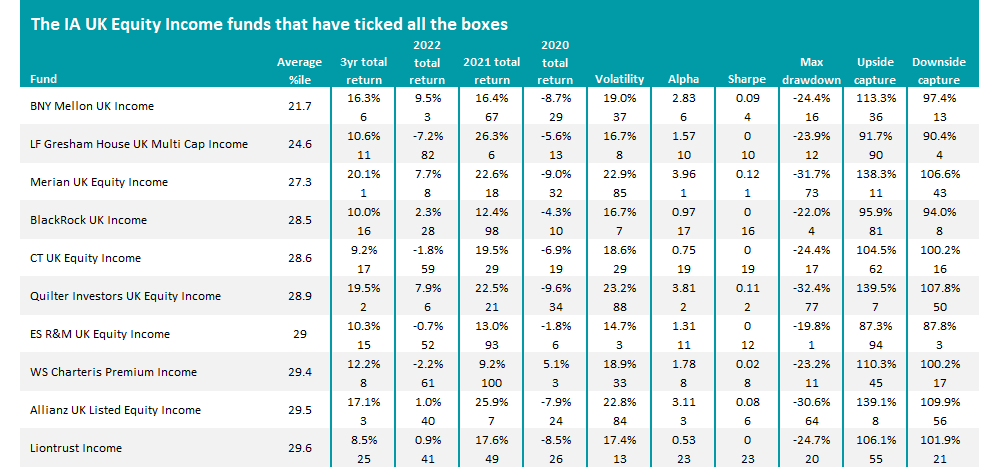

In this ongoing series, Trustnet looks for funds that have beaten their peers on cumulative total returns, volatility, alpha, Sharpe ratio, maximum drawdown, upside capture and downside capture over the past three years, as well as returns in each of 2022, 2021 and 2020.

We then work out an average percentile score for each fund across these 10 metrics: the lower the average percentile, the better the fund has performed overall. When a benchmark for IA UK Equity Income funds is needed, we’ve used the FTSE All Share index – the most common benchmark in the sector.

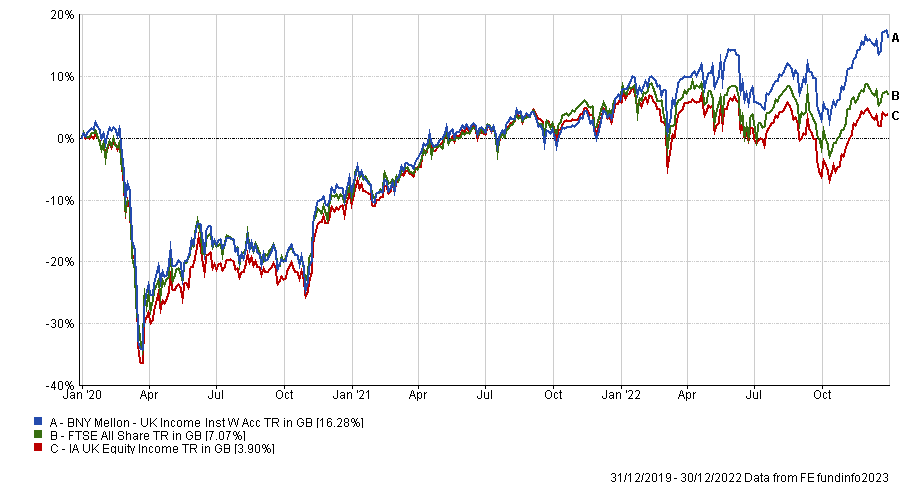

BNY Mellon UK Income vs sector and index over 3yrs to the end of 2022

Source: FE Analytics

The fund shown in the chart above won first place in this research: BNY Mellon UK Income, which has an average percentile score of 21.7 thanks to strong three-year returns, alpha generation and Sharpe ratio.

Managed by Tim Lucas and David Cumming, the £1.3bn fund tends to invest in value stocks – which fell behind the growth style when interest rates were historically low but has rallied since central banks started hiking them – and those at the larger end of the market cap spectrum. The fund is overweight industrials, energy and financials with the likes of Shell, Lloyds, Barclays, BP and BAE Systems among its top 10 holdings.

In an outlook at the start of the year, the managers said: “Moving into 2023, the market has priced in a recession by derating more economically sensitive areas of the market, leaving these areas as the standout valuation opportunities. We have therefore been selectively deploying capital into a range of more cyclical shares and have reduced some of the more defensive positions we held in 2022.

“Balance sheet strength and dividend sustainability remain important preconditions to investing into more cyclical companies, given deteriorating economic conditions. The clearest illustration of this is that the fund is now meaningfully overweight financials. Banks are trading on very low multiples of book and earnings relative to the market and their own history and balance sheets are better capitalised than they have been in a generation.”

BNY Mellon UK Income’s bias towards value stocks is not an isolated example. Below are the IA UK Equity Income funds with the highest average percentile ranking in this research and seven of them use the value style. LF Gresham House UK Multi Cap Income, Merian UK Equity Income, Quilter Investors UK Equity Income and ES R&M UK Equity Income are among these.

What’s more, none of the remaining three funds on the list that do not use the value style of investing are dedicated growth funds either. They have a ‘blended’ approach that mixes elements of the two investment styles.

Source: FE Analytics

There are some notable funds on the above list, such as Merian UK Equity Income – which stands out for making a 20.1% total return last year. This was the best return of the IA UK Equity Income sector, where the average fund made just 3.9% after surging inflation and rising interest rates sparked a broad sell-off.

CT UK Equity Income, meanwhile, is the second largest fund in the peer group with assets of £3.9bn and came in fifth place. It is Columbia Threadneedle Investments’ core UK equity income offering and has a strong long-term track record, although veteran manager Richard Colwell retired last year and was replaced by longstanding deputy Jeremy Smith.

None of the peer groups other giant funds made the shortlist, however. The £4.7bn Artemis Income fund was in 15th place out of 77 funds with an average percentile score of 32.1 but none of the next largest funds came close: the £3.7bn HL UK Income fund was ranked 56th, the £1.8bn Halifax UK Equity Income fund was 55th and the £1.7bn Jupiter Income Trust was 42nd.

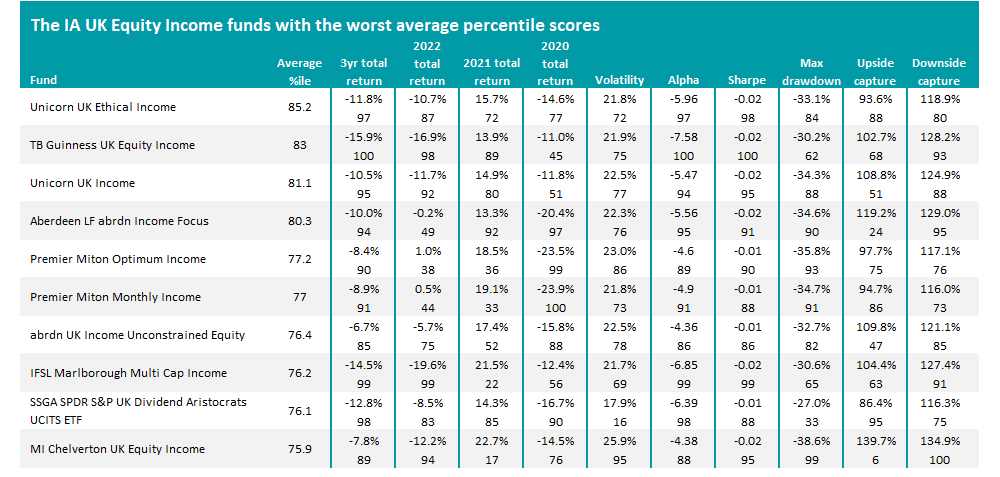

Source: FE Analytics

Unicorn UK Ethical Income was the fund that came out worst in this research, after its average percentile ranking for the 10 metrics examined averaged 85.2. The fund invests in small-caps, which have been of the parts of the market that was hit hardest in the interest rate-driven volatility of recent years.

Again, this is represented by other funds performing poorly in this study: Unicorn UK Income, abrdn UK Income Unconstrained Equity, IFSL Marlborough Multi Cap Income and MI Chelverton UK Equity Income are examples of other funds that look outside of traditional large-caps for opportunities and look more to small- and mid-caps.